Britons face £130k shortfall in retirement to cover care costs

Diligent savers who pay into their pension are at risk of retiring with a pot that is £130,000 short of what is needed to pay for care in later life.

The average care home stay lasts two and a half years, costing £86,710 for residential care or £118,170 for nursing care, according to figures provided by Laing Buisson, a health data provider.

However, the average earner will have squirrelled away nowhere near enough into their pension to cover these enormous costs.

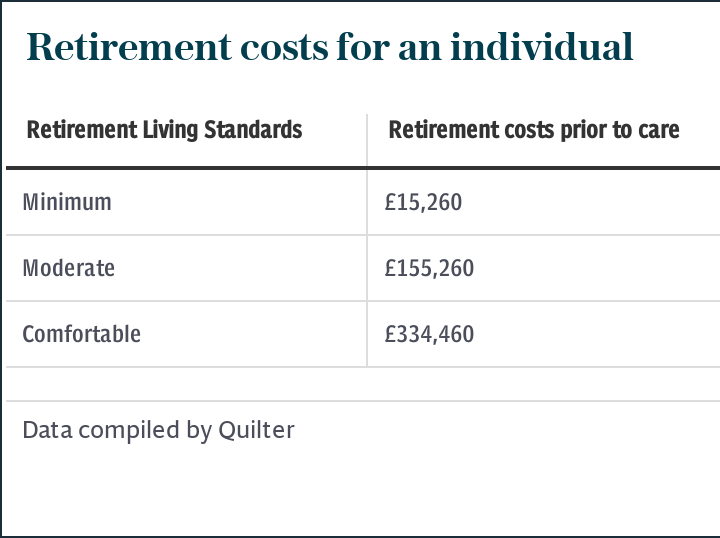

Figures compiled for Telegraph Money by investment firm Quilter show that you need pension savings of £241,970 or £273,420 to cover the costs of retirement plus the average stay for residential care or nursing care, respectively, assuming a life expectancy of 81.

These pot sizes would be enough to cover “moderate” living standards, as set out by the Pensions and Lifetime Savings Association, a trade body. This level of lifestyle, costing about £20,200 a year in income, would allow the retiree to go on holiday in Europe for two weeks a year and eat out a few times a month.

But an average British earner on a salary of £30,420 a year, saving in a pension at the auto-enrolment minimum for 30 years, risks falling more than £100,000 short of the PLSA’s “moderate” retirement income, according to analysis by fund shop A J Bell. That is before accounting for the added cost of care in later life.

To live a “comfortable” lifestyle requires an income of £33,000, according to the PLSA. This would provide enough to go on holiday in Europe for three weeks a year, as well as eat out and go to the theatre regularly.

To live comfortably and cover the costs of care, you would need to have saved a pot worth £421,170 to cover the cost of residential care, or £452,630 for nursing care, Quilter estimated.

Even someone earning £50,000 a year is likely to fall well short of a “comfortable” retirement unless they take action and save more than 8pc.

Olivia Kennedy, of Quilter, said despite most people’s inability to cover the costs of care, it is highly unlikely that any social care system put in place by the Government will offer free care to all.

This means that the burden will fall on loved ones if savers fail to prepare properly.

Each year, around 20,000 people are forced to sell their home in order to cover their care costs, research by Independent Age, a charity, has shown.

The trend has continued in spite of a pledge from Boris Johnson, the Prime Minister, last year that no one would have to sell their home to pay for care.

Tom Selby, of A J Bell, warned that millions of savers risked sleepwalking into retirement disappointment as many were unaware they were currently failing to save enough.

Those earning £30,000 a year and saving into their pension for 30 years at the minimum set out by the automatic enrolment rules – introduced in 2012 to solve the savings crisis – could build up a pot worth about £140,000.

But if the state pension provided £9,000 a year, then their private pensions would need to provide £11,000 to enjoy the “moderate” retirement income of £20,000 plus additional nursing care costs – requiring a pot of £273,420.

Mr Selby said: “Automatic enrolment has been hugely successful in boosting how many are saving for retirement.

“However, the danger is people will think simply paying in at the minimum is enough, when anyone wanting a ‘moderate’ or ‘comfortable’ retirement will almost certainly need to take responsibility and save over and above the auto-enrolment minimum to achieve their goal.”

To create a pension worth £115,000 above your auto-enrolment pot, you would need to make personal contributions of £1,600 a year, which would be topped up by £2,000 a year by pension tax relief.

On a monthly basis, that means you would need to save about £133 extra a month.

A report earlier this year by legal firm Irwin Mitchell and the Centre for Economics and Business Research consultancy urged workers to put hundreds of pounds more into their pensions each month in order to be able to meet the cost of care in their later years.

It found that only about the top 10pc of retired households by income could afford to pay for nursing care from their income.

Josie Dent, of Cebr, said: “With the cost of care set to rise, many more elderly people will find themselves using up their wealth or turning to local authorities for support in the future.”

The average weekly fees of for-profit nursing care have jumped 104pc in the past 22 years, from £465 a week in 1998 to £909 today.

Similarly, the weekly cost of residential care has risen 74pc to £667 a week, far outstripping inflation, according to figures from Laing Buisson.

This means there is already a funding shortfall, which is expected to increase to £1.5bn for 2020-21, according to the Irwin Mitchell report. This shortfall is forecast to rise to £3.5bn in just five years’ time.