CIM: Following the Flow

By Henry Schwartz

News Corp (NWSA) has been notching to new highs after gaining more than 10% year-to-date. The stock is in focus Monday on news it is selling a gaming unit to J2 Global’s Ziff Davis. The news comes just a few days before the company reports earnings and, although shares haven’t seen a lift on the headline, some players in the options market seem to be positioning for a rally in the stock in the months ahead.

According to web site AllthingsD, NWSA has nearly finalized a deal to sell its IGN Gaming Unit to Ziff Dafis for an undisclosed amount. IGN has web sites like AskMen.com and Gamestats.com and, citing “sources close to the situation,” the report notes that the price for the unit is likely to be considerably lower than the $650 million NWSA paid in 2005.

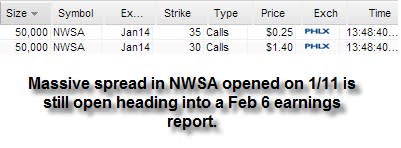

NWSA is down $0.15 to $28 despite the headline, but notched new record highs Friday after nearly doubling in value over the past two years. Investors are attracted to the stock’s steady cash flows and strong name brand. In the options market, investors seem bullish on the name as well On January 24, for instance, one investor bought a substantial July 28 – 30 (1X2) call ratio spread on the stock for $0.30, 6250X (bought 6250 of the 28s and sold 12,500 of the 30s). However, the largest open interest positions in NWSA are in the January 30 and 35 calls after an investor bought the January 30 – 35 call spread on the stock for $1.15, 50000X on January 11. OI in the January 30s is 69,818 contracts and in the January 35s, it is 50,282. The total interest in those two contracts, of 120K represents 43.3% of the total OI positions in the name.