This one chart shows why you should be skeptical of 'adjusted' earnings

Investors should be wary of the earnings announcements they read every quarter.

When companies announce their quarterly earnings, they often provide two parallel sets of numbers: GAAP earnings and non-GAAP earnings. The former is based on “generally accepted” accounting principles and the latter is based on adjustments to GAAP earnings that management believes you should be considering.

Those non-GAAP earnings — sometimes called pro forma earnings or adjusted earnings — are the numbers management wants you to focus on because they’d argue these numbers better reflect the true underlying profitability of the company. Furthermore, they’re the numbers that analysts forecast in their research reports.

The issue: non-GAAP earnings are almost always higher than GAAP earnings.

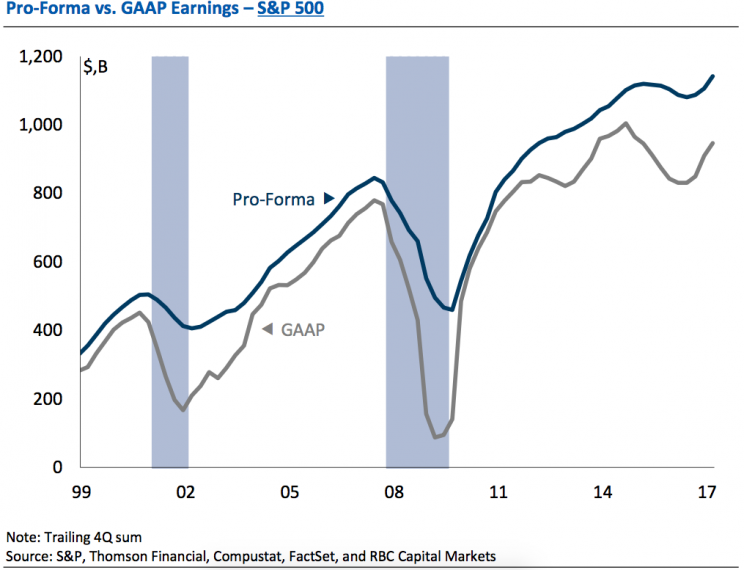

Consider this chart from RBC Capital’s Jonathan Golub. For S&P 500 (^GSPC) companies, the earnings number with managements’ adjustments have been higher than the unadjusted number for all of the 21st century so far.

Now, it’s not hard to imagine why management would make these adjustments higher. It could be a bias towards optimism. It could be personal financial interests like owning a lot of stock options in the company. It may actually be that GAAP does an unfair job of capturing the underlying profitability of the company.

Regardless of management’s reasoning, it’s a bit jarring to see that these adjustments rarely cut the other way. For example, a big one-time profit on an asset sale may inflate earnings in one quarter, forcing management to make an adjustment lower. But as you can see in the chart, these adjustments to the upside tend to overwhelm adjustments to the downside.

There’s no perfect, standard way to measure earnings

When accounting for business, CFOs are guided by a standard known as generally accepted accounting principles, or GAAP. GAAP represents an attempt to promote uniformity in how companies report their financial performance.

But income statements reported based on GAAP don’t always do a good job of reflecting the ongoing performance of a company’s underlying operations. GAAP earnings will include a lot of non-recurring or one-time items like asset write-downs and restructuring costs. These items distort quarterly profits and arguably misrepresent long-term profitability. And so, a company will also provide an adjusted, or non-GAAP earnings number that excludes what are arguably non-recurring items.

Unfortunately, non-GAAP earnings often reflect a lot of liberties taken by managers aiming to inflate their numbers. For example, one of the more popular items that gets added back is stock-based compensation expenses, which Warren Buffett once characterized as “the most egregious example” of companies favorably fudging their numbers.

There are some signs to suggest that change is coming to the way companies employ these practices. Last quarter, Facebook (FB) said it is “no longer reporting non-GAAP expenses, income, tax rate, and earnings per share (EPS).”

The bottom line: There is no perfect standard for accounting for a company’s financial performance in a given period. While this is not ideal for many, it doesn’t change the fact that investors and analysts need to do their homework when they’re looking into a company and considering it as an investment.

–

Sam Ro is managing editor at Yahoo Finance.

Read more: