Bullish Sentiment Renewed in Crude Oil

After stumbling since late January, Crude Oil may see speculative bullish action developing.

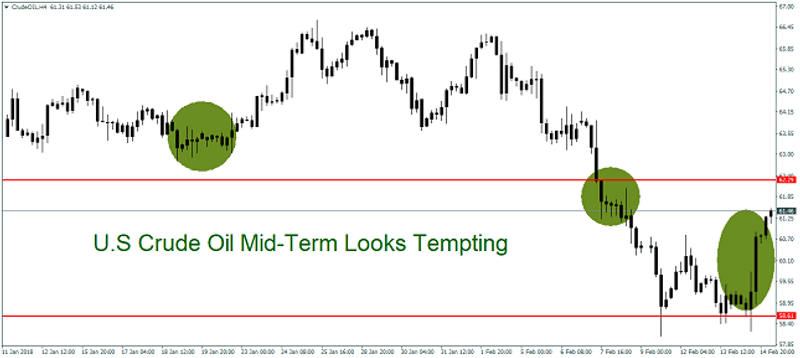

U.S Crude Oil Bounce off Lows

While forex proves a tough beast to tame, commodity markets have provided more tranquil surroundings for bullish speculators. U.S Crude Oil came off lows yesterday and is trading above 61.00 U.S Dollars a barrel.

Support for Crude Oil appears to be around the 58.50 juncture, while resistance appears to be about 63.00 U.S Dollars a barrel.

Demand Outpacing Supply Short Term

U.S Crude Oil supply numbers were published yesterday and inventories were 1 million barrels below expectations. This showed that demand for the commodity is strong, meaning even as energy producers have ramped up production, demand appears to be outpacing supply in the short-term.

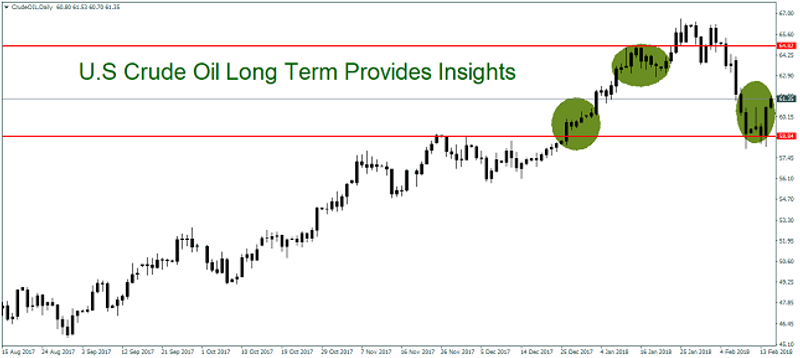

Crude Oil has had a solid mid-term and long-term trend upwards, and although it has met headwinds since late January, the commodity may be ready for bullish sentiment to renew.

In the short term, we believe U.S Crude Oil may be positive. The mid-term and Long term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire