CFA® vs CPA: Know the Differences to Choose the Best Career

AI was used in the creation of this article. The article was reviewed, fact-checked and edited by a content review team. We might earn a commission if you make a purchase through one of the links. McClatchy newsrooms were not involved in the creation of this content.

When it comes to advancing your career in finance, choosing between the Chartered Financial Analyst (CFA®) and Certified Public Accountant (CPA) certifications is a pivotal decision. Both the CFA® charter and CPA license paths offer distinct advantages and cater to different interests within the finance and accounting sectors.

So, which one is best for you?

Below is a straightforward comparison with several factors, like program requirements, exam difficulty, career paths, salaries, and more, to help you decide which certification might be the right fit.

Key Takeaways

Career Focus: The CFA® is ideal for investment and portfolio management careers, targeting roles in finance sectors like hedge funds and asset management. The CPA is suited for auditing, reporting, and tax advisory professionals, with opportunities in public accounting and corporate finance.

Preparation and Requirements: CFA® candidates need a bachelor’s degree and four years of work experience, with around 300 hours of study per exam level. Certified public accountant aspirants require 150 semester hours of education and typically 100-150 hours of study per exam section.

Certification Benefits: CFA® charterholders excel in financial analysis and investment strategy, opening doors to high-level finance roles. CPAs are key to accounting and compliance and are essential for leadership positions in accounting practices.

Dual Certification Advantage: Pursuing both the CFA® and CPA designations offers you a competitive edge, blending expertise in investment management with accounting and compliance and broadening career opportunities across finance and accounting sectors.

CFA® vs CPA Program Requirements

The CFA® designation, awarded by the CFA® Institute, equips finance and investment professionals with deep analytical skills and comprehensive knowledge of portfolio management and investment analysis.

CFA® Entry Requirements

A CFA® license requires candidates to have a bachelor’s degree or be in the final year of a bachelor’s degree program. Alternatively, four years of professional work experience or a combination of professional work and university experience totaling at least four years is also acceptable.

Additionally, candidates must have an international travel passport and meet the professional conduct admission criteria to register for the exams.

The CFA® Exams (Levels I, II, III)

The CFA® program consists of three exams that candidates must pass sequentially. Each level tests a different mix of investment industry skills with increasing complexity.

Level I focuses on understanding investment tools and ethical and professional standards.

Level II emphasizes asset valuation and applying analysis to investment management.

Level III centers on portfolio management and wealth planning, requiring candidates to apply everything they’ve learned cohesively and practically.

Study Duration and CFA® Exam Fees

Preparing for the CFA® exams requires a substantial investment of time, with candidates typically dedicating around 300 hours of study for each of the three levels. This commitment can fluctuate based on an individual’s prior experience and familiarity with financial concepts. In addition to the time investment, there are financial considerations as well.

CFA® candidates must pay a one-time enrollment and registration fee for each exam level. The cost varies depending on when you register: early registration is currently $940, while the standard registration fee is $1,250. Additionally, a one-time enrollment fee of $350 is required to begin the CFA® Program journey.

CPA Certification

The CPA certification is globally recognized, opening many opportunities in the accounting, finance, and business sectors. Awarded by the American Institute of Certified Public Accountants (AICPA), the CPA designation signifies a high level of expertise and ethics in accounting practices.

CPA Entry Requirements

To sit for the CPA exam, candidates must meet specific educational requirements that typically include a minimum of a bachelor’s degree and 120 to 150 semester hours of college coursework, depending on the state board’s requirements. The most common requirement is 150 semester hours and specific accounting and business-related courses. Additionally, most states require at least one year of accounting experience under the supervision of a CPA.

CPA Exam Structure

Technically, there are actually six CPA exams, each designed to test a different domain of accounting knowledge and skills needed to earn a CPA license. However, CPA candidates only need to take four of these exams for certification since only one discipline section is required.

Auditing and Attestation (AUD): This section covers the principles of auditing, including preparing and evaluating audit reports and other attestation services.

Financial Accounting and Reporting (FAR): FAR tests knowledge of financial planning, financial accounting standards, the preparation of financial statements, and the application of various reporting requirements.

Regulation (REG): This part focuses on federal taxation, ethics, professional responsibilities in tax practice, and business law.

The CPA exam now includes a choice among three specialized disciplines, allowing candidates to align their certification with specific career goals. Here’s a concise guide to help you decide:

Specialized Discipline Exams

Business Analysis and Reporting (BAR): Best for those interested in the technical aspects of accounting and financial reporting. It opens doors to careers in auditing, corporate accounting, and high-level positions like CFO.

Information Systems and Controls (ISC): Ideal for candidates interested in information technology, data management, and cybersecurity within accounting. Careers can range from IT auditor to CIO or CTO roles.

Tax Compliance and Planning (TCP): Suited for those focused on tax laws and regulations, offering pathways to roles in tax advisory, public accounting, government, and finance institutions.

CPA Licensure Process and Exam Fees

Achieving CPA licensure requires successful completion of the CPA exam and fulfilling the experience and ethics criteria determined by the candidate’s state board of accountancy. It’s important to note that exam fees are subject to variation across different states. Typically, these fees encompass an application charge and a specific fee for each exam section.

While the costs can differ, in most states, the fee for each exam section is $344.80, and there is a $50+ registration fee. Candidates should also be aware that additional charges may be related to obtaining licensure after passing the exam.

Exam Content Difficulty: CFA® vs CPA

CFA® Exam Difficulty

The CFA® exam series comprises three levels, each escalating in complexity and depth. The exams cover various topics, including ethical and professional standards, quantitative methods, financial reporting and analysis, corporate finance, economics, equity investments, fixed income, derivatives, alternative investments, and portfolio management.

Depth of Knowledge: The CFA® exams require a thorough understanding of financial analysis and investment management, testing candidates on both the breadth and depth of financial topics. The Level II and III exams, particularly, are known for their intensive focus on analytical skills and application of knowledge in portfolio management and wealth planning.

Pass Rates: Historically, the pass rates for CFA® exams have been relatively low, with Level I often seeing rates below 50%. This reflects the exam’s difficulty and the comprehensive understanding required to succeed.

Study Time: Candidates typically invest around 300 hours per level, indicating the substantial effort needed to grasp the wide-ranging material.

CPA Exam Difficulty

The Uniform CPA exam is difficult for several reasons. These include:

The breadth of Knowledge: The CPA exam covers a broad spectrum of accounting, tax, and business knowledge. While it demands a thorough understanding of accounting principles and practices, it does not delve as deeply into any topic as the CFA® exam does with investment analysis.

Pass Rates: CPA exam pass rates have sections that fluctuate around 45-55%, suggesting a challenging but somewhat more consistent level of difficulty across its sections than the CFA® exam.

Study Time: Candidates often spend 100-150 hours studying for each section of the CPA exam, totaling around 400-600 hours for the entire exam. This reflects the extensive range of topics covered but at a shallower depth compared to the CFA® curriculum.

CFA® vs CPA: Career Paths

Careers for CFA® Charterholders

CFA® charterholders are recognized as finance industry experts in investment management, portfolio management, and investment analysis. This specialization positions them for impactful roles within the finance sector, particularly in:

Investment Banks: CFA® charterholders often work in roles that involve financial modeling, mergers and acquisitions (M&A) advisory, and capital markets.

Hedge Funds: They contribute to strategy

Private Equity Firms: CFA® charterholders are involved in deal sourcing, due diligence, financial analysis, and portfolio company management.

Asset Management Firms: They play key roles in fund management, research, and developing investment strategies.

The role of a CFA® in the investment management industry is multifaceted, focusing on maximizing portfolio returns, managing financial risks, and conducting in-depth financial analysis to inform investment decisions. Their expertise is crucial in navigating the complexities of global markets, evaluating investment opportunities, and implementing strategies that align with client goals.

Careers Certified Public Accountants

CPAs are essential in virtually every sector and are known for their financial accounting, auditing, tax preparation, and consulting expertise. Their certification opens pathways to diverse roles, including:

Public Accounting Firms: CPAs engage in auditing, financial reporting, consulting, and advisory services, helping businesses comply with accounting standards and regulations.

Corporations: Within corporate settings, CPAs often hold positions such as CFO, overseeing the financial operations, strategy, and reporting of the company. They play a critical role in budgeting, financial forecasting, and ensuring the organization’s financial health.

Government Agencies: CPAs in government roles are involved in financial management, compliance, and auditing, ensuring public funds are used efficiently and according to the law.

The CPA’s role in financial reporting and compliance is indispensable, ensuring financial statements’ accuracy, transparency, and integrity. They are trusted advisors, guiding businesses through complex tax laws, accounting standards, and financial strategies to optimize performance and compliance.

CFA® vs CPA Salary Expectations

Generally, CFA® charterholders find themselves in lucrative roles within the investment sector, including portfolio management, investment banking, and financial analysis positions. The specialized nature of the CFA® designation often commands high salaries, with compensation packages reflecting the charter holder’s expertise in investment strategies and financial analysis.

Here is a breakdown of salary ranges for starting, average, and mid-to-experience level salaries, along with some examples of common CFA® and CPA job roles, according to Payscale and CareerEmployer.

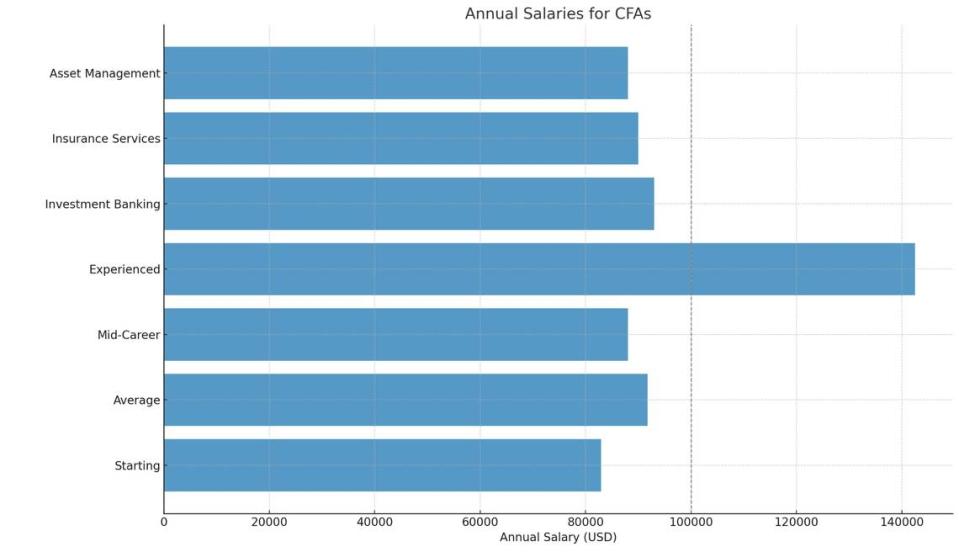

Chartered Financial Analyst (CFA) Salaries

Starting Salary: Entry-level CFAs can expect to earn an average total compensation of about $82,893.

Average Salary: The average salary for a CFA is around $91,723, with a range from $62,000 to $192,000.

Mid-Career Salary: Those with 5-9 years of experience earn an average of $88,000, while CFAs with 10-19 years of experience have an average salary of $142,500.

Experienced Salary: CFAs with over twenty years of experience also make around $142,500 on average.

Industry Variations: Investment banking, insurance services, and asset management are among the top-paying industries, with average salaries ranging from $76,000 to $93,000.

Certified Public Accountant (CPA) Salaries

Starting Salary: Entry-level CPAs can expect an average total compensation of around $59,064.

Average Salary: The average salary for a CPA is approximately $76,485, with a range from $54,000 to $123,000.

Mid-Career to Experienced Salary: Mid-level CPAs with three to five years of experience receive an average annual salary of $75,000 to $90,000, while those with more than six years of experience receive around $90,000 to $120,000.

Industry and Experience Impact: CPAs in certain sectors like financial technology or healthcare might earn above the average due to high growth in these industries.

This data highlights the significant earning potential for professionals in the financial sector, especially for those who advance their careers and gain experience in high-demand industries. Whether you’re considering becoming a CFA or CPA, these roles offer lucrative opportunities, with the potential for salary increases based on factors such as experience, industry, and geographic location.

Impact of Having Both the CFA® and CPA Designations

Professionals pursuing both the CFA® and CPA designations set themselves apart with a unique blend of investment management and accounting expertise. This combination can be particularly powerful in roles that require a deep understanding of both financial analysis and accounting principles, such as corporate finance, investment analysis, and strategic planning roles.

Holding both designations increases an individual’s marketability and potential for higher compensation and broadens their career opportunities, allowing for greater flexibility in navigating between the finance and accounting industries.

Firsthand Accounts: Navigating the CFA® and CPA Exams

“Passing the CPA exam was a milestone in my career, demanding a disciplined study regimen and a deep dive into the intricacies of accounting standards and practices. The journey through its four parts tested not just my knowledge but my endurance and commitment to the field,” shared a CPA holder on Reddit.

They emphasized the importance of practice problems, stating, “The more questions you tackle, the better you understand the exam’s logic—academic knowledge is key, as real-life applications often diverge from exam requirements.”

Another finance professional, who conquered both the CFA® and CPA exams, offered a comparative perspective: “The CPA is undoubtedly tough, with its breadth covering a wide array of subjects. However, the depth and intensity of the CFA® exam’s content, especially in financial analysis and investment management, present a different kind of challenge.”

This individual highlighted a strategic approach to studying: “For both exams, immersing yourself in practice problems is crucial. It’s about understanding the ‘language’ of the questions and responding with textbook precision.”

Reflecting on the CFA® exam, a charterholder remarked, “The CFA® program was a rigorous test of my financial knowledge and analytical skills, spanning three levels. Each level built on the last, pushing me to memorize concepts and apply them in complex scenarios.”

Many find the decision between pursuing a CFA® or CPA designation hinges on career aspirations. “If you’re drawn to the world of investment banking, portfolio management, or equity research, the CFA® is your beacon. For those leaning towards accounting, auditing, or corporate finance, the CPA opens doors,” one professional advised.

For individuals considering both certifications, the consensus suggests a formidable advantage. “Holding both the CFA® and CPA designations sets you apart in the finance and accounting industries. It’s a testament to a broad and deep skill set, from investment analysis to financial reporting and beyond,” shared a dual-holder. They added, “It’s not just about passing exams; it’s about shaping a versatile and robust professional profile.”

CFA® vs CPA: Making a Choice

Below, I will outline scenarios to help pinpoint the path that best matches your career objectives, whether you’re inclined toward the intricacies of financial markets or the precision of financial reporting and compliance. Let’s explore the key factors that could steer you toward the CFA® or CPA designation.

If you’re passionate about investment management, portfolio strategy, and financial markets, then you may want to pursue the CFA® designation. The CFA® focuses extensively on developing your expertise in these areas.

If you see yourself playing a crucial role in auditing, financial reporting, and ensuring compliance with tax laws, then becoming a CPA might be your calling. CPAs are essential in maintaining the financial integrity of businesses and organizations.

If you’re drawn to the idea of analyzing companies, securities, and investment opportunities to advise clients or make investment decisions, then you may want to be a CFA®. This designation is highly regarded in the fields of equity research, asset management, and hedge fund management.

If you’re interested in navigating the complexities of corporate finance, mergers and acquisitions, or financial consulting within various industries, then the CPA certification could open the right doors for you. CPAs often hold strategic positions in corporate finance departments and consulting firms.

If your goal is to become an expert in risk management, derivatives, and global financial strategies, then you may want to pursue the CFA® designation. The CFA® covers these topics in depth, preparing you for roles in risk analysis and strategic investment planning.

If you envision yourself leading a company’s financial direction as a Chief Financial Officer or offering comprehensive accounting services as a public accountant, then becoming a CPA is a step in the right direction. The CPA credential is a staple for individuals in these high-level financial roles.

Conclusion

Regarding CPA vs CFA®, each leads to distinct career paths. Both paths demand a significant commitment to mastering a broad range of financial and accounting principles, with the CFA® requiring deep knowledge of investment analysis and the CPA covering a wide spectrum of accounting practices.

While the CFA® might appeal to those drawn to the investment world, the CPA is suited for individuals looking to excel in accounting and regulatory compliance. Ultimately, the choice depends on your career aspirations and interests.

FAQ

How much study time should I allocate for each CFA® exam level?

Both CFA® and CPA candidates should plan for approximately 300 hours of study per level for the CFA® exams, adjusting based on personal pace and familiarity with the material.

What are the exam fees for the CFA® and CPA certifications?

CFA® exam fees include a one-time enrollment fee of $350 and a registration fee that ranges from $940 for early to $1,250 for standard registration. CPA exam fees vary by state but generally include an application fee plus $344.80 per section, with additional registration fees.

What career paths are available for Chartered Financial Analyst designation holders?

CFA® charterholders often pursue careers in investment management, portfolio management, financial analysis, and advisory services, primarily within investment banks, asset management firms, and hedge funds.

Is it possible to hold both CFA® and CPA designations?

Yes, it’s possible and beneficial to hold both designations, as they complement each other and broaden career opportunities in finance, investment analysis, and accounting.

What’s the difference in focus between the CFA® and CPA certifications?

The CFA® certification focuses on investment management, financial analysis, and portfolio strategy, making it ideal for careers in the finance sector. The CPA certification is centered on accounting principles, tax, auditing, and financial reporting, preparing candidates for accounting and compliance roles.