The Ticket

The TicketHousing policy enters presidential race as candidates tour Florida, Nevada

Although the housing crisis has hurt many Americans across the country for much of the past decade, voters who have thus far participated in the 2012 Republican primary hail from states where housing is relatively secure.

That all changes this week as voters from Florida and Nevada cast ballots in the presidential race. The foreclosure rates in Florida and Nevada are significantly higher than the national average.

Florida's foreclosure rate for December 2011 was 1 in 360 housing units, according to RealtyTrac, while Nevada's stood at 1 in 177 units. For the fifth consecutive year, Nevada has the highest foreclosure rate in the country—6 percent of of the state's housing units—according to RealtyTrac.

The presidential candidates are acutely aware of the significance of the housing crisis in Florida, where Republicans vote today, and in Nevada, which holds its caucuses on Saturday. But no candidate has offered an extensive plan to remedy the housing crisis. Instead, much of the talk on the trail these days has focused on the back and forth between Romney and Gingrich, who are accusing one another of profiting off their connections to the mortgage giants Fannie Mae and Freddie Mac.

Here's what we do know about the candidates' proposals for housing policy:

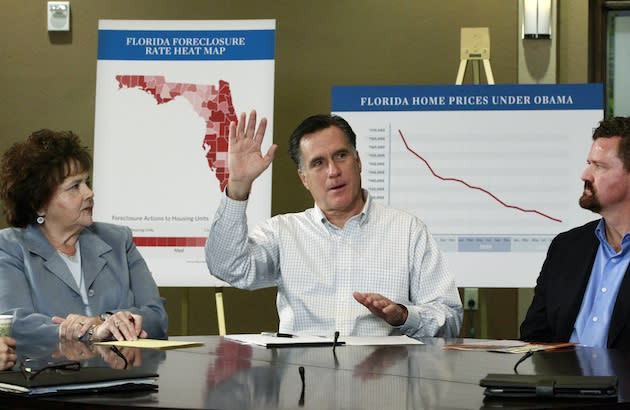

Mitt Romney: Romney led a roundtable discussion on housing and foreclosures in Tampa, Fla., on Jan. 23 in which he said that lending institutions need to take a role in fixing the crisis. Overall, Romney advocates a private-sector approach to solving the housing crisis, saying that past federal efforts to encourage Americans to buy homes have been ineffective at boosting the market. At last Thursday's debate, Romney criticized Fannie and Freddie for continuing to offer mortgages to "people who can't possibly repay them."

"We're creating another housing bubble, which will hurt the American people," he said. He also criticizes Dodd-Frank, the financial regulatory overhaul signed by Barack Obama, saying the legislation is a source of burdensome regulation for the banking industry, which in turn affects mortgage lending.

Romney's current proposals somewhat contrast with the position he advocated during his 2008 presidential campaign. Back then, he floated expanding the Federal Housing Administration's loan portfolio limits to allow for more lending opportunities.

Newt Gingrich: Gingrich said on the campaign trail Friday at the PGA Museum of Golf in Port St. Lucie, Fla., that one major action to take to restore the housing market is to repeal Dodd-Frank—which Gingrich argued "drives down" housing prices.

"Because the federal regulators are now that hostile and that destructive ... the repeal of Dodd-Frank will immediately improve most housing in America literally overnight," Gingrich said. He added that when the economy improves and Americans have more money in their pockets, they'll be able to buy and pay for their homes. "America only works if Americans are working, and that should be the number one domestic goal of this government."

Gingrich contends that the Federal Reserve's efforts to create low interest rates created the housing bubble—one of the many reasons he wishes to reform the Fed. Gingrich said at last Thursday's debate that he would break Fannie and Freddie each into "five or six separate units" and "over a five year period, I would wean them from all federal sponsorship."

Rick Santorum: Santorum touts a history of opposition to the two government-sponsored enterprises, and he claimed at last Thursday's debate to be one of several lawmakers who warned of the meltdown in 2006. He advocates a gradual drawdown of Fannie and Freddie's power.

"The reform we'd need is to gradually decrease the amount of mortgage that can be financed by Freddie--or underwritten by Freddie and Fannie over time, keep reducing that until we get rid of Fannie and Freddie," he said at the debate. In his tax plan, Santorum proposes eliminating the cap on deductions for losses incurred in a home sale as another way to benefit homeowners.

Ron Paul: Paul, who is skipping Florida's primary and focusing on Nevada's caucuses, said during last week's debate in Jacksonville, Fla., that he believes Fannie and Freddie "should have been auctioned off right after the crash came."

"It would have been cleansed by now," he said of the market.Paul believes Fannie and Freddie should be abolished and has long held the position that the entities distort the housing market. In 2003 he introduced a bill removing their government subsidies as well as those directed to the National Home Loan Bank Board. Paul opposes any government efforts to stimulate the housing market, because they help to maintain high housing prices instead of prompting the lower prices demanded by the market. Paul has opposed the Community Reinvestment Act.

Chris Moody contributed reporting for this story from Port St. Lucie, Fla.

Read more coverage of the 2012 Florida primary at Yahoo News.

Other popular Yahoo! News stories:

Want more of our best political stories? Visit The Ticket or connect with us on Facebook, follow us on Twitter, or add us on Tumblr.

Handy with a camera? Join our Election 2012 Flickr group to submit your photos of the campaign in action.