A Broad Market Alternative to S&P 500 ETFs

There are broad market exchange traded fund alternatives to the S&P 500 and in good news for frugal investors, some of those ETFs can be accessed at rock bottom prices.

Consider the case of the popular Vanguard Total Market ETF (VTI) . With annual fees of just 0.05%, VTI is cheaper than 95% of ETF’s with comparable holdings, according to Vanguard. Frankly, VTI is one of the cheapest ETFs around. Period.

With over $37.9 billion in assets under management, VTI also ranks as the seventh-largest U.S.-listed ETF. VTI and related total market ETFs represent compelling alternatives to the cap-weighted S&P 500 “because a total-market index holds more small and midsize companies, and over the long term those stocks have performed better than big-company stocks. Over the past 15 years, including so far in 2013, the Wilshire 5000 Total Market index, the best-known of the broad-market indexes, has beaten the S&P 500 11 times,” reports Kaitlin Pitsker for Kiplinger’s Personal Finance.

Year-to-date, VTI has slightly outpaced its S&P 500 rival, the Vanguard S&P 500 (VOO) . Over the past three years, the difference if 50 basis points in the favor of VTI. [Build a Diversified Portfolio With Six ETFs]

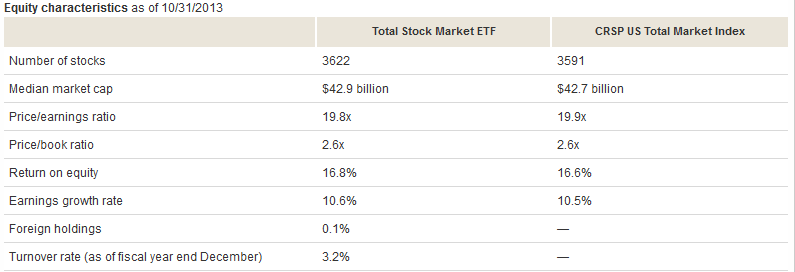

VTI lives up to its billing as a broad market fund with 3,622 holdings. The top-10 include Apple (AAPL), Exxon Mobil (XOM), Google (GOOG) an Wells Fargo (WFC). VTI’s top-10 holdings represented 14.5% of the fund’s total weight.

Six sectors – financial services, technology, consumer services, and industrials, health care, consumer services and consumer goods – receive double-digit weights in the fund.

Earlier this year, Forbes rated ETFs based on a measure of cost-efficiency that considers expense ratios, securities lending revenue and trading spreads and VTI was one of the magazine’s top choices. [Forbes Flags Favorite ETFs]

VTI Vitals

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.