British media group Perform invests $1 billion to stream boxing in America

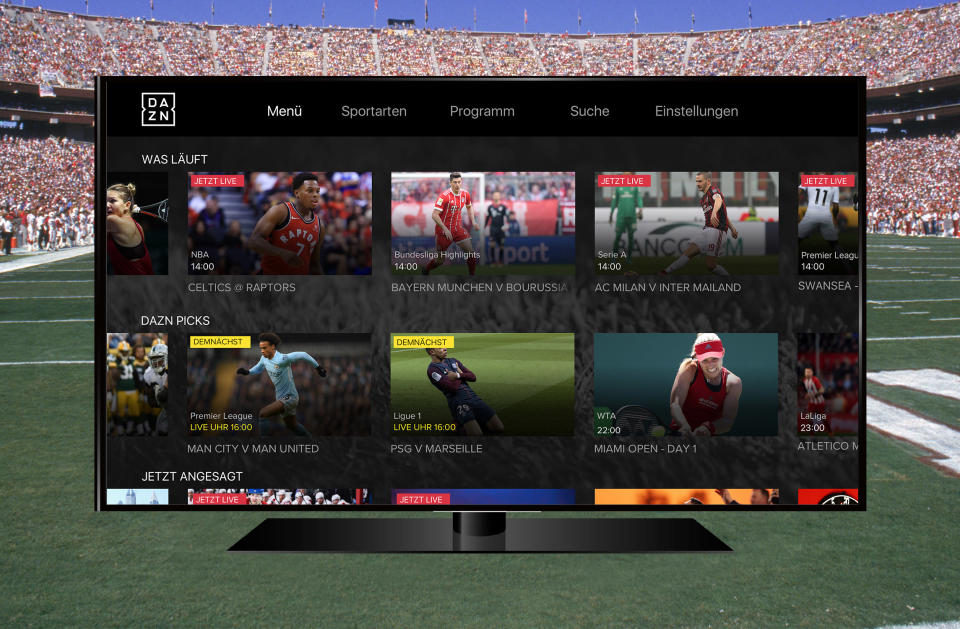

American sports fans are about to become a lot more familiar with Perform Group, the privately-held British media company that operates a sports streaming platform, DAZN, in Germany, Canada, Japan, and other markets outside the U.S. Perform has quietly been using its digital media holdings (especially Goal.com and Sporting News) as marketing vehicles for DAZN subscriptions.

On Thursday, Perform announced it has invested $1 billion in British boxing promoter Eddie Hearn’s company Matchroom Boxing; the eight-year deal will bring 16 fights per year to America, all shown exclusively on DAZN (pronounced “Da Zone”) for subscribers.

This will be DAZN’s first entry in the U.S., launching later this summer. Outside the US, DAZN has been called the “Netflix of sports.”

Perform also announced it has hired former ESPN President John Skipper as its executive chairman, a move that now makes sense in light of the U.S. launch plans.

Streaming boxing in America

“We’re going to do 16 shows [per year] in the U.S., all the major cities in the U.S., and we want to do big fights,” Perform Group CEO Simon Denyer tells Yahoo Finance in an exclusive interview. “Big fights that might typically have been on Pay-Per-View costing 70 to 80 bucks, we’re going to take them all off Pay-Per-View, we’re going to put them all on DAZN, one monthly fee, affordable price.”

In Canada, DAZN charges $20 per month. Perform declines to share DAZN’s U.S. pricing yet.

DAZN has grown quickly in markets like Canada, where it streams NFL games, Germany, where soccer is king, and Japan, where MLB is its most popular offering. Boxing may not be the most obvious sport to start with for an American launch, and DAZN will be competing with HBO and Showtime in the boxing broadcast business.

Denyer explains the thinking this way: “We look at a market and go, What is there that’s undervalued? There’s no point in just competing for stuff that’s overvalued. If you look at the UK, boxing has had a huge comeback… Boxing in the U.S. is now behind the UK. The shows aren’t good enough, there aren’t enough of them, the Pay-Per-View is too expensive. It’s kind of eaten itself alive and the whole thing needs revitalizing.”

Eddie Hearn is one of the biggest boxing promoters in the UK, and the joint venture with Perform will create Matchroom Boxing USA, which will seek to lure American boxers to sign with Matchroom. Perform, in a press release, touts that the deal, “will change boxing categorically.”

Denyer says that by summer, Perform will announce additional sports that will be available on DAZN in time for its US launch.

Competing with Amazon, Google, and ESPN

To be sure, the U.S. sports streaming market is extremely crowded. Amazon, Facebook, Twitter, and YouTube TV have all paid for streaming rights, and then there’s AT&T DirecTV Now, Sling TV, Sony PlayStation Vue, and Hulu with Live TV.

ESPN also just launched its own OTT product ESPN Plus, which is additive to what’s on ESPN’s cable network but includes the entire library of 30 For 30 films. On the Walt Disney Co.’s earnings call this week, Disney CEO Bob Iger said of the company’s first-ever direct-to-consumer offering, “We are not going to give specifics on ESPN+ except to say: so far, so good. The technology is working, the user interface is good, the fan reaction has been strong.”

In other words, DAZN faces a number of much bigger competitors in streaming live sports in America, including the “worldwide leader” in sports. But at least with taking on ESPN, the company has a key new hire: John Skipper.

“We’re 10 years old, but we’ve only ever done digital,” says Denyer. “We’ve never been a sports broadcaster, and somehow we’ve ended up becoming one of the biggest sports broadcasters in the world. So it’s a good idea to hire someone who’s done it before… We need him. We are a British company, but the U.S. is going to be our biggest-ever market, we need to have a lot more experience and knowledge from the U.S.”

—

Daniel Roberts is the sports business writer at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

ESPN’s new streaming service is aimed at a very specific sports fan

How MLB’s video arm got so big that Disney had to buy it

Amazon Prime, YouTube TV are in a sports streaming race

How British owners turned America’s oldest sports newspaper upside down