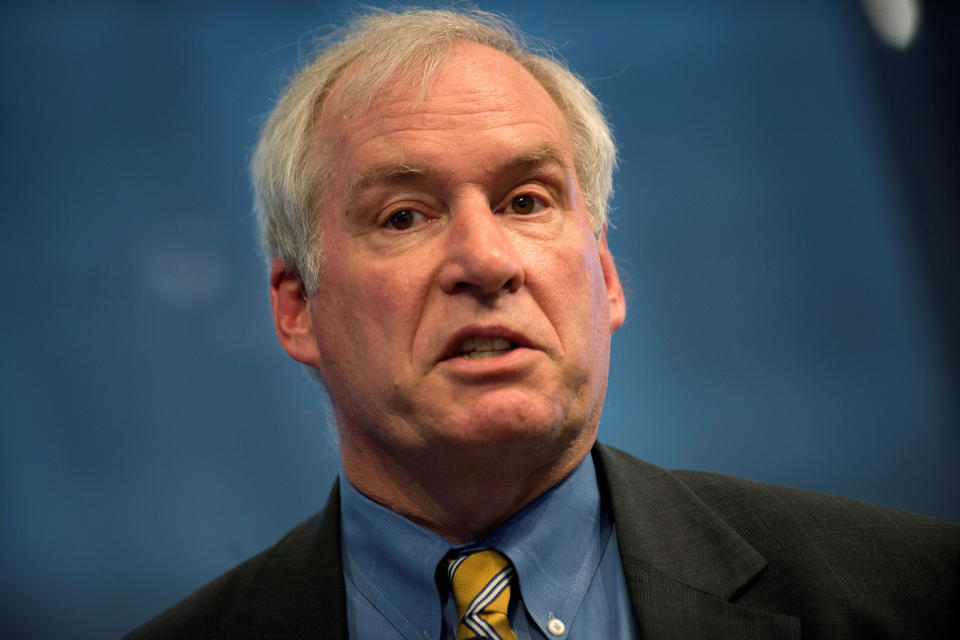

Boston Fed's Rosengren: 'We don't need to do very much at all' on interest rates

Boston Fed President Eric Rosengren says he does not see a need for the central bank to move on rates given the “relatively positive” outlook for the U.S. economy. But Rosengren cautioned that accommodative policy could squeeze the labor market to the point of “rapid” inflation.

"Overall the outlook is good and it's basically a soft landing, which means we don't need to do very much at all on interest rates,” Rosengren told Yahoo Finance on the sidelines of a Connecticut business conference on Monday morning.

In a speech in Hartford on Monday, Rosengren said he expects a tighter labor market and a pick-up in inflation over the course of 2020, an “almost ideal” outcome that would grow U.S. GDP at or above its potential.

But Rosengren said the U.S. economy could accelerate “faster than expected” as a result of the central bank’s three rate cuts in 2019. Rosengren, who opposed all three of those rate cuts, said he worries about price pressures building up as a result of “currently accommodative” monetary policy.

“I don’t think there’s much slack in the labor market, to be honest,” Rosengren told Yahoo Finance.

‘Substantial wage growth is a good thing’

Inflation, as measured by core personal consumption expenditures, came in at about 1.6% for the month of November, well below the Federal Reserve’s 2% target. Wage pressures have eased as of late, with the most recent reading of year-over-year average hourly earnings rising by 2.9% in the month of December. Wage gains peaked in 2019 at about 3.4%, in February.

Rosengren said he still sees wage gains trending up over the last couple of years, saying the December jobs report was a “little bit of an anomaly.”

The head of the Boston Fed added that there have been “relatively few cases” in Fed history where interest rates and the unemployment rate (currently at a 50-year low of 3.5%) have been below policymakers’ estimates of where they should be in the long-run.

As a result, Rosengren worries that letting the economy run hot could create competition for workers that bids wages up, which ultimately could push producers to raise prices on goods and services. He clarified that while rising inflation is a risk to the economy, it is not his expectation at the moment that inflation rises substantially.

Rosengren also acknowledged that “sustainable wage growth is a good thing,” but added that the U.S. economy does not have the levels of productivity to allow higher wage growth without some costs being passed onto consumers.

Trade and geopolitical concerns

Rosengren says he sees the U.S. economy as “doing quite well,” adding that he still expects inflation to return to its 2% target. His forecast for GDP growth in 2020 is around 2%.

He added that while headwinds from the U.S.-China trade war have “moderated” over the last six months, but cautioned that the Phase One trade deal is only a partial agreement that has not removed all standing tariffs.

“I don’t think we’re out of the woods in terms of some of the trade concerns,” Rosengren told Yahoo Finance in an exclusive broadcast interview, pointing to continued trade tensions between the U.S. and Europe, as well.

On U.S.-Iran relations, Rosengren said it is “unlikely” that geopolitical concerns in the Middle East derail U.S. economic growth.

Rosengren notably dissented from the Federal Open Market Committee’s decisions last July, September, and October to cut interest rates. He shrugged off trade concerns and said he saw the economy as “pretty close” to the Fed’s dual mandate of maximum employment and stable prices.

He instead expressed concern that unnecessary rate cuts could create leverage in the financial system as a result of cheaper money.

In his speech Monday, Rosengren reiterated that cheaper money could be making way for “relatively high valuations” in commercial real estate properties.

“That is an area that we should continue to watch to make sure that the accommodative monetary policy that we have right now doesn’t start causing imbalances in the economy that become a problem,” he told Yahoo Finance.

Rosengren was a voting member of last year’s Federal Open Market Committee, which sets interest rate policy. As is protocol, new reserve bank presidents have rotated into this year’s FOMC. Rosengren will be able to participate in FOMC meetings but will note vote on actual policy decisions for 2020.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

5 major themes from this year's largest gathering of economists

America's economy needs to pull more workers into the labor force: Fed officials

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.