Crude Oil Price Forecast: September Low Halts Decline

DailyFX.com -

To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

Crude Oil Technical Strategy: Short Bias Remains As Falling Resistance Holds On Strengthening USD

Supply and Demand Imbalance Fix At Algiers Could Trigger LT Bullish Head & Shoulders Pattern

Contrarian Sentiment System Now Favors Further Downside Risk

A likely rise in Oil exports and the continued rise in global supply relative to demand has continued to grip the world’s focus and put pressure on the price of Oil down toward the September low of $43.02/bbl. Recent stories on stories of Libya and Nigeria restoring production are further putting attention on the September 27 Algiers OPEC Meeting.

If Algiers passes without an agreement to cap production from Saudi Arabia, now the world’s largest exporter again then oversupply will continue to be a worry that could keep the price of Oil below $50/bbl.

Access Our Free Q3 Oil Outlook As Oil's Best Quarter Looks For Confirmation

One upside into balancing global supply and demand imbalance appears to be China’s plans to build their strategic oil reserves, but there is a likelihood that this will not be enough to support the Oil market if the US Dollar continues to trade higher or if OPEC is unable to reach a production-cap agreement in Algiers.

Track short-term Crude Oil price levels and patterns with the GSI indicator!

TradingView D1 Crude Oil Price Chart: Head & Shoulder’s Bullish Pattern Still Validating

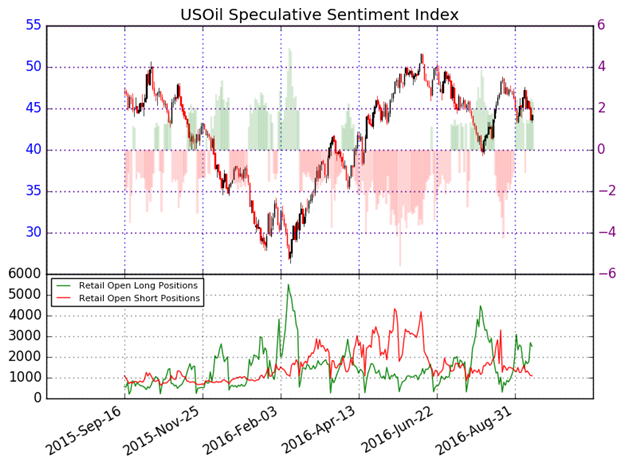

Contrarian System Now Favors Downside Risk as of 9/13/16

The chart above is simple has competing stories. First, the head and shoulders is a classic bullish price pattern that fails to play out as often as newer traders would hope. However, it’s unwise to show that after an extreme low in February, the market has recovered aggressively and is now sitting close to long-term price channel resistance and sitting above the 200-DMA at $40.91/bbl.

The key drivers appear to be the Bearish (Red) Andrew’s Pitchfork where resistance sits at ~$48.50/bbl and the 200-DMA at $40.91/bbl.

Given the recent US Dollar strength, which is emerging against commodity FX like the Canadian Dollar and Emerging Market currencies like the Mexican Peso we could continue to see a move toward the 200-DMA. A supportive component of US Dollar strength appears to be USD Funding costs on the international interbank stage that are shown with 3M USD LIBOR currently at 7-year highs.

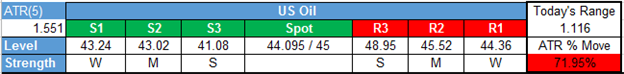

Short-term support remains at the September opening range low at $43.02/bbl. A break below there would turn the focus to the 200-DMA. Short-term resistance favors the September opening range high at $47.71/bbl. From a Global Macro perspective, we may continue to see more stories favoring support being tested.

In addition to the technical focus, we should keep an eye on retail sentiment as the downside is beginning to align with our Speculative Sentiment Index or SSI for now.

As of midday-Thursday, the ratio of long to short positions in the USOil stands at 2.29 as 70% of traders are long. Yesterday the ratio was 2.11; 68% of open positions were long. Long positions are 7.0% higher than yesterday and 44.8% above levels seen last week. Short positions are 1.6% lower than yesterday and 37.9% below levels seen last week. Open interest is 4.3% higher than yesterday and 11.5% above its monthly average.

We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives a signal that the USOil may continue lower. The trading crowd has grown further net-long from yesterday but unchanged since last week. The combination of current sentiment and recent changes gives a further bearish trading bias.

Key Levels Over the Next 48-hrs of Trading As of Thursday, September 15, 2016

T.Y.

Think Oil has more room to run? Trade Oil With Low Margin Requirements (non-US Residents only)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.