Can C. H. Robinson Start Delivering Big Capital Gains Again?

- By Robert Abbott

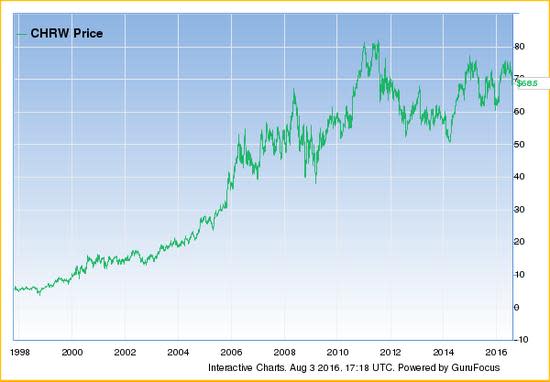

C. H. Robinson Worldwide, Inc. (CHRW) dominates the freight brokerage business and has done well for the investors--mainly institutional--who bought its shares some years back.

However, its share price has languished for the past five years, after climbing fairly steadily since it went public in 1997.

Warning! GuruFocus has detected 6 Warning Signs with CHRW. Click here to check it out.

The intrinsic value of CHRW

Should we buy this Fortune 500 company and resident of the Undervalued Predictable screener, with expectations it will start delivering capital gains again?

History

1905: Charles Henry Robinson incorporates the C. H. Robinson company, a wholesale produce (fruits and vegetables) broker in Grand Forks, North Dakota;

1919: The company moves to Minneapolis, MN;

1945: Begins transporting produce, mainly by rail, as an extension of its brokerage business;

1968: Gets into the regulated trucking business as a contract carrier;

1984: Begins operations as a contract carrier;

1988: Enters the intermodal business;

1993: Establishes itself in Europe by buying the French trucking company Transeco;

1997: C.H. Robinson Worldwide, Inc. (CHRW) begins trading on the NASDAQ;

2003: Opens an office in Hong Kong, and buys an international freight forwarding and third party logistics company there;

2004: Opens seven offices in China, and begins operations there;

2012: Sells its payment services business;

2015: Acquires Freightquote.com, a privately-held freight broker headquartered in Kansas City, MO.

History based on information at the company's website.

Comments: A company that's now operated as a broker for more than a hundred years, shifting its emphasis from produce to a broad range of consumer and industrial goods.

The Business of CHRW

C.H. Robinson Worldwide, Inc. calls itself one the largest third party logistics companies in the world, providing freight transportation services and logistics solutions to companies of all sizes, in a wide variety of industries (unless otherwise noted, information in this section comes from the company's 10-K for 2015).

It remains in the brokerage business, facilitating connections between its customers and transportation companies. In its own words, "we enter into contractual relationships with a wide variety of transportation companies and utilize those relationships to efficiently and cost-effectively transport our customers' freight."

Last year it served more than 110,000 customers worldwide, which varied in size from very big companies to small businesses, across a wide range of industries. The largest customer accounted for about 2% of its total revenue.

To broker customer products and transport carriers, Robinson operates a network of offices in North America, Europe, Asia and South America. In 2015, it worked with 68,000 different carriers to handle just under 17 million shipments.

The second and much smaller segment of the business, is sourcing of produce through a company called Robinson Fresh.

Note that as a broker, the CHRW avoids the cost of buying transportation equipment, such as trucks, trains and ships. Instead, it needs only offices for its employees to connect manufacturers, importers and others with carriers.

Comments: C. H. Robinson Worldwide specializes in knowledge of the transportation industry and uses that knowledge to service its customers with optimized transport services.

Revenues

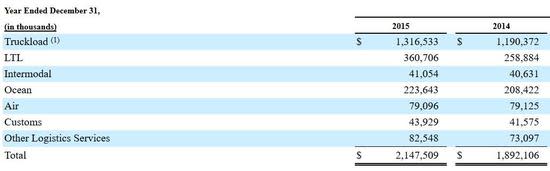

As this excerpt from the 10-K for 2015 shows, transportation and logistics account for about 95% of the company's revenue:

And as this note indicates, growth in several areas has been driven by recent acquisitions:

"Transportation services accounted for approximately 95 percent of net revenues in 2015, 94 percent of our net revenues in 2014, and 93 percent in 2013. The increase in LTL in 2015 was primarily due to the acquisition of Freightquote on January 1, 2015. The increases in ocean, air, and customs revenues in 2012 and 2013 were primarily related to our acquisition of Phoenix International Freight Services, Ltd., ("Phoenix"), on November 1, 2012."

About 90% of total revenue comes from the United States.

Comments: Although the company has a number of lines of business, there is really only one that counts: transportation and logistics. In the future, though, other lines may become increasingly stronger through acquisitions.

Competition

CHRW characterizes the industry as ". . . highly competitive and fragmented. We compete against a large number of logistics companies, trucking companies, property freight brokers, carriers offering logistics services, NVOCCs, IACs, and freight forwarders. We also buy from and sell transportation services to companies that compete with us."

Donald Yacktman has commented, "C.H. Robinson continues to face challenges and earnings pressure from improved competition. We think the company is well positioned to handle challengers and remain a dominant force in the logistics industry."

Morningstar lists its top competitors as United Parcel Services (UPS) and Fedex (FDX), both of which are much larger by market cap (and better known as carriers than brokers). GuruFocus lists a number of other competing companies, including Kuehne & Nagel (KHNGY), Royal Mail PLC (the British post office) and the Bidvest Group (BDVSY), as well as a number of trucking companies. Reuters lists competitors as Ryder Systems Inc. (NYSE:R), Expediters Inc. of Washington (EXPD.OQ) and J B Hunt Transport Services Inc. (JBHT.OQ).

Moat

C. H. Robinson Worldwide says, in its 10-K for 2015, that its competitive advantages are:

Empowered and dedicated employees

Proven processes and solutions

Navisphere(R), ". . . a single platform that allows customers to communicate worldwide with every party in their supply chain across languages, currencies, and continents. Navisphere(R) offers sophisticated business analytics to help improve supply chain performance and meet increasing customer demands."

A vast network of people and resources

Relationships, which allow for "global connections and valuable market knowledge"

Portfolio of Services

Scale, for ". . . substantial shipment volumes for better efficiency, service, and marketplace advantages"

Stability: "Our financial strength, discipline, and consistent track record of success for strategic support of our customers' supply chains."

This image from the 2016 Investor Day presentation sums this up from another perspective:

Comments: Over the past century, C. H. Robinson has developed expertise, technologies and synergies that allow it to maintain its place in the transportation industry. Donald Yacktman (Trades, Portfolio) says the company faces challenges from competitors, but should be able weather that and retain its industry dominance.

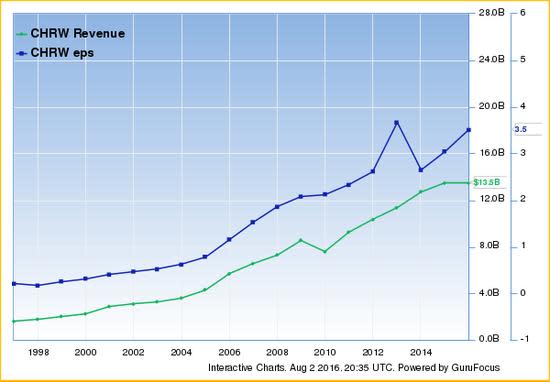

Growth

This chart shows how CHRW's revenue (green line) and Earnings per Share (blue line) have grown since the company went public in 1997:

Note that when the American (and international) economy took a tumble in 2008/2009, CHRW continued to grow its earnings, despite a pullback in revenues.

Mairs and Power says, "The company is well positioned in both consumer and industrial markets and should benefit as the industrial sector picks up."

The consensus among analysts followed by NASDAQ is that C. H. Robinson will increase its earnings by 6.06% this year (ending on December 31st).

The 12-month consensus price target among analysts followed by NASDAQ is $75.50, which would be a 10.4% increase over the August 2 closing price of $68.36.

Comments: Steady growth of earnings in the past decade, despite the economic slowdown that began in 2008; reasonable growth in earnings and share price among analysts.

Risks

Fluctuations in the economy affect C. H. Robinson, both domestically and internationally. In particular, if the American economy slows down, this company's growth will feel the effects.

Fuel costs involve a more complex set of dynamics; in its 10-K the company says,

" . . . fluctuating fuel prices may result in decreased net revenue margin. While our different pricing arrangements with customers and contracted carriers make it very difficult to measure the precise impact, we believe that fuel costs essentially act as a pass-through cost to our truckload business. In times of fluctuating fuel prices, our net revenue margin may also fluctuate."

Natural and man-made catastrophes may also take a bite out of the company's revenues and earnings.

Heavy reliance on technology comes with the brokerage business and is a vulnerability that could affect the company's top and bottom lines.

Comments: A number of risk factors could pose problems, but the same risks pertain to other companies in the transport business.

Other

C. H. Robinson Worldwide is registered in Delaware and has its head office in Eden Prairie, MN.

CEO and Chairman: John P. Wiehoff, age 54, has been chief executive officer since 2002, president since 1999, a director since 2001, and became the chairman in 2007. Previous positions with the company include senior vice president, chief financial officer, treasurer and corporate controller. Prior to that, he was employed by Arthur Andersen LLP. (CEO Wiehoff's age from Reuters)

At the end of 2015, the company had 13,159 employees.

In an article at Seeking Alpha, Jonathon Wheeler notes that CHRW has increased its dividend for 18 consecutive years, which means it is now just seven years away from becoming a Dividend Aristocrat.

Ownership

Ten of the investing legends followed by GuruFocus hold positions in C. H. Robinson Worldwide, the largest of them being Mairs and Power (Trades, Portfolio) with 1,981,697 shares. PRIMECAP Management (Trades, Portfolio) and Donald Yacktman (Trades, Portfolio) are the second and third largest, both with more than a million shares.

In the first half of this year, the GuruFocus Trades page shows many gurus either closing out or reducing their holdings in CHRW. Among those reducing their positions were the three biggest holders listed above. Contrarians buying in or adding to their holdings were Jim Simons (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio) and Ray Dalio (Trades, Portfolio) (who had closed his position earlier in the year).

Institutional investors have a big stake in CHRW, 87.68%.

Insiders and shorts have roughly even holdings, at 6.85% and 6.64%, respectively. The high insider holdings no doubt reflect the fact that employees owned 100% of the company for a time before the company went public.

Comments: Almost all of C. H. Robinson's stock is owned by either institutions or insiders.

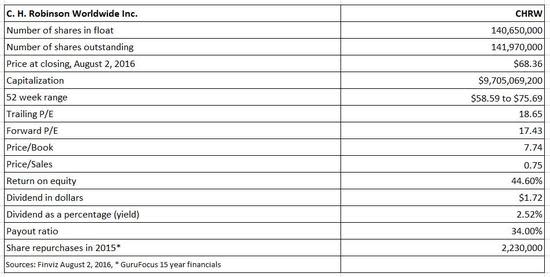

CHRW by the Numbers

Comments: Very high Return on Equity, a share price roughly midway between its 52-week high and low, a modest of two and a half percent dividend, as well as share buybacks.

Financial Strength

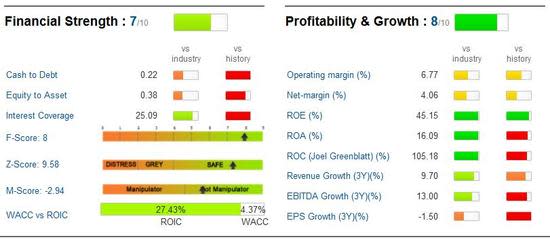

CHRW receives good ratings from the GuruFocus automated system; Financial Strength of 7 and Profitability & Growth of 8:

Reviewing the Financial Strength column, we get more depth on the reasons for the score of 7:

Debt: compared to what it was in previous years

Piotroski F-Score: 8 (which is just one below top rank), and

WACC vs. ROIC: showing the company manages its capital very well.

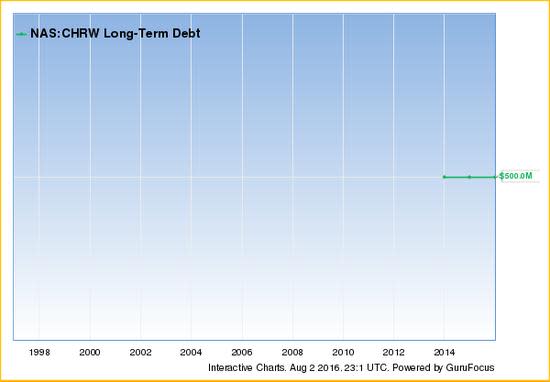

This interesting chart shows why CHRW gets the red icons for financial strength:

The company carried no long-term debt at all until fiscal 2013, when it took on $500-million. In its 10-K for 2015 it says,

"In 2013, we entered into a Note Purchase Agreement to fund the accelerated share repurchase agreements to repurchase $500 million worth of our common stock. The Note Purchase Agreement was amended in February 2015 to conform its financial covenants to be consistent with the amended revolving credit facility. We also expect to use the revolving credit facility, and potentially other indebtedness incurred in the future, to assist us in continuing to fund working capital, capital expenditures, possible acquisitions, dividends, and share repurchases."

Can it manage the debt load? Yes. As GuruFocus reports for the first quarter,

"Interest Coverage is a ratio that determines how easily a company can pay interest expenses on outstanding debt. It is calculated by dividing a company's Operating Income (EBIT) by its Interest Expense. C.H. Robinson Worldwide Inc's Operating Income for the three months ended in Mar. 2016 was $199 Mil. C.H. Robinson Worldwide Inc's Interest Expense for the three months ended in Mar. 2016 was $-9 Mil. C.H. Robinson Worldwide Inc's interest coverage for the quarter that ended in Mar. 2016 was 22.68. The higher the ratio, the stronger the companys financial strength is."

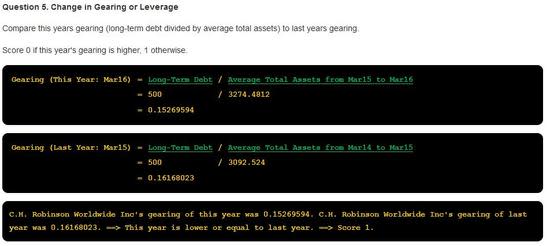

Turning to the Piotroski F-Score, we see an 8. This score is based on a series of nine key questions about the company's financial metrics; each question answered successfully adds one point to the score. In this case, the missing point involves debt and leverage:

Finally, looking at the relationship between the Weighted Average Cost of Capital (WACC) and the Return on Invested Capital (ROIC), we see ROIC is 6.3 times greater than WACC. Or in non-technical language, the company brings in $6.30 of operating income for each dollar of capital.

Comments: While C. H. Robinson loses some points in the Financial Strength category for taking on long-term debt in 2013, it does have the managerial skill to make the most of the debt and equity capital it takes in.

Valuation

First, we note C. H. Robinson Worldwide is a 5-Star Predictability company, meaning it delivers consistently higher earnings than almost every other American stock. All of which means it is more likely to deliver higher share prices in the years ahead and less likely to get into trouble.

An Earning Power Based valuation is recommended for CHRW by GuruFocus. One such valuation comes in the form of The Median P/S Value, which at the close of trading on August 2, came in at $98.76, a 44.4% premium over the closing price of $68.36.

GuruFocus explains,

"Median P/S Value is calculated as trailing twelve months (TTM) revenue per share times 10-Year median P/S ratio. C.H. Robinson Worldwide Inc's revenue per share for the trailing twelve months (TTM) ended in Mar. 2016 was $91.441. C.H. Robinson Worldwide Inc's 10-Year median P/S ratio is 1.08. Therefore, the Median P/S Value for today is $98.76." and

"As of today, C.H. Robinson Worldwide Inc's share price is $68.36. C.H. Robinson Worldwide Inc's median P/S value is $98.76. Therefore, C.H. Robinson Worldwide Inc's Price to Median P/S Value Ratio for today is 0.69."

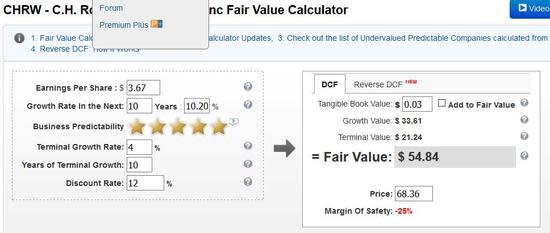

An earnings-based DCF calculation gives us a much lower valuation, 25% below the current price:

Compared to its peers in the global integrated shipping and logistics industry, it has a middling P/E ratio: 18.63 compared to the industry median of 15.32.

And, as noted earlier, the analysts followed by Morningstar have a 12-month price target of $75.50, which is 10.4% higher than the current price.

Comments: We see some variation in valuations, with a couple indicating a higher price and three suggesting a lower price would be appropriate.

Conclusion

C. H Robinson Worldwide, Inc. is a strong company. It has the confidence of Mairs and Power (Trades, Portfolio), as well as Donald Yacktman (Trades, Portfolio) and many more institutional investors--87.7% of the company's stock is in their hands. Insiders own more than 6%.

Between the dividend, which has risen for 18 consecutive years, and share buybacks, investors in this company should do well.

More important, though, is CHRW's earnings power, which is helped by the fact it does not need to invest in hard transportation assets. It lets others worry about the cost of trucks and rail cars and even fuel costs.

It does have some debt, but as we have seen that is at a manageable level, with operating income 25 times greater than interest costs.

However, the biggest obstacle for many value investors will be C. H. Robinson's valuation. We've seen both positive and negative share price targets or valuations, but nothing compelling that would make us want to run out and buy this with an eye to future capital gains.

Disclosure: I do not own shares in any of the companies listed in this article, nor do I expect to buy any in the foreseeable future.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 6 Warning Signs with CHRW. Click here to check it out.

The intrinsic value of CHRW