Bill Nygren Gets Better Than Fair Value for a Stakes

- By David Goodloe

Bill Nygren (Trades, Portfolio) of Oakmark Fund sold more stakes in the first quarter a five a than he had in more than a year. In all but two of those transactions, he sold the shares for well in excess of their fair values.

Warning! GuruFocus has detected 5 Warning Signs with F. Click here to check it out.

The intrinsic value of AXP

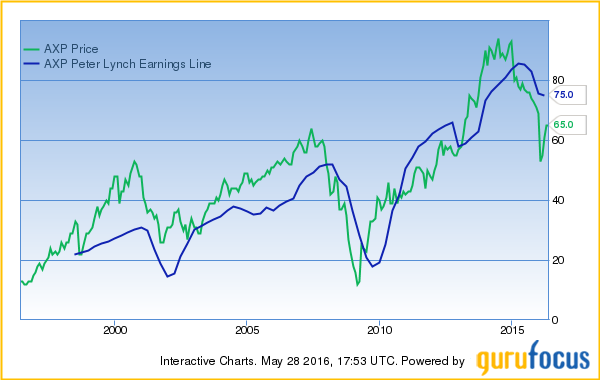

Nygrenas most noteworthy transaction in the first quarter was the sale of his 4.8 million-share stake in American Express Co. (AXP), a banking and financial services company based in New York City, for an average price of $58.34 per share. The divestiture had a -2.06% impact on Nygrenas portfolio.

American Expressa leading shareholder among the gurus is Warren Buffett (Trades, Portfolio) with a stake of 151,610,700 shares. The stake is 15.94% of American Expressa outstanding shares and 7.24% of Buffettas total assets.

American Express has a P/E of 13.1, a forward P/E of 11.7, a P/B of 3.1 and a P/S of 2. GuruFocus gives American Express a Financial Strength rating of 4/10 and a Profitability and Growth rating of 8/10.

American Express sold for $65.52 per share Friday. The DCF Calculator gives American Express a fair value of $61.17, which exceeds what Nygren received for the shares but currently results in a margin of safety of -7%.

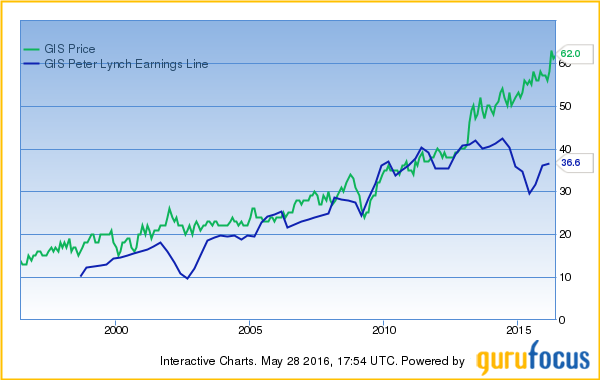

Nygren sold his 4,066,000-share stake in General Mills Inc. (GIS), a Golden Valley, Minnesota-based food processing company, for an average price of $58.04 per share. The divestiture had a -1.45% impact on Nygrenas portfolio.

General Millsa leading shareholder among the gurus is now Mairs and Power (Trades, Portfolio) with a stake of 3,273,319 shares. The stake is 0.55% of General Millsa outstanding shares and 2.95% of Mairs and Power (Trades, Portfolio)as total assets.

General Mills has a P/E of 25.7, a forward P/E of 20.8, a P/B of 7.6 and a P/S of 2.3. GuruFocus gives General Mills a Financial Strength rating of 7/10 and a Profitability and Growth rating of 8/10.

General Mills sold for $62.87 per share Friday. The DCF Calculator gives General Mills a fair value of $27.82 for a margin of safety of -126%.

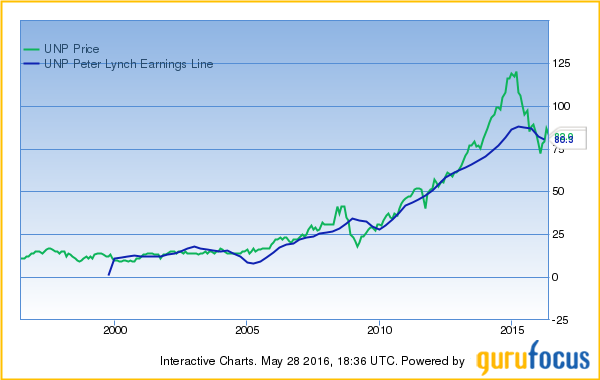

Nygren sold his 2,950,000-share stake in Union Pacific Corp. (UNP), the principal operating company of Omaha, Nebraska-based Union Pacific Railroad, for an average price of $77.26 per share. The divestiture had a -1.42% impact on Nygrenas portfolio.

Union Pacificas leading shareholder among the gurus is Dodge & Cox with a stake of 12,252,674 shares. The stake is 1.46% of Union Pacificas outstanding shares and 0.95% of Dodge & Coxas total assets.

Union Pacific has a P/E of 15.6, a forward P/E of 14.3, a P/B of 3.4 and a P/S of 3.4. GuruFocus gives Union Pacific a Financial Strength rating of 8/10 and a Profitability and Growth rating of 9/10.

Union Pacific sold for $82.97 per share Friday. The DCF Calculator gives Union Pacific a fair value of $152.31, resulting in a margin of safety of 46%.

The guru sold his 1.6 million-share stake in Ferrari NV (RACE), the Amsterdam-based automaker, for an average price of $40.38 per share. The divestiture had a -0.38% impact on Nygrenas portfolio.

Ferrarias leading shareholder among the gurus now Mohnish Pabrai (Trades, Portfolio) with a stake of 1,277,192 shares. The stake is 0.52% of Ferrarias outstanding shares and 15.39% of Pabraias total assets.

Ferrari has a P/E of 29.6, a forward P/E of 20.5, a P/B of 103.9 and a P/S of 2.5. GuruFocus gives Ferrari a Financial Strength rating of 7/10 and a Profitability and Growth rating of 4/10.

Ferrari sold for $41.98 per share Friday. The DCF Calculator gives Ferrari a fair value of $16.34, producing a margin of safety of -157%.

Nygren exited his position in Chesapeake Energy Corp. (CHK), a petroleum company based in Oklahoma City, with the sale of his 12 million-share stake for an average price of $3.52 per share. The divestiture had a -0.33% impact on Nygrenas portfolio.

Carl Icahn (Trades, Portfolio) is Chesapeakeas leading shareholder among the gurus with a stake of 73,050,000 shares. The stake is 10.67% of Chesapeakeas outstanding shares and 1.4% of Icahnas total assets.

Chesapeake has a forward P/E of 9 and a P/S of 0.2. GuruFocus gives Chesapeake a Financial Strength rating of 4/10 and a Profitability and Growth rating of 6/10.

Chesapeake sold for $4.16 per share Friday. The DCF Calculator gives Chesapeake a fair value of $-194.34.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with F. Click here to check it out.

The intrinsic value of AXP