Campbell's Soup and Deere — What you need to know in markets on Friday

Stocks in the U.S. bounced back on Thursday after enduring their worst day of the year on Wednesday.

Despite finishing off their best levels of the day, each of the major U.S. indexes closed in the green, while the price of gold — traditionally a safe-haven during market turmoil — fell more than 1%.

On Friday, the economic calendar will give investors little to contend with though the earnings calendar will have something for markets to chew on, with results expected from agricultural giant Deere (DE), footwear retailer Foot Locker (FL), and all-American brand Campbell’s Soup (CPB).

Pick a narrative, any narrative

On Wednesday, stocks sold off.

This decline was attributed to negative headlines about President Donald Trump, but the idea that a fresh round of headlines were really going to be “the ones” that derailed the market’s faith in his presidency was and remains pretty specious.

Also, as we wrote, the market was basically done with betting on Trump’s signature economic plans coming to fruition.

But markets need a story. Or, more specifically, the market is a story.

And so on Thursday, when stocks bounced back, there’s a part of the investor class that says, “See? Everything is fixed.” Others will argue that this bounce in stock prices merely sets us up for a bigger disappointment later. Others don’t really care.

In a note to clients on Thursday, Gluskin Sheff strategist David Rosenberg that after Wednesday’s market action “the bloom is off the rose.”

“It is important not to read too much into a single day of trading,” Rosenberg wrote, “but the cracks really are starting to add up here for this once-Teflon market. [Wednesday] was important insofar as it was the first major test of Mr. Market’s resolve amidst growing uncertainty on whether Trump’s ‘pro-growth’ policies will ever see the light of day.

“It is unclear what will happen when the dust finally settles, but this Comey file is likely to only further delay the tax cut and fiscal stimulus goodies that have been cheered by pundits.”

But, as we noted on Wednesday, it isn’t clear there is still anything like support for Trump’s policies coming from the market.

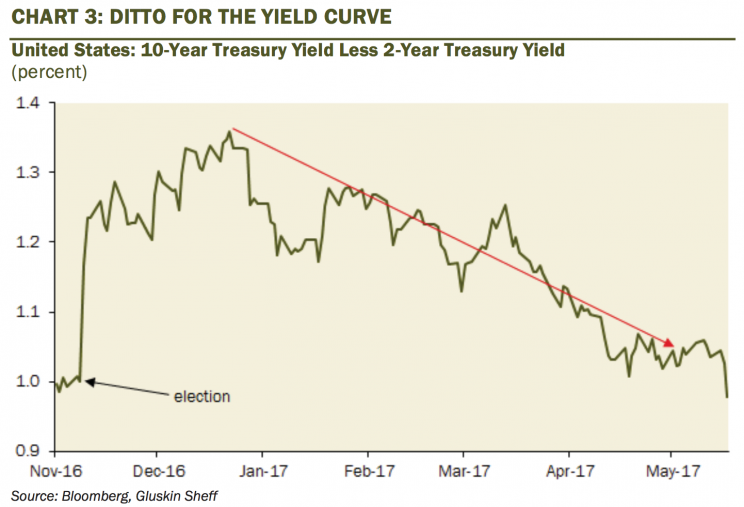

As Rosenberg goes on to note, the dollar’s post-election rally has now been erased. So too has the steepening of the yield curve been wiped out, a reflection of investors losing faith that a Trump tax cut or infrastructure package would be inflationary.

That Wednesday’s move served as the event which made everything happening or not happening in the markets clear is, well, not all that clear.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: