China's Wanda buys luxury yacht maker Sunseeker

BEIJING (AP) — Chinese property and cinema conglomerate Dalian Wanda Group said Wednesday it is buying British yacht maker Sunseeker and will develop a high-end London hotel, expanding into the luxury market as part of the latest foray abroad by a major Chinese firm.

The company will acquire a 91.81 percent stake in Sunseeker, in a transaction worth 320 million pounds ($500 million). The deal enhances Wanda's international reputation and position in the global luxury, entertainment and tourism markets, while boosting Sunseeker's access to the rapidly growing Chinese market for expensive goods to show off newly acquired wealth.

"China's consumption is growing, especially the market for high-end luxury products — it is growing very rapidly," Wanda founder and CEO Wang Jianlian said at a lavish new conference in the Chinese capital. "For instance, we have noticed the growth in consumption of luxury yachts, also private planes — the growth is exponential."

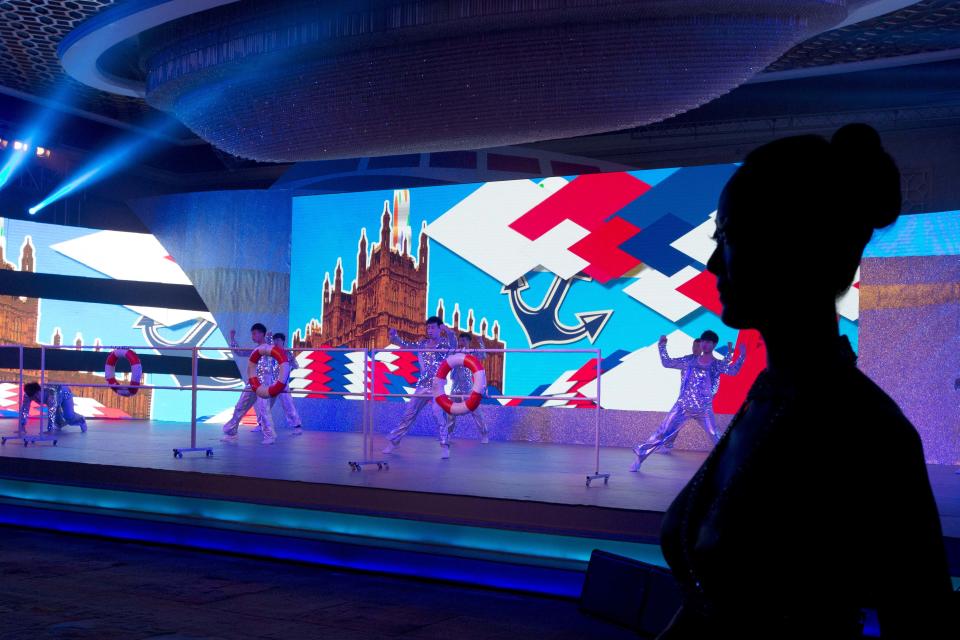

The announcement was made at a Wanda-managed five-star hotel in downtown Beijing featuring a laser show, costumed dancers and musicians.

The luxury motorboat company will remain a British company, based in the town of Poole in Dorset, and will maintain its British production centers and workforce.

"Under no circumstances will we compromise the Sunseeker brand. Absolutely, it will not happen, " Sunseeker managing director Stewart McIntyre said. "We have to maintain our position as a prominent brand in the world, and we will do everything in our hands to make sure that happens."

Wanda said it also plans to invest 700 million pounds ($1 billion) in its five-star, 160-room London hotel on the South Bank overlooking the Thames River.

The 105,000-square meter (1.13 million-square foot) project will also include 63,000 square meters (678,000 square feet) of luxury apartments, appealing to wealthy Chinese looking to invest in overseas property.

Wanda said that would be the first luxury hotel operated by a Chinese firm overseas and the first in a planned chain of Wanda hotels in foreign cities.

Wanda last year set the current record for the biggest Chinese takeover of an American company when it bought the AMC cinema chain for $2.6 billion.

Founded in 1988, Wanda within China runs 38 five-star hotels, 57 department stores and 6,000 cinema screens, among other commercial concerns, with assets worth a total of 300 billion yuan ($49 billion), the company said.

Cash-rich but inexperienced Chinese firms are increasingly seeking foreign brands, technology and skills to speed their development.

That was demonstrated in spectacular fashion by Chinese meat packer Shuanghui International's $4.7 billion bid last month for Virginia-based pork producer Smithfield Foods, although the offer has yet to receive regulatory approval and some shareholders say it undervalues the company.

Unlike Western buyers, which might lay off employees, Chinese companies tend to keep them and sometimes hire more. Sweden's Volvo Cars expanded its workforce after it was acquired in 2010 by Chinese automaker Geely Holding Group.

The overseas expansion by Chinese entrepreneurs' comes as the country's explosive double-digit economic growth that powered their rise slows.

___

Isolda Morillo of Associated Press Television News contributed.