CL Educate And Other Top Cheap Stocks

CL Educate and Piccadily Agro Industries are stocks on my list that are potentially undervalued. This means their current share prices are trading well-below what the companies are actually worth. Investors can benefit from buying these companies while they are discounted, because they gain when the market prices move towards the stocks’ true values. Below is a list of stocks I’ve compiled that are deemed undervalued based on the latest financial data.

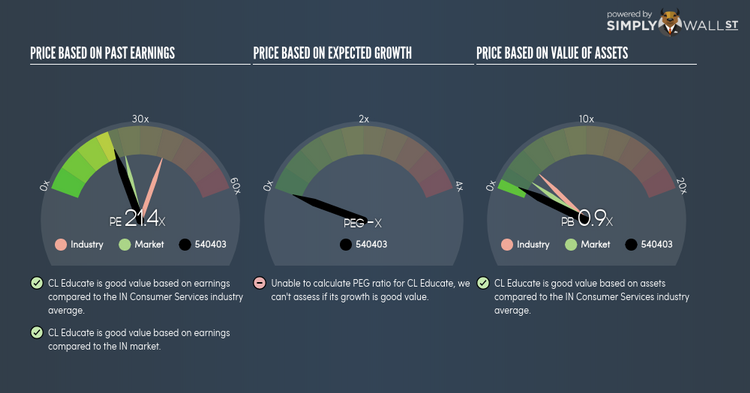

CL Educate Limited (BSE:540403)

CL Educate Limited engages in the education business. Established in 1996, and currently lead by Gautam Puri, the company provides employment to 376 people and with the market cap of INR ₹3.12B, it falls under the mid-cap group.

540403’s shares are now hovering at around -84% beneath its intrinsic value of INR1343.09, at a price of ₹220.20, according to my discounted cash flow model. This discrepancy gives us a chance to invest in 540403 at a discount. Additionally, 540403’s PE ratio is trading at around 21.4x against its its Consumer Services peer level of, 38.31x meaning that relative to its peers, you can buy 540403’s shares at a cheaper price. 540403 is also strong financially, as short-term assets amply cover upcoming and long-term liabilities. The stock’s debt-to-equity ratio of 10.41% has been falling for the last couple of years demonstrating its capability to reduce its debt obligations year on year. Continue research on CL Educate here.

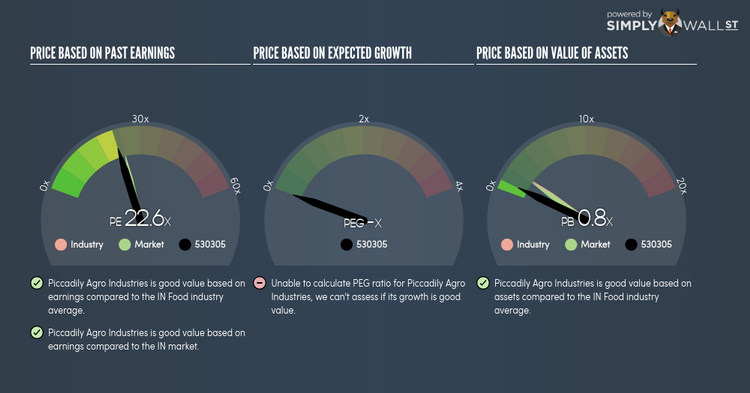

Piccadily Agro Industries Limited (BSE:530305)

Piccadily Agro Industries Limited manufactures and sells sugar, molasses, and bagasse. Established in 1994, and now run by Harvinder Chopra, the company employs 143 people and with the company’s market cap sitting at INR ₹1.22B, it falls under the small-cap group.

530305’s shares are now floating at around -84% beneath its actual value of INR80.17, at a price tag of ₹12.89, according to my discounted cash flow model. signalling an opportunity to buy the stock at a low price. Also, 530305’s PE ratio stands at around 22.6x while its index peer level trades at, 24.41x meaning that relative to other stocks in the industry, you can buy 530305’s shares at a cheaper price. 530305 is also a financially robust company, with current assets covering liabilities in the near term and over the long run. It’s debt-to-equity ratio of 83.93% has been diminishing over time, demonstrating 530305’s capability to reduce its debt obligations year on year. More on Piccadily Agro Industries here.

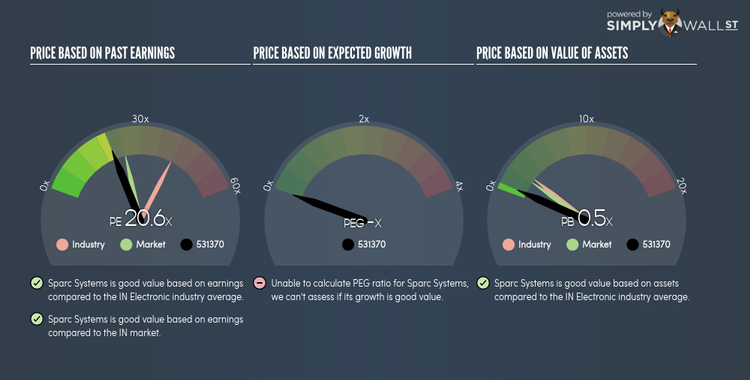

Sparc Systems Limited (BSE:531370)

Sparc Systems Limited provides software and hardware electronic security solutions in India. Sparc Systems was founded in 1989 and with the stock’s market cap sitting at INR ₹17.84M, it comes under the small-cap stocks category.

531370’s stock is now hovering at around -51% beneath its intrinsic value of INR7.42, at the market price of ₹3.65, based on its expected future cash flows. This mismatch indicates a chance to invest in 531370 at a discounted price. Furthermore, 531370’s PE ratio stands at around 20.57x compared to its Electronic peer level of, 41.73x suggesting that relative to other stocks in the industry, you can buy 531370’s shares at a cheaper price. 531370 also has a healthy balance sheet, with short-term assets covering liabilities in the near future as well as in the long run. 531370 also has a miniscule amount of debt on its balance sheet, which gives it headroom to grow and financial flexibility. More detail on Sparc Systems here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.