Crude Oil Price Update – Trend Changed to Down When $70.24 Failed as Support

July West Texas Intermediate Crude Oil is trading sharply lower on Friday as investors are dumping long positions in reaction to chatter that Russia is preparing to increase production in June.

Russia has been floating the idea of ending the production for several weeks, with energy minister Alexander Novak saying on Thursday that restrictions on oil production could be eased “softly” if OPEC and non-OPEC countries see the oil market balancing in June.

Prices are likely to remain under pressure all session now that the entire Iran-sanction premium has been nearly wiped out by aggressive shorting and profit-taking.

Daily Swing Chart Technical Analysis

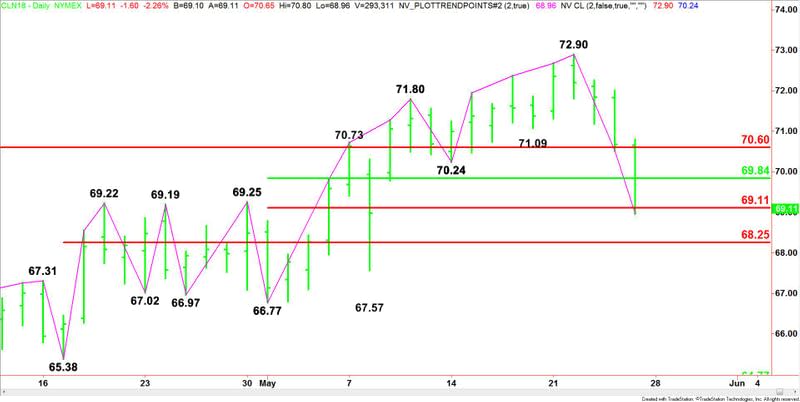

The main trend is down according to the daily swing chart. The trend turned down earlier in the session when sellers took out the last swing bottom at $70.24.

The short-term range is $66.77 to $.72.90. Its retracement zone at $69.84 to $69.11 is currently being tested.

The main range is $65.38 to $72.90. Its retracement zone at $69.14 to $68.25 is the next downside target.

Combining the two retracement zone creates a possible support cluster at $69.14 to $69.11. We could see a technical bounce on the first test of this zone.

Daily Swing Chart Technical Forecast

Based on the current price at $69.11, the direction of the market the rest of the session is likely to be determined by trader reaction to $69.14 to $69.11.

A sustained move over $69.14 will indicate the return of buyers. This could lead to an intraday short-covering rally with $69.84 the nearest upside target.

A sustained move under $69.11 will indicate the selling is getting stronger. This could fuel an acceleration into the main Fibonacci level at $68.25. This is another trigger point for an acceleration into a pair of targets at $67.57 and $66.77.

Watch the price action and read the order flow at $69.11 to $69.14 all session.

This article was originally posted on FX Empire