Campbell (CPB) Stock Down on Drab Q3 Earnings, Sales View

After back-to-back positive earnings surprises in the last two quarters, Campbell Soup Company CPB delivered a miss in third-quarter fiscal 2017. Both earnings and sales declined year over year and lagged estimates.

Management blamed the murky quarter on the tough macroeconomic scenario in the food industry, where sales remained generally soft due to lower consumption. In fact, management stated that consumer spending grew at its lowest rate, in about eight years – which considerably hampered the top line. Though sales rebounded in March and April, the softness in February could not be compensated.

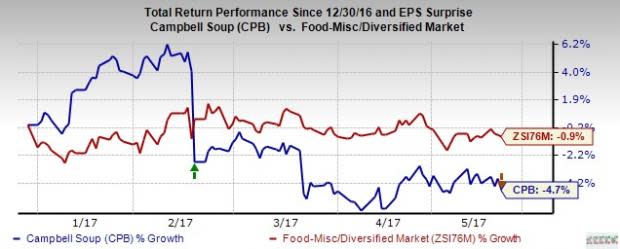

The disappointing quarter and current industry trends also compelled Campbell Soup to curtail its fiscal 2017 sales outlook. However, it raised the lower end of its earnings and EBIT outlook, reflecting confidence in the ongoing cost-savings program. However, following a disappointing quarter, shares of the company declined 5.6% in the pre-market trading session. Moreover, Campbell has lost 4.7% on a year-to-date basis, underperforming the Zacks categorized Food – Miscellaneous/Diversified industry’s loss of 0.9%.

Q3 in Details

Adjusted earnings of 59 cents per share dropped 9% year over year, falling short of the Zacks Consensus Estimate of 64 cents. Including one-time items, Campbell’s earnings fell 2% to 58 cents in the quarter.

Net sales of $1,853 million slipped 1% and also lagged the Zacks Consensus Estimate of $1,870 million, mainly owing to soft organic sales. Organic sales dipped 1% on account of greater promotional spending, whereas volumes remained flat. Further, weak organic sales across the Americas Simple Meals and Beverages and Campbell Fresh segments could only be partly compensated by improved results at the company’s Global Biscuits and Snacks segment.

Further, the company’s adjusted gross margin contracted 40 basis points to 36.6% in the reported quarter, thus crushing the gross margin expansion trend. The downside was mainly due to increased promotional expenditure, cost inflation and escalated supply chain expenses, somewhat offset by productivity enhancements and benefits from cost-curtailing efforts.

Moreover, adjusted EBIT for the quarter declined 2% to $305 million, owing to soft sales and gross margin contraction, partly negated by reduced marketing and selling costs.

Segment Analysis

Campbell reports its results under three segments, namely, Americas Simple Meals and Beverages, Global Biscuits and Snacks, and Campbell Fresh.

Americas Simple Meals and Beverages: In third-quarter fiscal 2017, sales at the division dipped 2% year over year to $982 million, on account of softness in V8 beverages and soup sales, somewhat compensated by strength noted in Prego pasta sauces. During the quarter, sales for U.S. soup dropped 4%, on account of a drop in broth and condensed soups, partly cushioned by strength in ready-to-serve soups.

Global Biscuits and Snacks: Sales at this division rose 2% to $623 million, backed by strength across Pepperidge Farm and Arnott’s biscuits.

Campbell Fresh: Sales at this segment declined 6% year over year to $248 million, accountable to soft sales of Bolthouse Farms refrigerated beverages.

Financials

Campbell ended the quarter with cash and cash equivalents of $1,790 million, long-term debt of $2,270 million and total shareholders’ equity of $1,490 million. Further, the company generated $1,011 million as cash flow from operations during the first three quarters of fiscal 2017.

Fiscal 2017 Outlook

Given a soft quarter and tough operating environment, management lowered its sales outlook. However, the company expects its solid ongoing cost savings initiatives to counter the weak sales, which encouraged management to raise the lower end of its previously issued EBIT and earnings per share views. Also, management remains optimistic about sustaining momentum at its Global Biscuits and Snacks division, which was the only saving grace in Campbell’s otherwise drab performance.

That said, management now anticipates sales growth for fiscal 2017 to range from negative 1% to flat, compared to the old forecast of flat to a 1% increase. Adjusted EBIT is now expected to rise 2–4% year over year, compared with 1−4% growth expected before. Finally, adjusted earnings for the fiscal are now envisioned to grow in the range of 3–5% to $3.04–$3.09 per share. Earlier, the company had projected adjusted EPS to increase 2–5% to $3.00−$3.09 per share.

Currency headwinds are still expected to have a nominal impact on the company’s fiscal 2017 performance.

Campbell currently carries a Zacks Rank #3 (Hold).

Key Picks in Campbell’s Space

Some better-ranked stocks in the miscellaneous food space include Conagra Brands, Inc. CAG, B&G Foods, Inc. BGS and Aramark ARMK, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Conagra has outperformed earnings estimates by an average of 10.7% in the trailing four quarters. Also, the company has long-term EPS growth rate of 8%.

B&G Foods has outperformed earnings estimates by an average of nearly 2% in the trailing four quarters. Also, the company has long-term EPS growth rate of 10%.

Aramark, with a long-term EPS growth rate of 12.8%, flaunts a solid earnings surprise history.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Click for Free ConAgra Foods Inc. (CAG) Stock Analysis Report >>

Click for Free Campbell Soup Company (CPB) Stock Analysis Report >>

Click for Free B&G Foods, Inc. (BGS) Stock Analysis Report >>

Click for Free Aramark (ARMK) Stock Analysis Report >>

To read this article on Zacks.com click here.

Zacks Investment Research