China Plans $139 Billion Special Ultra-Long Debt for Economy

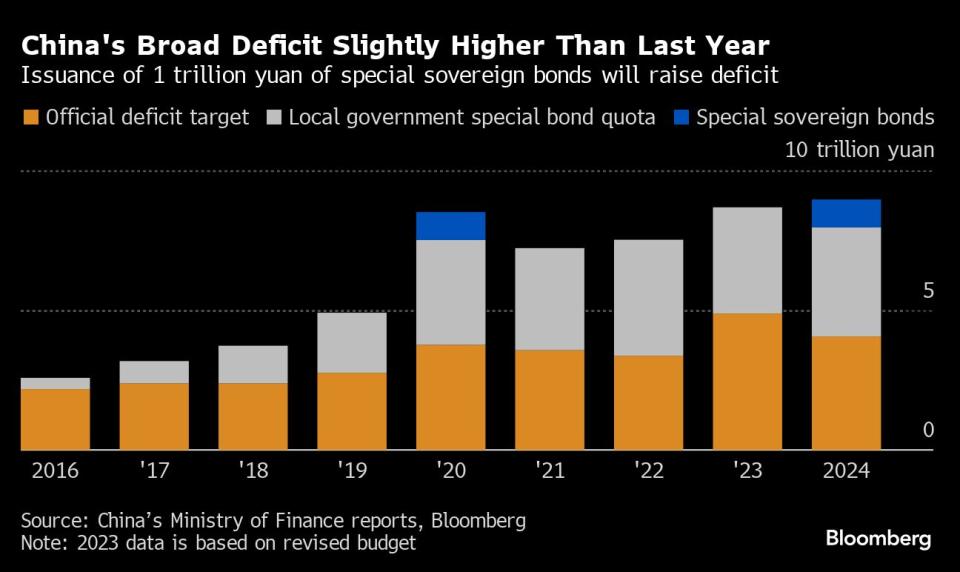

(Bloomberg) -- China plans to issue 1 trillion yuan ($139 billion) of ultra-long special central government bonds this year as authorities vow to ramp up fiscal stimulus for the world’s second-largest economy.

Most Read from Bloomberg

Tech Giants Drag Down US Stocks After Torrid Rally: Markets Wrap

Gold Climbs to Record on Mix of Fed Pivot and Geopolitical Risks

Bitcoin Retreats After Record-Setting Run That Topped $69,000

Premier Li Qiang outlined the proposal on Tuesday in a government work report delivered at the National People’s Congress, an annual gathering of China’s parliament in Beijing. It’s only the fourth such sale in the past 26 years, with the most recent one in 2020 when authorities issued 1 trillion yuan worth of those bonds to pay for pandemic response measures.

China aims to issue such ultra long-term special bonds for several consecutive years, though Li’s report didn’t include a target beyond 2024. Li said the government will “appropriately enhance the intensity of our proactive fiscal policy.”

The issuance this year — which Bloomberg News reported in January was under consideration — signals a focus by President Xi Jinping’s government this year on tapping fiscal support to help the economy, which is facing pressures from deflation, a property crisis and dampened consumer confidence. The issuance of special sovereign bonds shows an effort to centralize spending at a time when local officials are struggling under a mountain of debt.

“It’s a very necessary move, logically speaking. Local governments clearly lack the fiscal resources looking at the overall fiscal financing picture,” said Yao Wei, chief economist for Asia Pacific at Societe Generale SA. “The future trend should be the nation borrowing with the central government’s credibility.”

Chinese stocks listed in Hong Kong fell Tuesday after key targets — including an economic growth goal of around 5% for 2024 — were announced at the National People’s Congress. The Hang Seng China Enterprises Index slumped as much as 3%, the biggest decline in more than one month. The onshore CSI 300 Index swung between gains and losses before edging slightly higher in the afternoon session.

The planned issuance of special ultra-long bonds in 2024 is nearly three times the size of average sales in the previous three years, according to Bloomberg calculation based on official data. The yield on 30-year notes was little changed and remained near the lowest level in nearly two decades on Tuesday.

The funding raised through the issuance of special sovereign bonds this year will be used to finance “major national strategies and building security capacity in key areas,” according to the Ministry of Finance’s budget report on Tuesday.

Alongside the special central debt, local governments will be allowed to sell 3.9 trillion yuan ($542 billion) of new special bonds, according to the report.

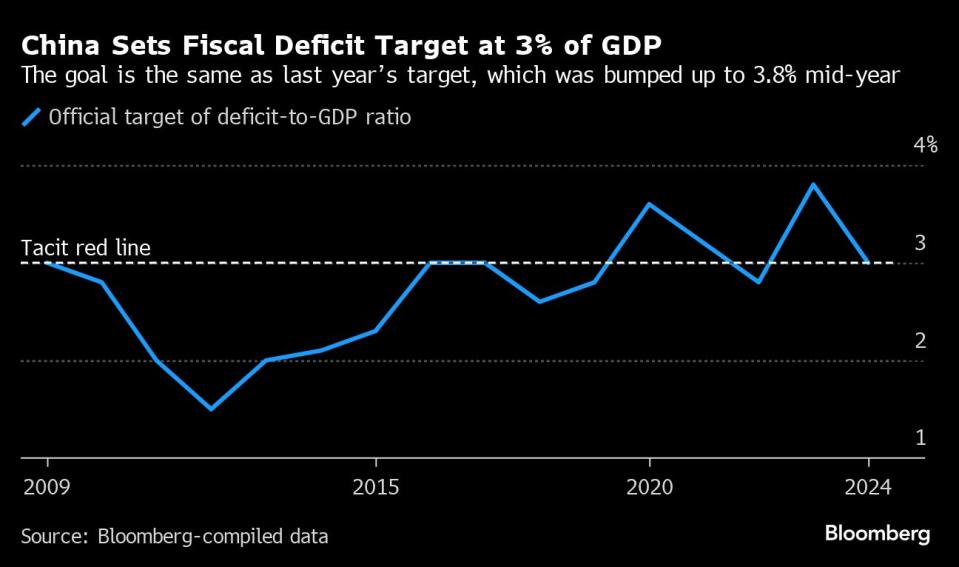

Beijing set its fiscal deficit target at 3% of gross domestic product. That’s the same as the goal set in last year’s budget report, which was bumped up to 3.8% in October alongside an announcement for extra debt issuance. The special bond issuance by local and central authorities doesn’t count within the official deficit ratio.

The overall deficit level is “appropriate,” said Huang Shouhong, director of research office at the State Council who helped draft the government work report, at a briefing Tuesday.

“It sends a positive signal to the outside world, helps control the government’s debt ratio, and can enhance fiscal sustainability. It reserves the policy room for dealing with potential risks and challenges in the future,” he said.

The issuance of the special sovereign debt is “much needed when local governments are increasingly fiscal constrained given the structural shortfalls in land sales,” said Xiaojia Zhi, head of research at Credit Agricole CIB.

In addition to the fiscal support, some economists pointed to the ongoing need for looser monetary policy as well if the government hopes to reach its economic growth goal this year. The target mirrors last year’s, but will be harder to achieve given a less favorable base of comparison.

“What is certain is that interest rates will go lower to mitigate the burden of more government bond issuance and stimulate demand,” said Gary Ng, senior economist at Natixis SA. “This means that it offers some catalysts for bonds, but the impact on equities and currency will depend on the stimulus’ effectiveness and real economic improvement.”

The central government plans to issue 3.34 trillion yuan ($464 billion) in general sovereign bonds in 2024, the Ministry of Finance said in its report. That’s 820 billion yuan less than 2023’s total — a figure that includes an extra 1 trillion yuan in sovereign debt announced in October.

The quota for general bonds to be sold by local governments is 720 billion yuan, unchanged from last year, according to the ministry’s report.

--With assistance from Krystal Chia, Emma Dong, Shulun Huang, Iris Ouyang, Zhu Lin, Yujing Liu, Jing Li, Wenjin Lv and Tian Chen.

(Updates with details about the size of the special bond issuance)

Most Read from Bloomberg Businessweek

Humanoid Robots at Amazon Provide Glimpse of an Automated Workplace

Immigration Rage Drowns Out the US Labor Market’s Need for Workers

The Monaco Royals Whose Deals Have Brought Peril to the Palace Doors

©2024 Bloomberg L.P.