China Adviser Flags Geopolitical Risks in Xi’s Industry Push

(Bloomberg) -- China needs to adjust its industrial policy to counter rising criticism of overcapacity from the US and Europe, two government-linked economists said, highlighting growing awareness of a pushback against hi-tech exports.

Most Read from Bloomberg

Putin Says Ukraine Deal Requires Security Pledges for Russia

An $80 Billion Crash in India’s Small Caps Flashes Warning Signs

Ukraine Hits Third Russian Refinery in Escalating Drone Strikes

Ex-Wall Street Banker Takes On AOC in New York Democratic Primary

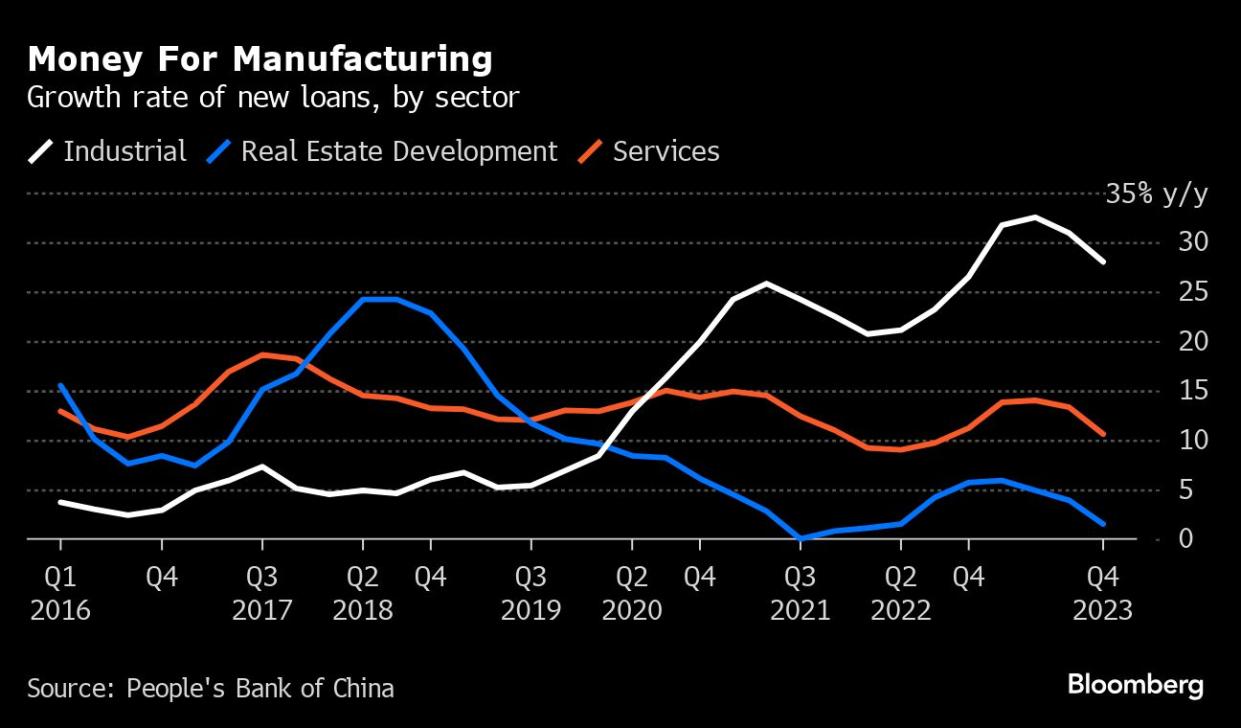

Huang Yiping, a former advisor to China’s central bank, on Wednesday said China’s industrial policy is at the heart of US concerns about Chinese overcapacity and the European Union’s anti-subsidy investigation into Chinese electric vehicle imports. His comments represent a rare admission among government advisers of the external challenges facing President Xi Jinping’s efforts to drive growth by pouring money into manufacturing.

“We should pay serious attention and recognize that this could be an important development in geopolitics,” Huang said during an online forum held by China Macroeconomy Forum, a think tank associated with the Renmin University of China in Beijing. “A widespread protectionist wave against Chinese products would be bad for China’s future development and innovation.”

Huang, who was consulted by Premier Li Qiang as recently as October, is one of the few elite domestic economists commenting in detail on the issue since trade tensions with Europe and the US heated up in recent months. US President Joe Biden pledged this week to look into a petition from a group of unions asking his administration to review China’s subsidies for shipbuilders.

While top policymakers have identified overcapacity as one of the main challenges facing the economy this year, and pledged to reduce financing to sectors with too much capacity, they haven’t given more detailed policies or named the sectors they’re targeting.

Huang said China should also address its domestic economic imbalances while refuting “unreasonable” criticism, which he didn’t identify.

The economy’s reliance on investment-driven growth over the past few decades has led to overcapacity in sectors from clothing to steel at different times because domestic consumption is weak compared to investment, he said. The government should improve residents’ income and social welfare to lift overall consumption, he added.

China also needs to make its industrial policy more “efficient, market-oriented and conforming to global economic conditions,” Huang said. Such policy should focus more on helping innovation rather than production, and be phased out when appropriate, he said.

Read More: Xi’s Solution for China’s Economy Risks Triggering New Trade War

Chinese industries with risk of overcapacity include computer chips, internal combustion engine automobiles, electric batteries, steel and household appliances, said Lu Feng, a professor at Peking University’s National School of Development, one of the country’s top state think tanks.

“Some of these sector are pillar industries in developed economies, so the impact of overcapacity is larger,” Lu said in a separate presentation Wednesday. “The US has already sent warnings about overcapacity”.

While the growth of high-efficiency production capacity in one country would previously replace higher-cost production elsewhere, the rise of protectionism and measures to boost domestic production worldwide means this adjustment mechanism is no longer effective, Lu said.

(Updates with second economist comments, chart)

Most Read from Bloomberg Businessweek

Gold-Medalist Coders Build an AI That Can Do Their Job for Them

Academics Question ESG Studies That Helped Fuel Investing Boom

Luxury Postnatal Retreats Draw Affluent Parents Around the US

©2024 Bloomberg L.P.