Catch, offering health insurance for gig workers, relaunches with new owners

- Oops!Something went wrong.Please try again later.

Catch, once a health and retirement benefits company for gig workers and self-employed individuals, reemerges today under new management after being shuttered in March by its original co-founders.

That’s when Alexa Irish and Laura Speyer, now the co-CEOs of Catch, told TechCrunch they invested their own money to acquire the company from its co-founders Kristen Anderson and Andrew Ambrosino that same month.

“We were really shocked when we saw that Catch was shutting down,” Irish told TechCrunch. “We obviously had been watching them from the sidelines just given that we were already entering the space. We reached out to Kristen and Andrew pretty much right away to say this is a really big need, that this audience should continue to have.”

Today, Irish and Speyer relaunch the company in time for open enrollment starting November 1, but without the retirement benefits piece. The company just offers health, dental and vision insurance.

Prior to Catch, Irish and Speyer had worked together at CLEAR, the identity platform for airport entry. They both left in 2022 and were actually working on developing their own insurance startup when they saw the news about Catch.

“When I left my corporate job, I said, ‘how the heck am I going to figure out health insurance?’” Irish said. “For us, that was a big wake-up call. There's 60 million independent workers in America facing the same thing, so we wanted to focus there and figure out how to crack that nut.”

Anderson and Ambrosino also wanted to do the same and started Catch in 2019 to offer health insurance, retirement savings plans and tax withholding directly to freelancers, contractors and anyone else uncovered.

Catch grew to have insurance licenses in 47 states and the District of Columbia, while Anderson and Ambrosino eventually raised $18.1 million in venture-backed funding, the most recent, a Series A round in 2021.

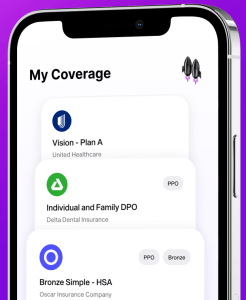

Catch offers health insurance plans for gig workers. Image credits: Catch

However, in March of this year, Anderson tweeted that she and Ambrosino decided to close Catch, saying “We were audacious enough to believe a trillion-dollar ecosystem built by corporations, the government, and our financial institutions over the last 75 years could be toppled by a startup turning everything on its head. Today? We still believe that. We just have to admit that we aren’t the ones to do it right now. We have made the difficult decision to shut Catch down.”

In a blog post, Irish and Speyer say the outpouring of support for Catch helped them decide that they couldn’t just let the company go away.

“We're now able to carry forward the mission as well as the technical platform,” Speyer told TechCrunch. “We're just super impressed with what they built.”

Catch is recreating corporate lifestyle benefits for self-employed individuals. It has partnerships with health insurance companies and the Centers for Medicare and Medicaid to offer plans through healthcare.gov. It also offers dental and vision plans.

“This is something we're personally passionate about,” Irish said. “We believe this is something that, candidly, fuels the future of American entrepreneurship. One in six Americans are at their corporate jobs today because of health insurance. By creating a brand and a product that unlocks that safety net for independent workers, it can change how people live, fulfill their passions and work.”

Edited to reflect that Catch was shut down in March, not June.