Crude Oil Price Update – Look for Upside Bias on Sustained Move Over $49.37

September West Texas Intermediate Crude Oil is trading higher shortly before the regular session opening. Traders are reacting to yesterday’s U.S. Energy Information Administration’s weekly inventories report and the expected export cuts from Saudi Arabia. The recovery from Tuesday’s steep sell-off suggests the hedge funds are long and in control.

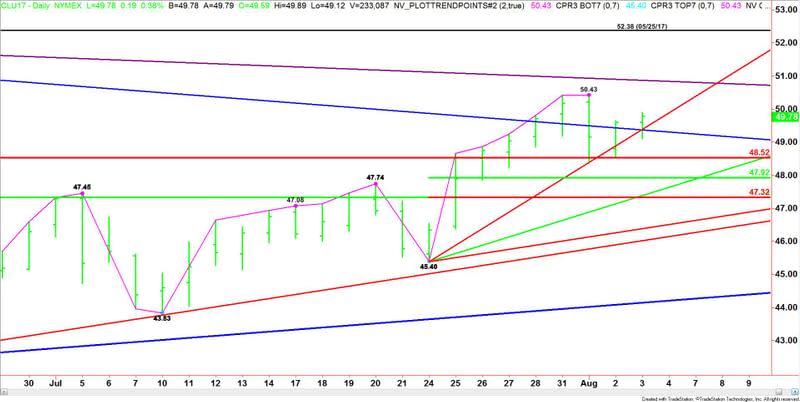

Technical Analysis

The main trend is up according to the daily swing chart. A trade through $50.43 will negate the closing price reversal top and signal a resumption of the uptrend. This could create enough upside momentum to trigger a rally into the May 25, 2017 main top at $52.38.

Crossing to the weak side of the Fibonacci level at $48.52 will put the market in a position to test the short-term retracement zone at $47.92 to $47.32.

Forecast

Based on the current price at $49.80 and the earlier price action, the direction of the crude oil market today is going to be determined by trader reaction to a price cluster at $49.40 to $49.37.

A sustained move over $49.40 will indicate the presence of buyers. This could drive the market into $50.43 then the downtrending angle at $50.87. The latter is the last potential resistance angle before the $52.38 main top.

A sustained move under $49.40 will signal the presence of sellers. This could trigger a fast break into potential support levels at $48.52, $47.92 and a support cluster at $47.33 to $47.32.

The daily chart indicates a strong upside bias will develop as long as the market holds above $49.37.

This article was originally posted on FX Empire