Chile left-wing candidates could form alliance, threatening market rally

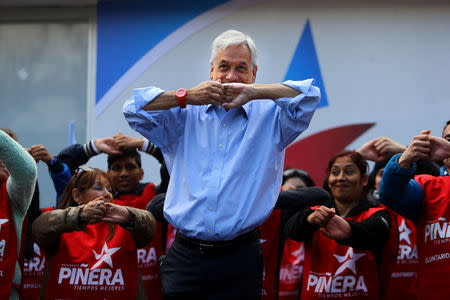

By Felipe Iturrieta and Luc Cohen SANTIAGO (Reuters) - Chile's stock market has priced in a victory of conservative presidential candidate Sebastian Pinera, even though progressive candidates could form an alliance in a December runoff, traders and analysts said. The IPSA stock market index has surged 27 percent this year and is on track for its best year since 2010, spurred by a rebound in prices of top-export copper and polls that have shown Pinera ahead in the race. Pinera, a wealthy businessman and supporter of free-market policies, is expected to come in first by a wide margin in November's first-round vote, but he is unlikely to win an absolute majority. That would result in a close runoff against the leading progressive candidate. "The majority is left of center," said Kenneth Bunker, a political scientist at Universidad Central de Chile. "A Pinera victory depends on division within the left." The most recent GfK Adimark poll shows Pinera, who has consolidated the support of the country's political right, leading at 34 percent of the vote. Center-left Senator Alejandro Guillier is second with 16 percent, well ahead of several candidates promising to continue President Michelle Bachelet's socially progressive policies. Hard-left candidate Beatriz Sanchez, who has proposed billions of dollars in new taxes on mining companies, was third at 15 percent. As campaigning officially began last week, Guillier appealed for unity, saying in a radio interview that he would share his policy platform with rivals on the left to try to align their positions. "No one doubts that in the second round we will all be together," Guillier said at a rally. A BANNER YEAR While Chile remains one of Latin America's most business-friendly countries, public debt has grown as falling copper prices hit government revenue, and Bachelet critics say she has not prioritized growth. Last month, her top economic officials resigned in part over the government's rejection of a $2.5 billion copper and iron project on environmental grounds. Investors are particularly attentive to candidates' proposals related to mining, Chile's most important industry. Guillier and Pinera have both pledged to streamline the mine permitting process, though Guillier has suggested modifying free-trade accords to promote domestic mineral processing. In a banner year for emerging markets, the IPSA has outpaced most regional peers. Brazil's Bovespa Index has surged 24 percent, Peru's leading index is up 20 percent, and Colombia's COLCAP index is up 9 percent. Only Argentina's Merval, up 49 percent, has surged more. The industrial and raw materials sectors have led Chile's market gains, surging 55 and 41 percent year to date, respectively. Lithium miner Sociedad Quimica y Minera de Chile SA has risen 77 percent in the past 9 months, while shipping firm Compania Sud Americana de Vapores SA is up 97 percent. In recent client notes, Credit Suisse and J.P. Morgan have said the so-called "Pinera effect" has passed and that now might be the time for traders to take profits or wait for election results. Hugo Rubio, president of brokerage BTG Pactual Chile, said a Pinera loss would cause a double-digit drop in the stock market, though the full extent would depend on the candidate. "It's a risk the markets don't seem to be alive to at this stage," said Edward Glossop, emerging markets economist at Capital Economics in London. "The risks are to the downside." (Additional reporting by Antonio de la Jara; Editing by Richard Chang)