Classic Car Values Keep Rising, But Backfires Multiply

It’s good to be a Ferrari. OK, maybe not just any Ferrari, but a Ferrari of unimpeachable provenance and standing. For those prized stallions, the price continues soar, as proven by a 2015 auction season that continued to show impressive overall growth while at the same time hinting at a correction for those cars that aren’t quite up to snuff.

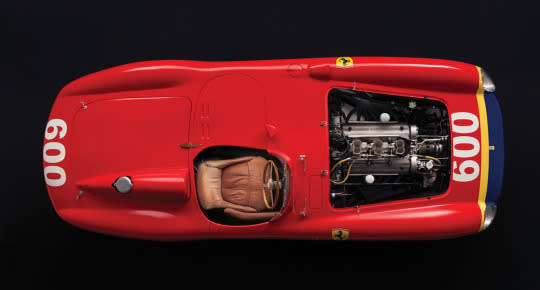

The world’s top auction houses—including but not limited to RM Sotheby’s, Bonhams, Gooding & Co. and Russo and Steele—posted record years as collectors continued to view classic cars as a combination of blue chip stock and realized childhood fantasy. Topping the list was the $28 million fetched for a 1956 Ferrari 290 MM Spider (RM Sotheby’s) shown above, not quite the $38 million hammered down in 2014 for a 1962 Ferrari GTO (Bonhams), but nothing to sneeze at.

Related: From Vettes To Shark-Nose Ferraris, Muscle Rules Russo & Steele Sale

In fact, according to classic car insurers Hagerty, the top 10 list is a veritable Ferrari-fest dominated by 250 models (RM Sotheby’s 1964 250 LM in second at $17 million, and so on), with this party crashed only by fellow racing legends Aston Martin (1962 DB4 GT Zagato Coupe sold for $14 million by RM Sotheby’s), McLaren (1998 F1 LM sold for $13.7 million by RM Sotheby’s, below) and Porsche (1982 956 sold for $10 million by Gooding & Co.).

North American classic car auctions hit a record $1.45 billion, up 11% over last year, Hagerty reports. Although there was a 9% drop in sales volume, the average price of most cars went up 21%, with some models experiencing even bigger jumps, notably 1974-1977 Porsche 911s (up 154%), 2004-2009 Aston Martin DB9s (up 141%) and Ferrari Testarossas (up 98%).

Related: Rare European Cars Follow American Muscle To Arizona

In case you’re wondering which cars took the steepest valuation decline, that would be the ‘50s Hudson Commodore (down 36%), early 70s BMW 2002 (down 33%) and the late ‘50s Studebaker Golden Hawk (down 30%).

As evidenced by that first buoyant line-up, most of the auction house movement these days is coming from 1980s and newer sports cars, signaling a passing of the collector baton to a generation of late-boomers and Gen Xers who have acquired the means to purchase the automotive crushes of their teenage years.

Despite a general slowdown in 2015 sales among vehicles that aren’t considered pristine examples of the breed, “the notable exception is rapid growth among younger buyers who are exercising their buying power by spending on the poster cars of their youth,” says McKeel Hagerty, CEO of Hagerty.

That means early supercars such as BMW M1, above, and even mass market exotics like Ferrari’s “Magnum P.I.”-starring 308/328 series have seen significant price upticks. The former has seen a tripling in three years to $600,000, while the once $50,000-all-day-long 328 GTS is now over $100,000 for a fine example of Pininfarina’s classic.

Related: Your Instant Ferrari Collection Is Just $12 Million Away

“The exponential compounding of values that we’ve seen in the past 18 to 30 months is plateauing,” says Drew Alcazar of Russo and Steele, which sold a 2005 Porsche Carrera GT at Monterey for nearly $800,000. “That (1950s) Mercedes-Benz Gullwing that was $500,000 in 2008 and is $1.5 million now, I don’t know that it’ll be $3 million in seven more years.”

In fact, for Alcazar, some top exotics not hitting their reserve at recent auctions speaks to a combination of election year concerns over the economy combined with a general feeling that only the best cars should be the best prices.

“Personally, I like a sense of stability, because when there’s blood in the water, you really aren’t sure how to counsel your buyers and sellers. But the good news is we’re not seeing any huge drops in values on good cars, which means that classic cars are still a good place to have some money parked in. Although I would argue that real dividend is in enjoying the cars.”

RM Sotheby’s saw its 2015 tally—some $593 million—jump 26% over 2014, despite selling fewer vehicles. “While we saw a leveling off as well on some cars, for a machine that has been restored properly or is authentic, you’re always going to get top dollar,” says RM Sotheby’s Gord Duff, who also cites the 300SL as well as Ferrari’s Daytona as examples of cars whose prices only skyrocket for the right, unique example.

“Porsches have been very hot, from the ‘70s and ‘80s, but that said, when a Turbo jumps from $80,000 to $300,000 and there are, relatively speaking, a lot for sale, then you see only the very finest get the best prices,” says Duff.

Related: The Old And The Beautiful Compete For New Money At RM Sotheby’s

Bonhams, which racked up $45 million in sales at its Monterey weekend Quail Auction alone, saw brisk sales for modern icons such as a 1989 BMW M3 for nearly $100,000 and a 2005 Ferrari Superamerica for $350,000. But specialist Jakob Greisen says “there’s also been a correction for less-than-excellent examples of some of the more iconic cars” including the 300SL. That said, he adds that “no matter how much we study the market, no one can place a value on passion or how much money someone might pay to drive a car that was once just a dream and a poster on his or her wall.”

The 2016 auction season starts off with its usual bang next week, as the major houses descend on the desert town of Scottsdale, Ariz., for a series of events that started as a spotlight on American muscle cars and now includes some truly rare European gems.

Ultimately, the real satisfaction isn’t in the acquiring, but in the driving. “I think the sheer enthusiasm and engagement within the collector car hobby will ensure that this market will sustain itself,” says Bonhams’ Greisen. “The increasing number of rallies, tours and concours events are all filled to the brim with people who simply love cars and don’t mind getting up at dawn to follow their passion. It’s a sure sign these cars were not just bought for investment, and that they can provide so much more fun than mere stocks and shares.”