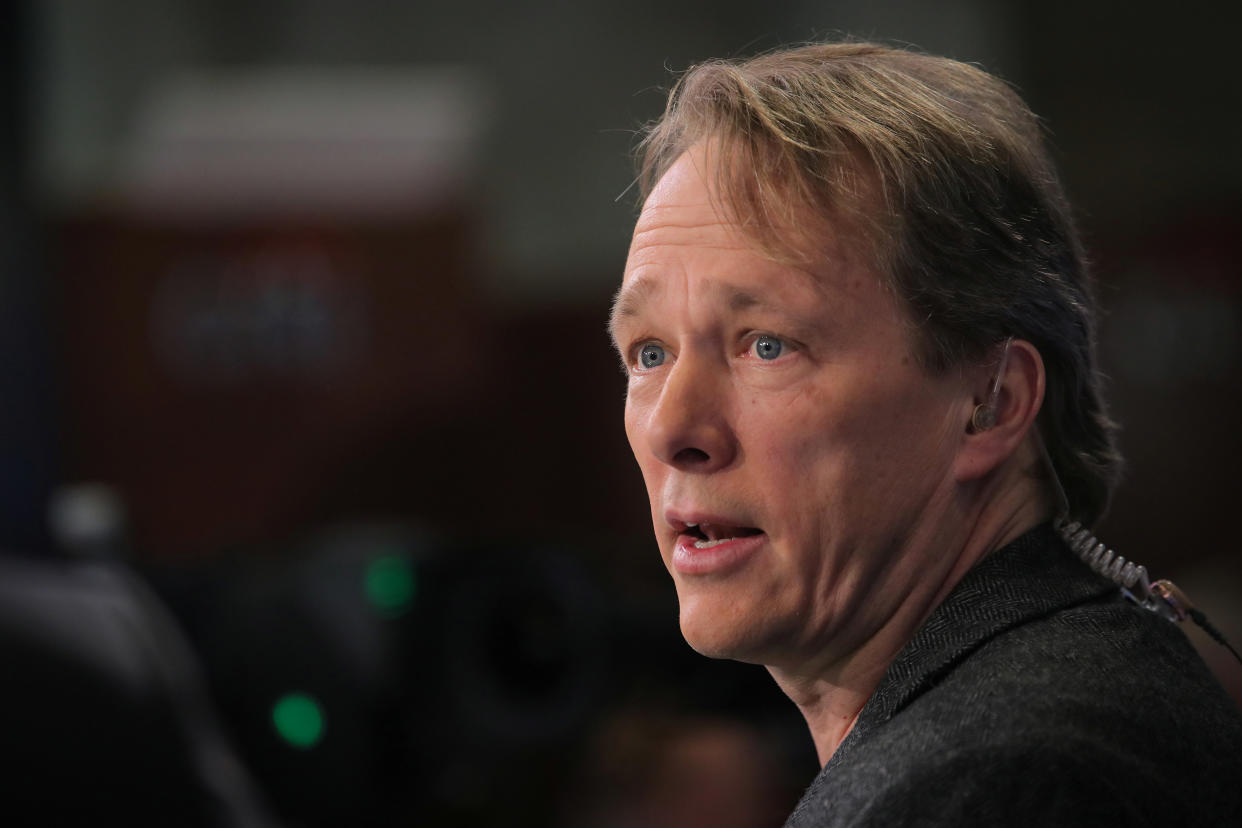

Bruce Linton fired again, this time by U.S. pot firm Vireo Health

Bruce Linton has been fired again, this time by the U.S. multi-state pot firm Vireo Health (VREO.CN).

The Minneapolis-based company said it has “elected to terminate its employment agreement with Bruce Linton as executive chairman, on an entirely without-cause basis, effective immediately.”

Linton joined Vireo in November of 2019, months after he was ousted from his high-profile co-chief executive officer role at Canopy Growth in July.

“I like the company and pushed it hard, obviously a little too hard for everyone’s enjoyment,” Linton said on Monday. “I’m not everyone’s favourite flavour. If I invest and bring people’s money along I’m a pretty demanding guy.”

"We wish Bruce well in his future endeavours," said Kyle Kingsley, chief executive officer and founder of Vireo.

Vireo said it does not expect to fill the executive chair role at this time. Linton’s term on the company’s board was set to expire at its July 15 Annual General Meeting of shareholders. His incentive stock warrants in Vireo will now vest with a modified expiration date of June 8, 2021, the company added.

According to regulatory filings, Linton’s holdings in Vireo include 1.7 million shares, and 1.7 million warrants with an exercise price of $0.96. According to a news release announcing Linton’s role on the board, the former Canopy (WEED.TO)(CGC) co-chief executive officer’s compensation included up to 15 million subordinate voting shares in Vireo. The shares were to be awarded in three tranches set to expire in 2024 with strike prices of $1.02, $3.81 and $5.86.

Vireo shares listed on the Canadian Securities Exchange closed at $0.91 on Monday. The company is scheduled to report its latest quarterly results on June 16.

Vireo reported a net loss of US$37 million in the three months ended Dec. 31, and incurred non-cash charges of roughly $28 million “to reflect changing market valuations.”

Vireo’s decision to narrow its focus to six core U.S. markets led to a write-down of non-core assets acquired in early 2019, when “global cannabis stocks were approaching all-time highs and valuation methodologies within the sector were predominantly tied to revenue growth expectations rather than cash flow or profitability metrics,” the company said.

Linton led Canopy through years of aggressive growth during his time at the Smiths, Falls Ont.-based pot giant. Since taking control in January, new CEO David Klein has swiftly dismantled large pieces of the company’s footprint and eliminated hundreds of jobs in a bid to achieve profitability and address changing market conditions.

"As we all know, Canopy grew quickly to achieve a leading position in a rapidly expanding industry,” said David Klein, chief executive officer of Canopy Growth, during an analyst call. "In that time period, being first was clearly rewarded. But being first isn't a sustainable strategy or a point of differentiation, nor is it necessarily tied to creating value."

With a file from Yahoo Finance senior writer and YFi PM host Zack Guzman.

Jeff Lagerquist is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jefflagerquist.

Download the Yahoo Finance app, available for Apple and Android.