Black-owned small businesses continue to face harsh cash crunch

As small businesses around the country continue to work through financial pressures from the COVID-19 crisis, Black-owned businesses in particular face an even steeper road to recovery.

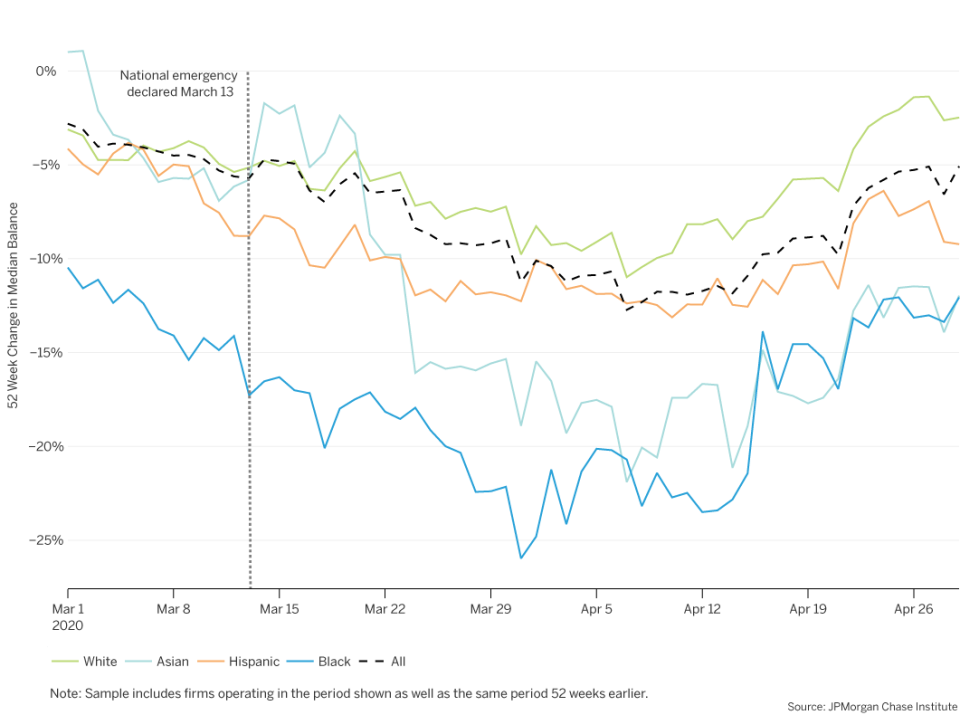

Research from the JPMorgan Chase Institute shows that cash balances at Black-owned firms took a dramatically harder hit in the depths of the crisis compared to the median small business.

By cross-checking race and ethnicity data from voter registration records, JPMorgan Chase found that among a subset about 95,000 small businesses in Florida, Georgia, and Louisiana, Black-owned businesses saw cash balances fall as steeply as 26% during the crisis. That figure, from late March, was far worse than the 12% decrease in the median overall small business seen during the same period.

The cash liquidity crunch highlights the challenges that Black businesses face in managing their finances.

“Many of our business owners, whether they are African-American or otherwise, have a passion for what they’ve done but don’t understand the intricacies of how to keep their businesses liquid and making the right decisions to help keep themselves afloat,” said Christopher Hollins, managing director of Chase Business Banking.

Hollins is leading a Chase initiative to work with four business advocacy groups (National Minority Supplier Development Council, US Black Chambers, National Urban League and Black Enterprise) to provide a crash course to Black entrepreneurs on navigating the coronavirus crisis.

The Advancing Black Entrepreneurs program will feature a series of virtual sessions with tips on managing cash flow, expenses, and inventory.

Hollins told Yahoo Finance that education will be critical to helping Black businesses stretch their finances, a difficult task when considering the JPMorgan Chase Institute’s finding that within 94% of Black neighborhoods, small businesses entered this crisis with cash reserves that would dry up in less than 14 days.

For comparison, only 35% of white communities had businesses with so low levels of cash.

Hollins says Chase’s initiative is designed to encourage businesses to develop relationships with banks and other sources of capital “before you actually need it.”

“Right now we’re trying to help businesses survive,” Hollins said.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

OECD adds risk of COVID-19 'double-hit' in bleak economic forecasts

Fed Chair Powell warns of economic fallout from a 'second outbreak'

Former CFPB head: SCOTUS decision allows consumer watchdog to 'go forward'

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.