Student debt cancellation, a 'war tax' and gay-marriage reparations: Three plans out of the mainstream — but not out of the question

Presidential elections are decided by many things: media exposure, financial backing, personal chemistry, timing and luck. Policy positions often are just a way of signaling where a candidate stands on the political spectrum. But 2020 is shaping up to be different, the most ideas-driven election in recent American history. On the Democratic side, a robust debate about inequality has given rise to ambitious proposals to redress the imbalance in Americans’ economic situations. Candidates are churning out positions on banking regulation, antitrust law and the future effects of artificial intelligence. The Green New Deal is spurring debate on the crucial issue of climate change, which could also play a role in a possible Republican challenge to Donald Trump.

Yahoo News will be examining these and other policy questions in “The Ideas Election” — a series of articles on how candidates are defining and addressing the most important issues facing the United States as it prepares to enter a new decade.

What do college students, military veterans and LGBT couples have in common? They would be the beneficiaries of a set of bold policy proposals from Democratic presidential candidates.

There are the college students and graduates among the 45 million Americans who collectively owe a staggering $1.6 trillion they borrowed for their education. The debt, which more than half of Americans say is “a major problem” for the country, affects the U.S. economy by preventing young families from buying homes and widening the wealth gap between black and white families.

There are the 2 million U.S. veterans who after serving their country are left without health insurance or with limited access to physical or mental health care. And there are the LGBT couples who historically faced unequal treatment by the federal government and only in recent decades have begun to receive equal protections and benefits.

To fix these problems, some leading Democratic candidates have stepped out of the contemporary mainstream of their party, hoping to right the wrongs of the past and prevent them from recurring.

Student loan debt crisis

Historically, getting a college degree was considered key to upward economic mobility. But the returns on higher education aren’t what they once were.

Student loans were first offered in 1840 at Harvard University and only became a federal program under Title IV of the 1965 Higher Education Act (HEA). The following year, the National Association of Financial Aid Administrators was created to monitor the programs created by HEA.

Financial aid expanded to help low-income students, and in 1976 all undergraduate students became eligible for Pell grants, a federal subsidy for postsecondary education, responsible for an increase in college attendance rates along with HEA.

But by the late 1980s, families owed nearly $10 billion in federal student loans, and debt began ballooning in the next decade. In 1996, the average debt of a four-year college grad was $12,750, according to the Institute for College Access & Success. The class of 2018 graduated with an average debt of $29,800.

In 2012, cumulative student loan debt passed $1 trillion, sparking outrage and protests. The Occupy Wall Street movement even bought up (at a huge discount) and retired $4 million in outstanding student debt at a private, for-profit college. The issue has gained momentum after decades of wage stagnation, rising tuition and living costs, and high interest rates have left four-year college graduates with levels of debt that in the past only afflicted graduates who pursued degrees in higher-paying fields such as law, business or medicine.

Now even more Americans stand to be affected, including students who drop out without a degree and retirees who co-signed loans for their children or grandchildren.

‘War tax’

War taxes date back to the Civil War, when President Abraham Lincoln imposed the first federal income tax in 1861 to help pay for the conflict. The War Revenue Act of 1917 dramatically increased federal income taxes to pay the costs of American U.S. participation in World War I.

President Lyndon B. Johnson in 1967 asked Congress in his State of the Union address to enact a 6 percent surcharge on personal and corporate income taxes to help fund the Vietnam War “for as long as the unusual expenditures associated with our efforts continue.” Congress, after a yearlong delay, approved the surcharge.

But as resistance to the war grew, protesters took aim at military funding, leading to a shift in how the U.S. financed warfare.

“For most of its history, the United States had paid for its wars through war taxes, and then around the Korean and especially the Vietnam wars, the United States started avoiding these taxes and paying for war through debt,” said Sarah Kreps, associate professor of government at Cornell University. “The effect was to create a distance between the public and the war, and erode these accountability linkages and remove these constraints on the ways the United States fights these wars.”

‘Gay reparations’

Same-sex couples weren’t allowed to legally marry in most states until 2013. But when the Supreme Court in 2013 struck down the Defense of Marriage Act, which withheld federal recognition of same-sex marriages, LGBT couples were permitted for the first time to file joint federal tax returns.

For couples who had been together before this landmark Supreme Court decision (United States v. Windsor), the Internal Revenue Service allowed them to file amendments to previous tax returns going back three years.

But three years didn’t seem fair for couples who had been legally married for nearly a decade, such as those in Massachusetts, which was the first state to legally recognize same-sex marriages in 2003.

Student loan debt crisis

To wipe out all outstanding student loan balances, which is expected to reach $2 trillion by 2022, Sen. Bernie Sanders, I-Vt., announced a sweeping debt reform plan in June.

The College for All Act of 2019, Sanders said in a statement, "cancels all student debt and ends the absurdity of sentencing an entire generation to a lifetime of debt for the ‘crime’ of getting a college education."

As a part of a bigger higher-education plan, the bill would forgive all $1.6 trillion of student debt for undergrad and graduate borrowers, regardless of the type of loan they took out or their income level, and even covers parents who incurred student loan debt for their children’s education. It would also make public higher education tuition-free, slow tuition increases for graduate programs at public colleges, and cap interest rates on loans at 1.88 percent. (Currently, rates on federal student loans range upward from about 4.5 percent.)

The plan, which would cost more than $2 trillion, would be funded by a series of taxes on Wall Street transactions over the course of 10 years.

“In 2008, the American people bailed out Wall Street. Now it is Wall Street's turn to help the middle class and working class of this country,” Sanders said.

The plan, however, would convey a large part of its benefit on affluent Americans, who account for one-third of the debt. And while it provides a blank slate for current and past borrowers, it doesn’t guarantee that future generations will not need to take on debt for higher education.

‘War tax’

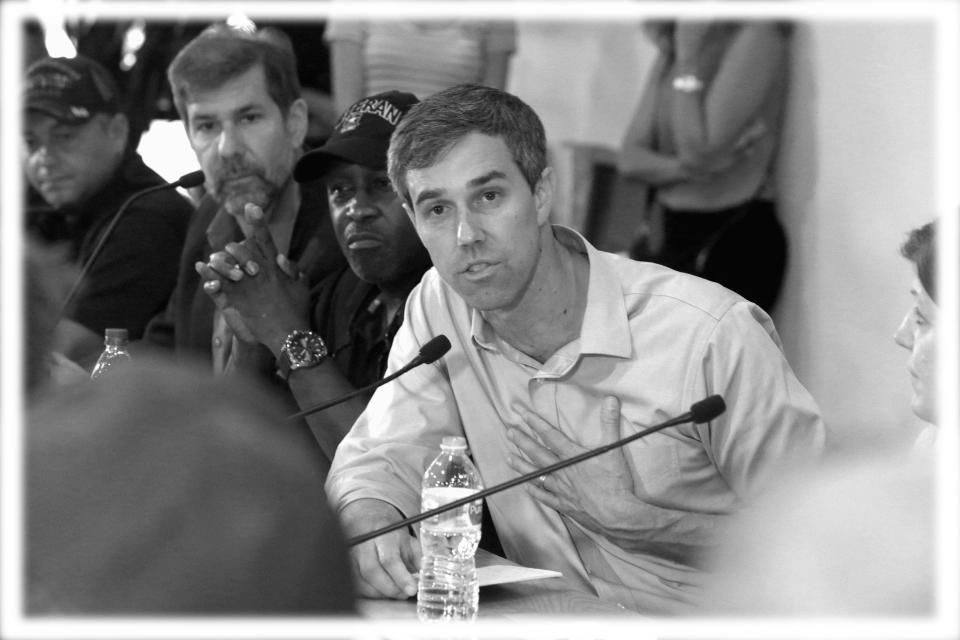

On the same day Sanders unveiled his plan to forgive all student loan debt, former Texas congressman Beto O’Rourke announced his plan to support health care for military veterans through a “war tax.”

The tax, which would go into effect during any future military conflict, would be levied on taxpayers who do not have family members in the U.S. military. Revenue would be deposited into newly established Veterans Health Care Trust Funds for each new war authorized by the federal government.

The tax would be levied on a sliding scale, from $25 annually for the lowest-income bracket to $1,000 a year for taxpayers who earn more than $200,000.

"This new tax would serve as a reminder of the incredible sacrifice made by those who serve and their families," the plan says.

O’Rourke’s proposal is part of a series of health and economic measures focused on improving care for veterans, but it also is meant to promote democratic accountability for wars entered into by the U.S.

“We fail to pay the full cost for those women and men who served in those wars,” O’Rourke said in an interview with the Nation in March. “We’re losing 20 veterans a day by their own hand in this country; [most] of those 20 have been unable or, for whatever reason, unwilling to go into a VA [Veterans Affairs] and get the care that might have saved their lives.”

After a 2014 scandal, which revealed that veterans waited for months to see doctors through the VA health care system, Congress appropriated emergency funds for a new program to allow them to access expanded private-sector care through a provision in the Veterans Access, Choice, and Accountability Act (VACAA), also known as VA Choice.

In 2018, President Trump signed the VA Mission Act, providing a record $200 billion budget to improve veterans’ access to care outside the VA network.

But O’Rourke’s plan to help veterans also is meant to rein in the country’s “forever wars,” such as the ongoing conflicts in Iraq and Afghanistan.

“Eighteen years into the war in Afghanistan, and nearly three decades after our first engagement in Iraq, the best way to honor our veterans’ service is to cancel the blank check for endless war — and reinvest the savings to ensure every American can thrive upon their return home,” said O’Rourke, who sat on the House of Representatives’ Armed Services and Veterans' Affairs committees for all of his six years representing El Paso in Congress.

‘Gay reparations’

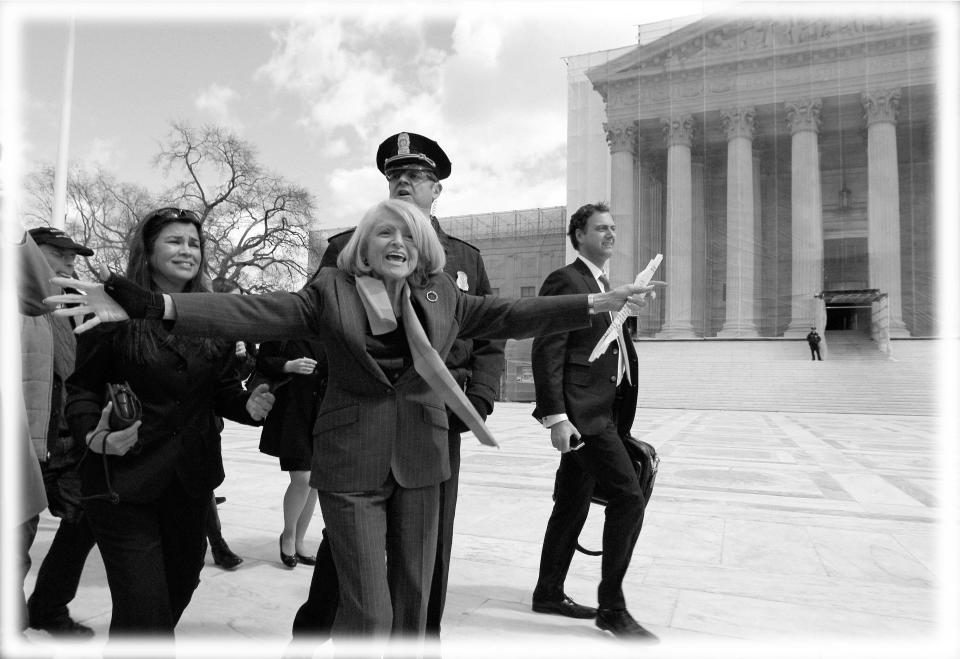

During LGBT Pride Month, Massachusetts Sen. Elizabeth Warren reintroduced her Refund Equality Act, a bill that would allow same-sex couples to amend past tax returns (beyond the three-year limit) and receive refunds for the amounts they overpaid the IRS during the years they were not allowed to file jointly.

“The federal government forced legally married same-sex couples in Massachusetts to file as individuals and pay more in taxes for almost a decade,” Warren said in a statement. “We need to call out that discrimination and to make it right.”

If the bill passes, same-sex couples who were married in states like Massachusetts, Iowa or California, where their marriage was legal before 2013, could file for federal income tax adjustments dating back to the year of their marriage and receive up to $57 million in refunds, according to the Joint Committee on Taxation.

“For nearly a decade, legally married same-sex couples had to file their taxes as single persons, often paying more taxes than they would owe if they could file as married,” Warren told NBC News when she first introduced the bill in 2017. “This bill is a simple fix to allow same-sex couples to claim the tax refunds they earned but were denied because of who they love.”

Progressive ideas such as Sanders's plan to wipe out all student debt, O'Rourke's proposal for a "war tax" to support veterans’ health care and Warren's bill to give tax refunds to LGBT couples are outside even a generously defined mainstream of contemporary Democratic politics. But that doesn’t mean they can never be enacted.

“Presumably some things are too out there for the Democratic Party mainstream, but these all seem to me like ideas that are popular," said Sean McElwee, co-founder of progressive think tank Data for Progress, which assesses the “electoral viability of an expansive progressive agenda.”

Considering that reparations for descendants of slaves, decriminalizing illegal immigration, and a Green New Deal have entered the public discourse, these “out there” ideas could stand to appeal to a wide group of young, progressive voters who advocate for civil rights, government-run health care and education reform.

McElwee said he polled policies such as student debt cancellation and Medicaid expansion and found them to be popular even in conservative states. And he believes tax fairness for same-sex couples and funding health care for veterans will meet with a positive response as well.

“The public is increasingly supportive of progressive policies,” he told Yahoo News, adding that there is “a generational shift” at play on the road to 2020. “Millennials are much more progressive on a range of issues, and as they age into voting at a higher rate the electorate will become more supportive of progressive policies. The political elites that were very insistent that we couldn't embrace any progressive policies have moved away from that, [which] has allowed for more discussion of progressive policies that are popular.”

“But,” he added in a cautionary note, “there's no evidence, as far as I'm concerned, that much of the progressive agenda is entirely viable.”

And this is a potential weakness for the Democratic Party, which President Trump has consistently painted as extreme, being pulled or veering “too far left.” Democrats, including a number of governors, have voiced similar concerns.

“The broader risk for the party, they say, is that too many of the candidates are courting only a segment of the liberal base rather than the entirety of the more moderate Democratic coalition,” reported the New York Times.

While Sanders and Warren currently rank in Democratic polls behind frontrunner Joe Biden, who is considered the most appealing to moderate voters, they took the lead in a recent progressive straw poll conducted quarterly by Democracy for America (DFA). Progressive grassroots leaders consider this a shift in the party.

“These results make it clear that Democracy for America members’ support is solidifying behind three candidates committed to bold, inclusive populism and structural reform,” said DFA chair Charles Chamberlain in a statement.

“While a lot will change between today and the first contests next year, after seeing these results, there is no doubt that, in 2020, Democrats are better positioned to nominate an unapologetic champion for progressive values for president than we’ve been in decades.”

Download the Yahoo News app to customize your experience.

Read more from Yahoo News: