China goes for the jugular on strategic minerals

- Oops!Something went wrong.Please try again later.

Gallium tops the list of 50 critical minerals deemed vital for American national security and hi-tech production, and deemed most vulnerable to supply-risk by the US Geological Survey. It is equally vital to Europe and the UK.

There is no US national stockpile. The Pentagon has confessed that it has no military reserves. It seems that the bureaucratic system has only just woken up to the irreplaceable properties of this silvery trace metal in advanced weaponry and in the race for global dominance of electric vehicles, 5G & 6G wireless and power electronics.

“Gallium nitride (GaN) is foundational to nearly all the cutting-edge defence technology that we produce,” said Colin Whelan, head of advanced military projects at Raytheon.

The Chinese today produce 98pc of the world supply of primary gallium. The figure falls to 80pc for purified gallium used in industry, but you cannot reach that stage without access to the raw material. This is the metal that China has chosen to target along with its sister germanium, 31 and 32 respectively on Mendeleev’s periodic table. It won’t be the last.

The British government has been insouciant. The UK let its last gallium processor wither on the vine in 2018.

“It is quite scary because this is time-critical,” said Olimpia Pilch, founder of the Critical Minerals International Alliance.

“There has been this ideology that the free market will take care of everything, but that will leave us completely out of the race. Governments have to step in with incentives to get production going,” she said.

The Center for Strategic and International Studies (CSIS) in Washington says China’s stranglehold is not a fluke or the outcome of normal market forces. The Communist Party compelled Chinese smelting companies to develop gallium refining capacity as a side-product of aluminium processing from bauxite.

Chinese production rose 20-fold from 2005 to 2015, enabled by mercantilist subsidies through state-controlled banks and by a suppressed currency. This flooded the world market and wiped out competitors. China has since acquired near total control over the gallium supply chain and processing industry.

It has now begun to close the trap. Restrictions on exports of gallium kicked in this month. This is the precursor to an embargo of unfriendly countries but not yet an actual embargo. “The export restrictions are quite clever. They are mapping out the supply-chain so they know exactly where it is going and where the vulnerabilities lie,” said Ms Pilch.

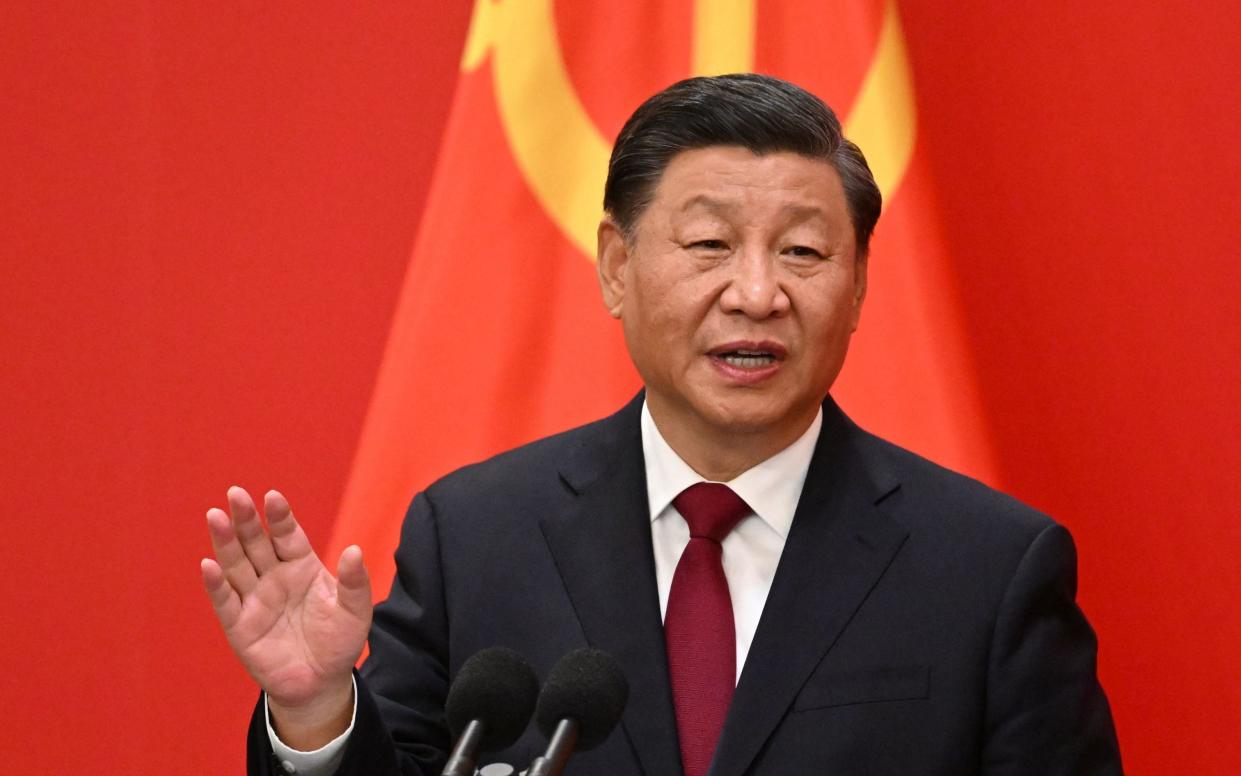

What we don’t know is whether this is merely a shot across the bow, retaliation for US restrictions on the sale of advanced semiconductors and the Dutch decision last month to restrict ASML sales of deep-ultraviolet lithography systems, or whether this has long been part of Xi Jinping’s game-plan for tech supremacy – laid out in Made in China 2025 and his strategy of “military-civil fusion”.

A string of industrial espionage cases targeting gallium technology in the US and allied states suggests that China has put sustained effort into this campaign, including the theft of classified material from the US semiconductor company Wolfspeed by the People’s Liberation Army.

Gallium nitride has a uniquely-high “bandgap” of 3.4eV compared to 1.2eV for silicon transistors and fast electron mobility. This allows it to operate at lightning speed and at high voltage. This is gold dust in hi-tech warfare.

“Gallium nitride is revolutionising modern radar, allowing new radar modules to track smaller, faster and more numerous threats from nearly double the distance,” said CSIS. It keeps the West a step ahead of Russian hypersonic missiles and Chinese stealth fighters.

The larger economic prize is in electronics and clean tech. Gallium nitride pushes the limits of power density, lowering the power loss in converters by 80pc.

Professor Umesh Mishra, dean of engineering at UC Santa Barbara and co-founder of the US semiconductor company Transphorm, said GaN has already delivered the “fastest technology shift in human history” by conquering half of the world’s lighting market in just two decades with LED light-emitting diodes. It is now going to do the same for power electronics.

“This revolution is nowhere near done. It is about to jump to a higher level,” he said.

Gallium technology makes it much cheaper to switch back and forth from DC to AC power, with sweeping implications for the efficiency of electric vehicles, solar panels, data centres or smart grids.

Navitas Semiconductor in the US is betting that it can slash the home charging time for EVs by two-thirds and cut energy use by 70pc, with products on the market by 2025. It aims to cut energy loss from solar inverters by 40pc.

Claims that the world will need a massive and costly increase in electricity generation to replace fossil fuel energy invariably ignore how much is wasted today and how much can be saved by the magic of power electronics.

Gallium can be replaced by other minerals for some functions, usually at lower efficiency. Silicon carbide is a rival for the next wave of EV electronics. But a Western economy without gallium would be at a serious disadvantage.

China has locked up much of the bauxite supply from Indonesia and in the West African state of Guinea, another military dictatorship slipping into the Sino-Russian orbit. But ultimately there is no shortage of aluminium ore in the world, and gallium can be extracted from zinc ores.

The imperative is time. It takes several years to develop an alternative supply chain from dependable allies such as Australia, or from Sweden, or from zinc mines in Alaska; by then China might have stolen a decisive march in the escalating clean-tech war.

It is already two years since the Biden Administration published a review warning that US reliance on gallium from China poses “far-reaching” risks. Little has changed so far.

China must be careful not to overplay its hand, as it has done repeatedly since the wolf warriors gained ascendancy.

It weaponised its 97pc monopoly over the supply of rare earth minerals in order to coerce Japan over the Senkaku Islands in 2010, and later issued periodic embargo threats against the West as political leverage.

It still has a commanding position, with 92pc control over minerals used for advanced magnets, but its overall share of processing for rare earths has dropped to 85pc, and its share of mine supply has dropped to 63pc. These minerals are not in fact rare and the liberal world is slowly responding.

Lisa Tobin, former China director at the US National Security Council, accuses the Communist Party of “brute force economics”.

It does not operate from the principle of comparative advantage, which regulates the normal rivalries of global competition: it pursues the zero-sum goal of absolute advantage, and it engages in a systematic state policy of coercion, predatory dumping and technology theft to achieve this aim.

One can overdo such Cold War hawkishness. At the end of the day, China itself depends on maritime imports of energy, raw materials and food, a vulnerability that eclipses its advantage over critical minerals.

The gallium and germanium curbs nevertheless show intent. We should assume that Xi Jinping will exploit this chokehold and extend it to other scarce metals when the moment is ripe.

Reducing reliance on Chinese supply is too urgent a matter to leave to the free market alone.

This article is an extract from The Telegraph’s Economic Intelligence newsletter. Sign up here to get exclusive insight from two of the UK’s leading economic commentators – Ambrose Evans-Pritchard and Jeremy Warner – delivered direct to your inbox every Tuesday