What Buzzwords From China’s Key Political Meeting Reveal, From ‘AI Plus’ to ‘New Three’

(Bloomberg) -- As lawmakers and advisers meet in Beijing this week for the nation’s biggest political gathering of the year, the Chinese Communist Party’s official People’s Daily newspaper released a list of the event’s buzzwords.

Most Read from Bloomberg

Chemical Linked to Cancer Found in Acne Creams Including Proactiv, Clearasil

How Trump’s Ex-Treasury Chief Landed 2024's Highest-Profile US Bank Deal

Stocks Climb on Bets Fed, ECB Closer to Rate Cuts: Markets Wrap

Tracking slogans and phrases from government and party documents has become an important way to gain insight into Chinese policymaking, especially as the country has increasingly restricted access to information. This year, Li Qiang will be the first premier in three decades to not hold a press briefing at the National People’s Congress, removing a rare platform to engage with one of the most senior officials in the country.

Here are the key terms that can help better understand China’s priorities for the upcoming year.

New Three (新三样)

Premier Li noted during his work report that exports of the “new three” growth drivers of electric vehicles, batteries and solar products grew by 30% last year. While the focus on the three sectors helps in the de-carbonization push, they are far from enough to replace traditional economic drivers such as the property sector. China’s push into high-end manufacturing is also already raising tensions with trade partners. The term hearkens back to the “old three” pillars of Chinese manufacturing, including household appliances, furniture and clothing.

Read more: Xi’s Solution for China’s Economy Risks Triggering New Trade War

Ultra-Long Special Central Government Bonds (超长期特别国债)

Li announced the country’s plan to issue 1 trillion yuan ($139 billion) of ultra-long special central government bonds as authorities ramp up fiscal stimulus. It’s only the fourth such sale in the past 26 years, with the most recent one in 2020 when authorities issued the same amount of such bonds to pay for pandemic response measures. The amount was in line with expectations, but analysts say China will need a lot more if it is to meet its aggressive growth target of around 5% this year.

Read more: China Plans $139 Billion Special Ultra-Long Debt for Economy

Consistency of Macro Policy Orientation (宏观政策取向一致性)

The phrase gained prominence during a Politburo meeting in December and then featured again at the Central Economic Work Conference later that month. The government has called for the stronger coordination of fiscal, monetary, employment, industrial and regional policies. Investors have complained about policy whiplash which has led to stock market swings, such as when harsh gaming curbs sparked a multi-billion dollar rout late last year.

What Bloomberg Economics Says ...

“The 5% target for 2024 sets a high bar, given a more challenging base than last year — hitting it will require more stimulus. The stronger-than-expected budget plan is consistent with the ambitious goal. The strategy may be to make an immediate fiscal push to boost growth. To succeed, policymakers will need to avoid a repeat of 2023, when spending fell behind schedule and additional stimulus was dispensed only slowly.”

— Chang Shu, David Qu and Eric Zhu, economists

Read the full report here.

New Productive Forces (新质生产力)

The term was introduced by Chinese leader Xi Jinping in September during an inspection trip to the country’s northeast. The official Xinhua News Agency said it means “advanced productivity freed from traditional economic growth models,” featuring new growth drivers that are “high technology, high efficiency and high quality.” State media has said these growth drivers include everything from the tourism industry to China’s “new three.” Leaders including Xi have recently stressed that traditional industries can also become “productive forces,” perhaps reflecting concerns about whether an overemphasis on new sectors could lead to a contraction in older ones. For now, the buzzword is being embraced: The chairman of one of China’s largest spirit companies called the liquor industry an important vehicle for “new productive forces” because it embraces technological innovation, local media reported.

Read more: Xi Wants ‘New Productive Forces’ to Fit Local Conditions

Worry-Free Consumption (放心消费行动)

A government drive to get consumers spending by focusing on issues with food safety, refund policies and disputes between buyers and sellers has been underway since at least the summer of last year. However, economists say that measures such as “worry-free” buying and trade-in programs highlighted in the government work report fall far short of the types of stimulus and confidence-boosting measures that will be needed to get consumers spending again. There are already plenty of signs of consumption downgrading due to the persistent property slump and slowing economy.

Read more: China Calls for New Appliances, More Vacation to Revive Spending

Future Industries (未来产业)

Li pledged to “formulate development plans for the industries of the future,” name-checking new fields such as quantum technology and life sciences. He also pledged to strengthen coordination and planning to prevent overcapacity and redundant development. The central government said it would increase spending on scientific and technology research by 10% in 2024, and pledged to harness the entire nation’s resources to drive tech advances.

Read more: China to Mobilize Nation as It Fights US for Tech Supremacy

Invest in China (投资中国)

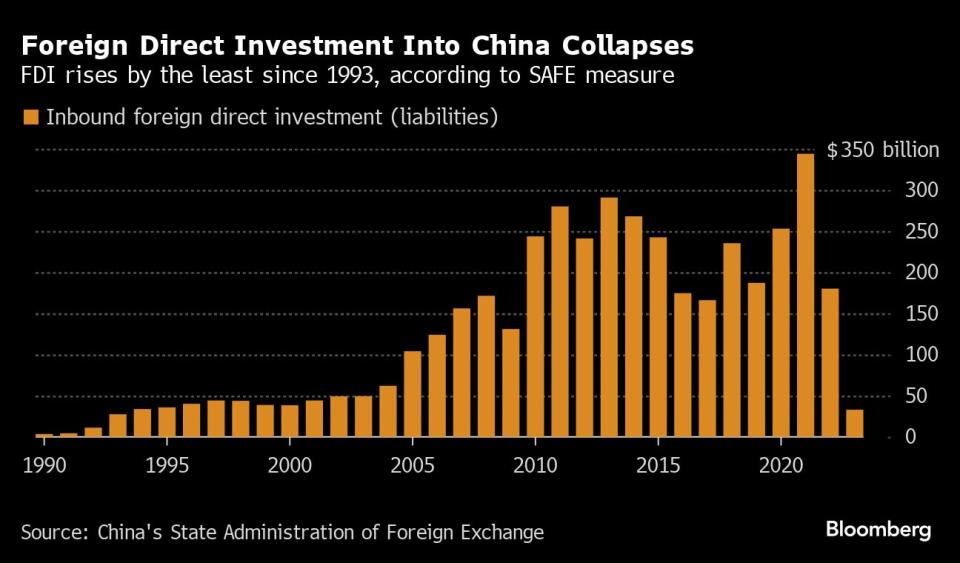

Li said China would increase efforts to attract foreign investment and build the “Invest in China” brand. Foreign direct investment slumped to a 30-year low in 2023 on concerns over China’s long-term growth prospects and as geopolitical tensions rise. A widening yield gap with the US also meant investors moved money offshore in search of higher returns. Though the government has vowed to improve the business environment and released a list of 24 points last year to achieve these ends, it may be too little for executives who believe the risk-reward trade-off of doing business in the country has fundamentally changed.

Read more: Xi’s Mixed Messages Leave Whiplashed Investors Wary of China

Nationally Unified Computational System (全国一体化算力体系)

Chinese officials have said they see computing power playing the same key infrastructure role that waterways and electricity grids have in the past, and set goals last year to build of a national computing network. As part of an effort to make a more digital economy, China already has an “East Data West Computing” plan, which involves building huge data centers in poorer western provinces to hold data generated by internet companies based in the east. The unified system would be able to better allocate computational power and storage, according to state media.

Read more: US Said to Consider Limits on Cloud Computing For China

AI Plus Initiative (人工智能+)

Li announced China would launch the AI Plus Initiative this year. While details are scarce, AI is a core area of competition between the US and China. State media cited an academic at a government-linked think tank as saying that the initiative would “promote the in-depth integration of AI and the real economy by deepening the research and application of AI technology.”

Read more: Chaotic Markets Give US an AI Edge Over China: New Economy

--With assistance from Junyi Wu, Fran Wang, Jing Li and James Mayger.

(Updates with Chinese language version of buzzwords, businessman’s comments on new productive forces.)

Most Read from Bloomberg Businessweek

How Apple Sank About $1 Billion a Year Into a Car It Never Built

The Battle to Unseat the Aeron, the World’s Most Coveted Office Chair

How Microsoft’s Bing Helps Maintain Beijing’s Great Firewall

Humanoid Robots at Amazon Provide Glimpse of an Automated Workplace

©2024 Bloomberg L.P.