Credit card skimmers have been reported in Illinois. Here’s how to spot them, avoid scams

A metro-east city recently received a dozen reports of unauthorized ATM withdrawals, which often involve the use of credit card skimmers.

The devices can do financial damage, especially to those who don’t know they’ve been scammed until several fraudulent transactions have been made.

The Fairview Heights Police Department is investigating the reports, which originated from a Scott Credit Union ATM at 555 Lincoln Highway, a March 19 department press release said. While the means used to make the unauthorized withdrawals haven’t yet been confirmed, card skimmers are a common culprit.

Skimmers, which are sometimes installed on credit card readers at gas stations, ATMs, restaurants and stores, collect people’s debit or credit card numbers and can even capture your PIN, Forbes reports.

The scam devices were reported at two pumps at Chatham gas station last year, as well as at a grocery store in Des Plaines in August.

How to see if a skimmer has been attached to a store's credit card reader https://t.co/G4K0HGAsjw

— CBS Evening News (@CBSEveningNews) February 2, 2024

Two fraud reports have been made in St. Clair County so far this year. Illinois State Police Trooper Melissa Albert-Lopez told the News-Democrat more specific information about credit card skimmers is not available through the office, so fraud reports may be about skimmers, wire fraud, forgery or other schemes.

Here’s what to know about credit card skimmers and best practices and tips you can use to protect your information.

How to avoid credit card skimmers

Here are some best practices to avoid credit card skimmers, from Illinois Attorney General spokesperson Drew Hill:

“Make sure the gas pump is closed and shows no signs of tampering. You may notice a security seal over the panel to indicate whether it has been tampered with.

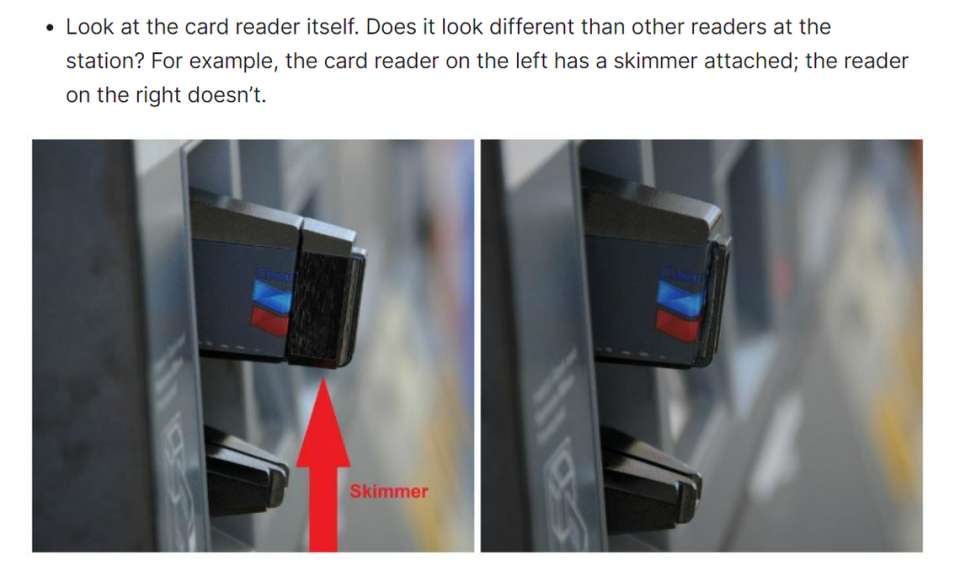

Look at the card reader and compare it to the other readers at the same station. If they look different, a skimmer may be attached.

If the reader wiggles, do not insert your card and report to the attendant.

If you use a debit card, run it as a credit card transaction to avoid the instant deduction that occurs when you conduct a debit transaction with your PIN.

Monitor your bank accounts and promptly dispute any unauthorized charges.

Consider placing a transaction alert on your account so that you receive an alert from your bank every time a transaction occurs above a certain dollar amount. If you receive an alert for a transaction that you did not initiate, check your statement and promptly dispute it if it was unauthorized.”

The Illinois attorney general also recommends anyone who is affected by a credit card skimmer in the state to file a complaint with the office.

What should you do if you’ve been scammed?

The U.S. Secret Service recommends people take the following steps after realizing they’ve been the victim of credit card fraud:

Report the crime to the police and get a copy of your police report and/or case number. You may need to provide this to your bank or credit card company and potentially your insurance company.

Contact your credit card issuer and get replacement cards with new numbers.

Call credit reporting bureaus’ fraud contacts to report the theft and ask them to flag your accounts.