This company has £167m in cash yet its market value is just £160m

Investors continue to withdraw money from funds that invest in British shares and one result is that the London market continues to offer up great value in all sorts of places.

The hard part is finding what is going to change investors’ minds and persuade them to snap up these potential bargains but in the case of Costain the valuation opportunity is clear and it is possible to discern potential catalysts that could lead to capital gains (and even dividends) for patient portfolio builders who are prepared to allocate a percentage of their capital to smaller stocks.

Costain is an infrastructure specialist and it provides contracting and consultancy services to the energy, transport, water and defence industries.

Key clients include BP, Shell, BAE Systems, United Utilities, Network Rail, Magnox, Transport for London and the Government.

The projects involved are usually big, multi-year ones and Costain’s £2.5bn order book provides good visibility for a business that is expected to generate £1.4bn in sales in 2023. Some £800m in sales are already secure for 2024.

The Berkshire-headquartered concern is also working on winning new business and has a pipeline of orders of some £1.5bn where it already has preferred bidder status.

This is not to say that closing these deals, and then managing them, will be easy. Costain got itself into a terrible tangle with two particular projects, made a loss from 2019 to 2021 and tapped shareholders for £100m in 2020.

The shares have flat-lined since March of that year and even now, as chief executive Alex Vaughan, chief financial officer Helen Willis and their team have got the company back into the black, the operating margin in the first half of 2023 looked skinny at 2.3pc on an underlying basis.

Management’s ultimate goal is to drive that figure above 5pc over time, helped in part by ongoing development of the higher-margin consultancy revenue stream. Reaching that target would give a good boost to earnings, even if such a margin would not mean that Costain’s stock deserved to trade on a high multiple of sales or earnings.

Yet here lies the rub. Adjusting for pensions and leases, Costain has £167m in net cash on its balance sheet and that compares with a market value of £157m. In effect, the company’s actual business is thrown in for free.

A multiple of around 10 times forecast earnings is also interesting, especially in the context of how profits are still relatively depressed, and the margin target implies far bigger profits by 2025 and 2026.

Even allowing for the risks of further troubled projects, changes to the timing of contracts and input cost inflation, as well as how the cash pile will ebb and flow over the year during the normal course of business, the valuation provides investors with some protection.

It also offers scope for gains should Costain prove that the woes of 2019-21 are behind it and profits and margins are indeed on the rise. The board is even looking into paying a dividend for the first time since 2019.

With water utilities about to ramp up capital investment as part of their “AMP8” regulatory cycle to appease a largely unhappy regulator and frustrated customers, nuclear power an option once again in the dash for energy security and improved infrastructure a national need, Costain’s skills should be in demand.

Even allowing for the Government’s backsliding on the northern leg of the HS2 rail project, the company has the opportunity to participate in such major projects as the £20bn Sizewell C nuclear power plant and Network Rail’s £40bn “CP7” spending plan for 2024 to 2029, as well as National Highways’ third Road Investment Strategy, which will run from 2025 to 2030.

Management needs to reassure investors that Costain is now better at tendering for (and pricing) these complex projects and managing the associated risks, but improved sales and higher margins could then be the catalyst that persuades investors to look at the stock.

After all, the share price has plunged by nearly 90pc from the levels reached in 2017-18, before difficulties with the A465 road project in Wales and the Peterborough & Huntingdon gas compressor project for National Grid hit home and punctured the profit and loss account.

The company’s financial year ends in December and the full-year results for 2023 are due in March 2024, when management may say more about dividends, progress towards the 5pc margin target and the outlook for next year, when the goal is to improve margins to 3.5pc.

Costain could finally be on the way back. Buy.

Questor says: buy

Ticker: COST

Share price at close: 56.8p

Russ Mould is investment director of AJ Bell, the stockbroker

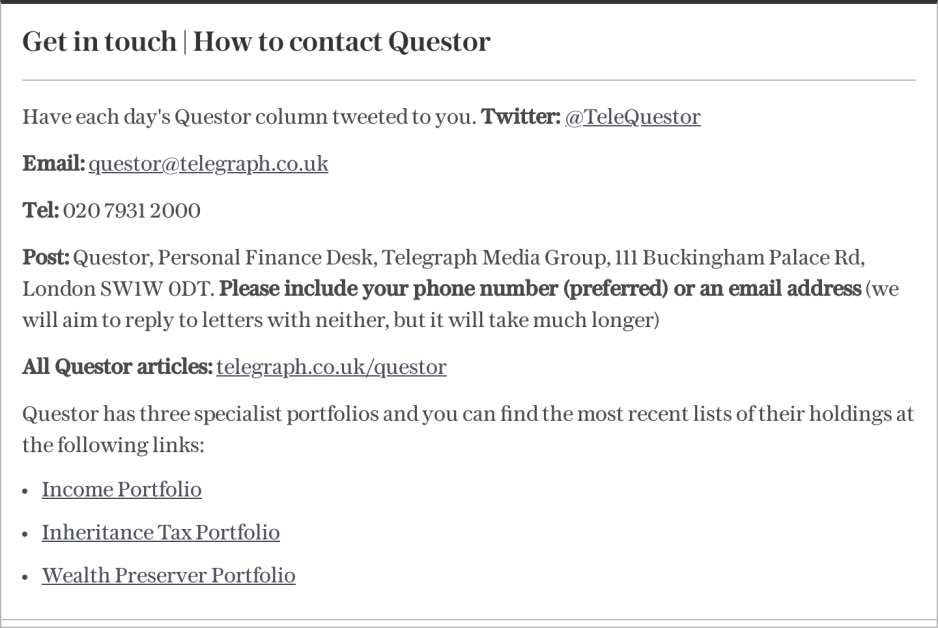

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips