How FAFSA 'fixes' have turned College Decision Day into chaos

Instead of attending college this fall, a Massachusetts teen plans to join the Marines.

A first-generation student from Illinois hopes her restaurant job will cover college costs.

A Floridian in her 30s says she might go back to exotic dancing to afford tuition.

May 1 has long been the deadline for many students to decide where to attend college. But for applicants across the country, 2024 has been the year the systems in place for decades fell apart. While picking a college is anxiety-inducing in a normal year, the government's botched handling of financial aid upended that decision-making process, disrupting the lives of a broad swath of American students.

The stress stems from a form called the Free Application for Federal Student Aid, which opens the door to government help with tuition and, many say, to a better quality of life. This year, glitches and holdups with the form kept many vulnerable people from getting across the finish line.

Historically, the application required students and their families to answer dozens of complicated questions using decades-old technology. Facing a mandate from Congress, Biden administration officials set out to fix it. But the new FAFSA was beset with issues and corrupted data, delaying aid offers for months and jeopardizing the prospects for some of the students the updates were supposed to help.

Even employees in the Education Department’s Federal Student Aid office, which was charged with streamlining the form, expressed frustration with their bosses’ handling of the rollout, two agency officials not authorized to speak publicly told USA TODAY. Then, last week, seemingly capping off the fiasco, the top Biden administration official overseeing the revised process resigned from his post.

“FAFSA is the stepping stone to everything,” said Galawe Alcenet, a senior in Minnesota who lost her chance at getting several private scholarships because of the processing delays. “The biggest challenge has been the waiting.”

Applicants’ experiences were also complicated by colleges’ evolving stances on standardized entrance exams, last year's Supreme Court decision banning affirmative action, feelings about the Israel-Hamas conflict and the ripple effects of the COVID-19 pandemic, which threw their middle and high school years into disarray.

More: How did the FAFSA rollout go so wrong? A look at the key events

The FAFSA fiasco hit low-income students the hardest. The vast majority of America’s college students – 85% as of the 2019-20 school year – rely on aid. But by late March, 40% fewer high schoolers had completed their FAFSA compared with the same period last year, according to federal data.

“We were out of runway,” said Alyssa Dobson, the financial aid director at Slippery Rock University, a public school in western Pennsylvania. By the time the Education Department announced in late March that it had flubbed key details on the already-tardy FAFSA information, Dobson said she had no more time to waste.

“The entire operation is a house of cards,” said Melissa, a student in Florida who kept getting error messages when she tried to submit her application – and still hasn’t gotten a clear answer on how much aid she’ll get. “I feel like if I make one wrong move it’s just going to collapse on itself.”

Melissa is among several students who asked USA TODAY to withhold her last name to protect her prospects. She is in her early 30s and pursuing college for the second time after earning her associate’s degree in her 20s. She had worked as an exotic dancer to cover her bills and said she will probably return to that gig given her precarious financial aid circumstances.

“The whole ‘we’re making FAFSA easier’ thing? Not true,” she said.

"It is an overhaul – it’s not just a new website," Education Secretary Miguel Cardona said at a Senate hearing Tuesday on his department's budget. But, he said, “there’s no excuse. Our students deserve better.”

More than 8 million students have submitted their FAFSA forms to date, said James Kvaal, the undersecretary of education, in a statement to USA TODAY. The applications are now being processed in one to three days, he said, as many schools make financial aid offers. Kvaal encouraged anyone applying to college who hasn't done so to submit the form as soon as possible.

In interviews over the past month, students, parents and financial aid professionals told USA TODAY many of them have struggled to cope with the bungled process.

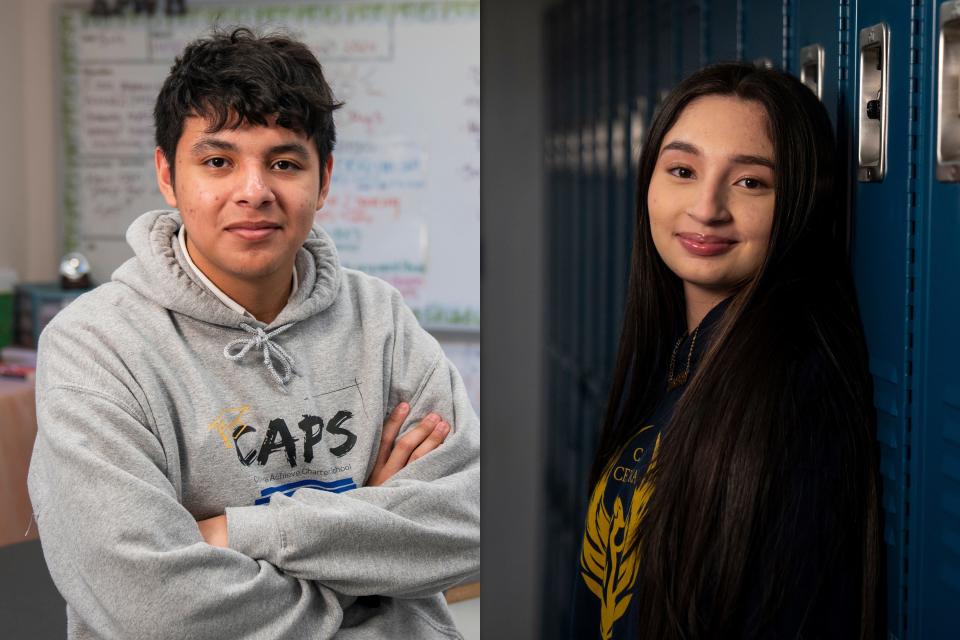

Military or college? FAFSA changed his mind

Growing up, Sam envisioned he’d be on the front lines after high school, protecting his community as a police officer or in the military. He brushed aside the idea of college. It wasn’t for him, he decided. He wanted to avoid student loans at all costs. He had been raised by a single mom in Milford, Massachusetts, and there was no way he could afford tuition.

Things changed his junior year when he learned of a national program at his school called OneGoal that works to transform postsecondary advising. The teacher who led the OneGoal class didn’t dismiss Sam’s blue-collar dreams but encouraged him to at least consider college.

That teacher made Sam realize getting generous financial aid for college was possible for a student like him who didn’t get perfect grades. Then he visited a campus, and the dream seemed within reach. Sam had pictured college as “a bunch of people just running around and partying, like in the movies,” he said. “I just can’t justify that money – that’s just stupid. I can party for free otherwise.” During the visit, Sam realized “people were actually taking this seriously.”

He applied to some nearby state schools – and was accepted. Then came the financial aid part.

“Man, the FAFSA killed me,” he said.

The form kept telling him there was an error with his mother’s information. None of his attempts at troubleshooting resolved it – not filling the form out backward, not using all caps or no caps. Like many students who spoke with USA TODAY, he tried to access a helpline. “It was rough. I was getting so mad.”

Sam never managed to submit his form. He has given up on going to college this fall. The endless dead ends were so frustrating he took them as a sign: He should just enlist in the Marines. The FAFSA frustrations, he said, were “what really, really made me not want to go to school and just go straight to the military.”

Students in mixed-status families waiting on answers

In mid-April, Janet Leon, 18, still hadn’t sent in her FAFSA. Like so many others, it wasn’t for lack of trying.

By the time Cardona, the education secretary, designated a “FAFSA Action Week” urging seniors to submit the form as quickly as possible, the senior had tried just about everything. But the FAFSA continued to boot out her parents, who are Mexican immigrants, every time they checked the box saying they didn’t have Social Security numbers.

Her father is a chef at a senior home, and her mother spends most of her time running around after her younger siblings. Getting the pair of them to sit down simultaneously and work through the form with her was a challenge. She’s busy, too: She has worked a restaurant job all through high school, pays her phone bill and is trying to piece together a college fund.

“It’s just so hard to get everyone in one place,” said Leon, who hopes to attend Iowa State University, several hours from her home in the Chicago suburbs. She would be the first person in her family to go to college – if word comes through that she can afford it.

Challenges have been widespread for students from mixed-status families, which is often when at least one parent is a non-U.S. citizen who doesn't have a Social Security number. Reports suggest many applicants, like Leon, continued to run into trouble long after the Education Department announced it would fix the problem in February.

It took until Tuesday, April 30 – one day before the traditional college decision deadline – for the agency to allow people without Social Security numbers to submit the form. The department called it a temporary fix and said students who didn't have one would have to verify their statuses with schools before they receive federal aid.

The news came too late for people like Angel Ulloa, a student in New Jersey who is still awaiting crucial financial aid information. When the 18-year-old was rejected from Princeton after being waitlisted, he felt disappointed on multiple fronts. Princeton covers tuition for families like his that fall under a certain income threshold. But that was no longer an option.

Ulloa faced FAFSA problems from the get-go: He couldn’t discern which information needed to go where or why error messages kept popping up. His mother was anxious about being on the hook for tens of thousands of dollars and tried calling customer service dozens of times. She made four calls every morning and often several more at night over a month.

“No matter how many times we got through, I just never felt like any of our voices were being heard,” Ulloa said. “I just wanted to bang my head on the computer.”

Eventually, Ulloa printed the form, filled out the information on paper and mailed it in. In late February, he got an update that his FAFSA had finally gone through. But after two months – and weeks later than students who graduated last year – he was still waiting to hear how much aid schools would offer him.

Some transfer students remain in limbo

Ximena Penuelas Quinonez wasn’t always an expert on how people pay for college.

After graduating from a public high school in Phoenix a few years ago, she didn’t apply to too many places. Like lots of students from low-income backgrounds, she didn’t want to give her parents something else to worry about. “I can’t afford college on my own,” she used to tell herself. “And I can’t ask my parents, because they’re already struggling as it is.”

So she applied to community college and continued living at home to save money and spend time with her siblings. She got a job in the financial aid office at Phoenix College, where she witnessed this year’s FAFSA disaster close up.

She’s on track to finish her associate’s degree and is heading to Arizona State University in the fall. ASU, like many four-year schools, funnels nearby community college grads onto campus as transfers, hoping they’ll turn their associate’s into bachelor’s degrees.

Penuelas Quinonez was admitted to ASU in March. By mid-April, she had determined which classes she’d be taking there. What she didn’t know was how much she’d be paying.

She struggled through the spring to submit her FAFSA, tripped up because her parents don’t have Social Security numbers. Without an idea of next year’s sticker price, she worried she’d have to keep living at home, even though the ASU campus is a longer drive.

She finally got her aid offer in late April, though it still didn't show how much tuition she’ll have to pay. She’s now looking for an on-campus job and planning to take out loans so she can get an apartment and avoid commuting about two hours, there and back, every day.

A tale of two FAFSAs: Corrections create a waiting game

Ashly and Derick Callejas are twins, two of four children raised by working-class immigrants in Plainfield, New Jersey. The teens’ financial information is identical. Yet when it came to filling out the FAFSA this year, they had very different experiences. Ashly submitted her form with very few hitches. Derick, meanwhile, encountered problems at almost every step.

In their case, it appeared successfully submitting the FAFSA came down to luck.

Perhaps because he pressed a button too many times or triggered some other glitch, Derick was informed he needed to correct his form once it was processed and couldn’t see his estimated aid until he fixed the problems. Making the necessary corrections promptly would be impossible. He’d have to wait weeks. He learned this not from the Education Department but from TikTok videos of students who had experienced similar problems.

The administration indicated the revised forms would accept corrections in March. Then officials extended the timeline, anticipating corrections could be submitted in mid-April. Most of these changes were simple (like adding a missing signature) and would take only a few minutes, Education Department officials and observers said.

Derick recently learned, again through TikTok, that he could finally correct his form. But after he submitted the revision, he realized he needed to make another correction. The processing delays prevented him from knowing how much aid he’ll get for the University of Pennsylvania, where he was accepted earlier this year.

Penn is one of several hundred institutions that uses the CSS profile, an online application that lets students apply for nonfederal financial aid. Derick is optimistic he’ll get most of his tuition covered, but he has refrained from committing to Penn until he knows more. Neither he nor Ashly wants to leave their parents with bills they can’t afford – sending one kid to college is expensive enough. And because of other changes to this year’s FAFSA, parents no longer get the same automatic discount for having two kids in college at once.

A smooth FAFSA experience and an alternative: success stories

Henry Wolfe will probably remember April’s total solar eclipse for the rest of his life – but not because of the rare astrological event.

Between his weekend track meets, he and his mother squeezed in a visit to Wake Forest University. While everyone else was busy staring at the sky outside, they were more concerned with the stuff on the ground: The band playing on the quad, the school’s mascot (the Demon Deacon), and the Department of Health and Exercise Science, where Wolfe hopes to study.

On the car ride back home to Columbia, Missouri, Wolfe seemed to make up his mind. “This visit moved the needle,” his mom said from behind the wheel.

While Wake Forest apparently still hadn’t received Wolfe’s FAFSA weeks later, the private North Carolina college uses the CSS Profile and estimated his aid that way. Wolfe got an offer in March that shaved tens of thousands of dollars off tuition, making it more affordable than the University of Pittsburgh, which he then eliminated from his shortlist. “Demon Deacons it is!” his mom wrote in a text to USA TODAY.

On the other side of the country in Stockton, California, 18-year-old Diorue Hodges has decided she’s attending North Carolina A&T, a top HBCU known for educating the most Black engineers in the country. The aspiring mechanical engineer said her relatively painless FAFSA experience allowed her to focus on other matters this semester – studying for finals, connecting with fellow students at her future school and spending quality time with her California classmates.

Hodges didn’t even know what the FAFSA was until her junior year. But her school hosted a week dedicated to teaching students and their families about the ins and outs of the process. Counselors also consistently reassured Hodges and her peers when there were delays and changes from the Education Department. “The form was just really easy,” she said. There weren’t any in-depth, confusing queries. “A lot of it was just, like, ‘Click this if it applies to you.’”

Even for the luckiest students this year, some questions remain. Because of processing delays, Hodges is still awaiting a finalized aid package.

Eroded trust: Colleges may struggle to solve enrollment problems

For years, the government wanted to put more money in the hands of more low-income college students. And over time, that will surely happen. The new FAFSA allows hundreds of thousands more students to qualify annually for federal aid.

Yet the success stories have been subsumed by an overwhelming frustration over how officials in Washington went about trying to make things better. The resentment that built up devolved into a broader erosion of public trust in the federal financial aid system.

Paul Dieken, financial aid director at Pomona College in California, said the Education Department hasn’t done a good job of rebuilding that trust. When the agency suggested that colleges could use corrupted data to get aid offers out the door as quickly as possible, Dieken was flabbergasted.

The government has a lot of work to do to regain credibility, experts told Congress a few weeks ago. In the meantime, all the students caught up in this year’s mess will have to live with choices they were forced to make more quickly than many felt was reasonable.

As of mid-April, the FAFSA completion rate at public high schools with the most minority students was down by more than a third.

Dieken worries about the long-term repercussions of the messiness that has defined this admissions cycle. If the number of students of color at Pomona were to decline, it would be all but impossible for the college to figure out why it had happened.

“We don't know if that's because of the FAFSA problem or the Supreme Court decision problem or even the campus protest issue,” he said. “It's really going to be hard for us to figure out what's causing changes in our class. ... If we don't know what the problem is, how do we course-correct?"

Alia Wong covers inequities in education for USA TODAY. You can reach her at (202) 507-2256 or awong@usatoday.com. Follow her on X at @aliaemily.

Zachary Schermele covers education and breaking news for USA TODAY. You can reach him by email at zschermele@usatoday.com. Follow him on X at @ZachSchermele.

This article originally appeared on USA TODAY: How FAFSA changes have turned College Decision Day into chaos