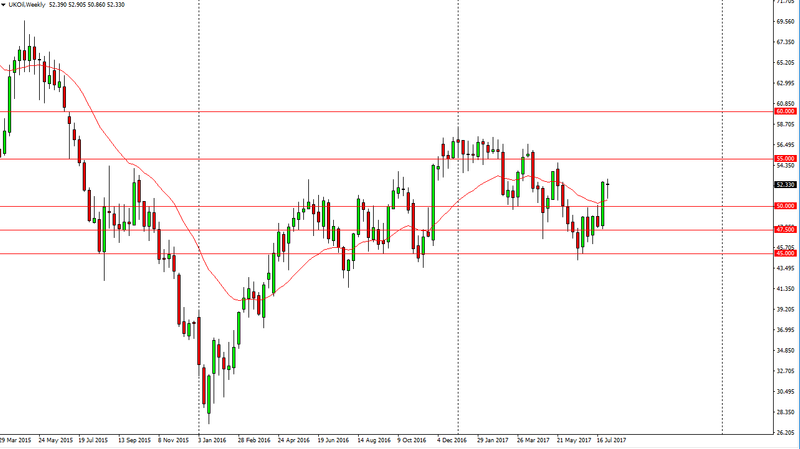

Crude Oil Price forecast for the week of August 7, 2017, Technical Analysis

WTI Crude Oil

The WTI Crude Oil market initially fell during the week but did find a little bit of resiliency towards the end of the day on Friday. Because of this, looks as if are going to form a bit of a hammer just below the $50 level, and a break above the top of the hammer for the week should send this market much higher, perhaps reaching the $52.50 level next, and then the $55 handle which is the top of the overall consolidation. Alternately, if we break down below the bottom of the weekly candle, that should send this market looking towards the $45 level as it would be a very negative sign. I think volatility is coming, but by waiting on the market to break one side of the candle or the other, it should put you on the right side of the trade.

WTI Video 07.8.17

Brent

Brent markets did very much the same, as they fell initially, but found enough support just below the $51 level to turn around and form a hammer. The hammer sits just underneath the $52.50 level, which has been somewhat important in the past. If we break above the top of the candle for the week, I don’t see the reason the market will go looking for the $55 level next. There is a massive amount of resistance just above there, so it’s not until we break above the $57 level that I would be comfortable hanging onto a longer-term moved to the upside. Ultimately, this is a market that is bullish, but face is a lot of headwinds just above. If we do not break above $57, it’s likely that the market will continue to stay within the consolidation that we have been in longer term.

This article was originally posted on FX Empire