CMRE Stock May Have Hit a Wall, Says Analyst

Costamare Inc (NYSE:CMRE) has been on a roll lately, the stock just touched a one-year high of $8.29 earlier this week, and clocked a 29.5% for October, making it the ship manufacturer's biggest monthly gain in over 10 years. This rally could be sputtering out soon though, according to Citi, which downgraded the equity to "sell" from "neutral," but upped its price target to $7.50 from $6.50 -- a slight discount to current levels. The analyst said Castamare's massive year-to-date gain of nearly 80% seems to be getting ahead of fundamentals, which could create moderate downside risk.

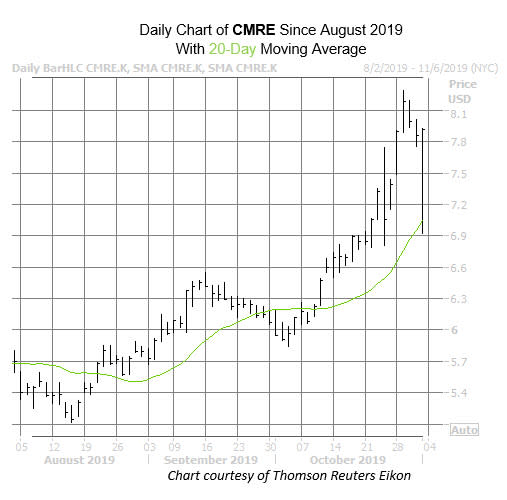

While Citi's downgrade initially rocked the stock, the equity was able to rebound off its 20-day moving average, and is now trading at $7.87. The stock could very well be in cool-down mode, however, since the site of this week's one-year highs has served as a ceiling for the security since October 2016.

Citi's pessimistic stance is the norm among other brokerages, with two-thirds of those in coverage considering the stock a "hold." Plus, the consensus 12-month target price of $7.25 is at a nearly 8% discount to current levels.

Options bulls have been much more on board, with over six calls bought for every put on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) during the last 10 weeks. This ratio sits in the 79th percentile of its annual range, suggesting that this appetite for bearish bets is healthier than usual.

This bullishness has carried into today's trading. While overall volume is light, 417 calls and 136 puts have crossed the tape so far -- double the intraday average. Most of this activity is taking place at the December 2020 7- and 5-strike calls, where positions are crossing at the bid price.

Meanwhile, the security's Schaeffer's Volatility Index of 39% sits in the low 19th percentile of its annual range. This means options traders are pricing in relatively low volatility expectations for the stock right now.