Consumers are ‘starting to see the pain’ from the trade war

Now more than a year into the U.S.-China trade war, American consumers have so far been largely shielded from the negative impact of tariffs. But one major Wall Street investment bank says that’s all about to change and it has the data to prove it.

“I think you're starting to see the pain,” Bank of America Securities Senior U.S. Economist Joseph Song told Yahoo Finance’s The Final Round. “We have a proprietary consumer confidence index, and it actually dipped on the trade headlines in the latest reading.”

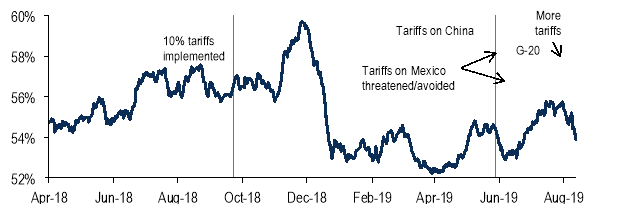

The Bank of America Merrill Lynch U.S. Consumer Confidence Indicator for consumer sentiment dropped since mid-July by 1.7 points to 53.9. In a note to clients, the bank’s Global Research team writes that “the ebb and flow in consumer confidence seems squarely tied to the U.S.-China trade war via negative headlines and financial market reaction to said trade war.”

Trade war escalates

Earlier this month, President Trump shocked the financial markets when he unveiled a new round of tariffs on roughly $300 billion in Chinese imports, which would primarily target consumer-related goods, set to take effect on September 1st. He later announced he would delay tariffs on select popular consumer products until mid-December.

But in the latest escalation of trade tensions between the U.S. and Beijing, President Trump on Friday announced even higher tariffs on most Chinese imports in response to China slapping tariffs on $75 billion worth of U.S. goods earlier in the day.

In a late Friday afternoon tweet, President Trump said the White House will raise the September 1st tariffs on $300 billion of products to 15% from 10%. Additionally, the U.S. will raise existing levies on $250 billion in Chinese goods to 30% from 25% starting on October 1st.

...Additionally, the remaining 300 BILLION DOLLARS of goods and products from China, that was being taxed from September 1st at 10%, will now be taxed at 15%. Thank you for your attention to this matter!

— Donald J. Trump (@realDonaldTrump) August 23, 2019

What does this mean for consumers?

“I think when those consumer tariffs go into effect September 1st, that's when you can actually start to see consumers pull back,” Bank of America Merrill Lynch’s Joseph Song told The Final Round. “And our expectation is that growth is going to start to slow below trend at the turn of the year. ”

The Global Research team at BofAML found that only 26% of consumers surveyed affirmed that they favored the trade war against China.

“The persistent uncertainty shock from the trade war is starting to show up in weaker global data and recession indicators are starting to flash yellow,” BofAML team writes in a client note. “Consequently, sentiment may fail to rebound, sparking further concern of an economic slowdown.”

Iryna Kirby is a Producer for Yahoo Finance. Follow her on Twitter at @IrynaNesko.

Read more:

David Zervos: The Fed is ‘the greatest monetary policy experiment in history’

Why the Fed shouldn’t be afraid to make a rate cut ‘mistake’ right now

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.