Bonds aren't following the bull market script

With equity markets (SPY) at all-time highs, investors are searching for any signal that could give them an advance warning to pull the rip cord. Even in the face of a paralyzed Washington, traders have stepped in to buy each and every dip.

Tax reform and other market friendly initiatives have largely fallen off the radar for 2017. Perhaps a corporate tax rate cut could make its way to the floor, but I see little consensus on either side of the aisle.

Bonds aren’t following the script

With a strong earnings season in the rear view and most economic indicators in the green, bonds are clearly not following the bull market script.

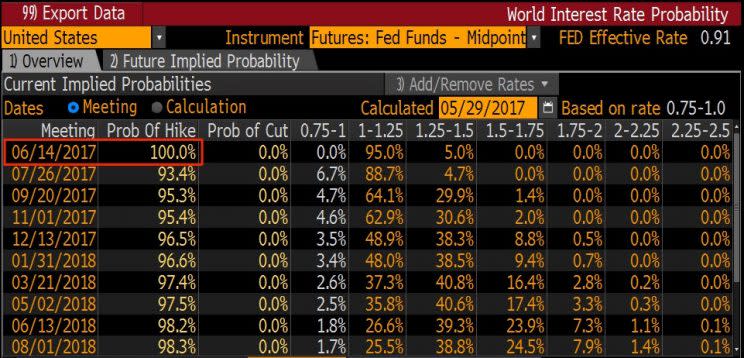

Even after strong signals from the FOMC minutes that a June hike is on the table and the unwind of a $4.5 trillion balance sheet would start by year’s end, 10-year yields drifted lower, indicating strong demand.

Economists believe June rate hike is a lock

With the short end of the curve moving higher and the long end flat to down, talk of an inverted yield curve started flying across trading desks. An inverted yield curve where short rates are higher than long rates often signals an approaching recession.

With little confirmation of the above, I believe the explanation lies elsewhere. For fixed-income players in sovereign markets, the United States is still a destination of choice. Strong demand for US Treasurys is nothing new when faced with some of the alternatives.

International yield curves

Today substantial portions of European and Japanese interest rate curves are still less than zero, with all maturities well below what’s available here.

In the face of this dynamic, the US dollar remains weak, well off highs after the election bump. This becomes an added cost as many offshore investors are forced to hedge their currency risk. To date, there seem to be few alternatives—unless you enjoy paying to have your funds held in a less-than-zero world.

History will be the judge of those willing to park funds in debt offering negative yields. The conventional wisdom that bond investors are smarter than stock investors is truly being put to the test.

*At the time of this article some funds managed by David Nelson were long SPY.

————————————————-

Please contact your Belpointe investment advisor representative if there are any changes in your financial situation or investment objectives.

Investment advice is offered through Belpointe Asset Management, LLC. Past performance is no guarantee of future returns. Insurance products are offered through Belpointe Insurance, LLC and Belpointe Specialty Insurance, LLC. It is important to read our email disclosures available at this link: http://belpointe.com/disclosures.