Bill Ackman explains why he's not impressed by ADP's triple-digit return

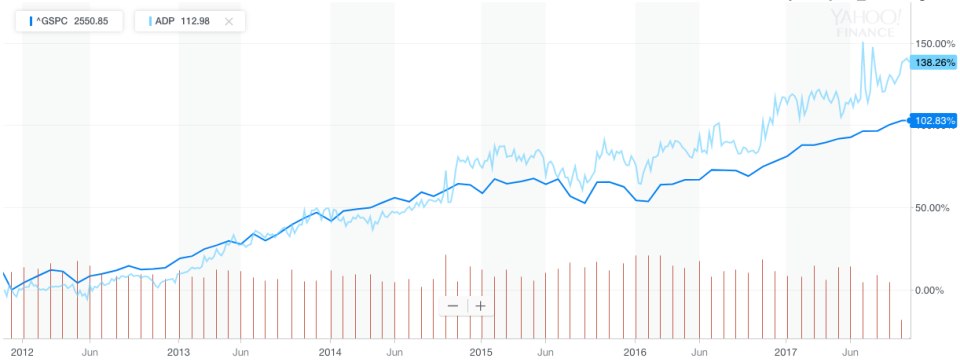

In recent years, Automatic Data Processing (ADP) shares have delivered triple-digit returns while also outperforming the S&P 500 (^GSPC).

But activist investor Bill Ackman isn’t impressed.

Ackman, the CEO of $11 billion Pershing Square Capital Management, is currently waging a proxy contest against ADP to get three new directors on the board, including himself. He believes this is a situation where the company is “vastly underperforming its potential.”

In a recent letter to shareholders, ADP pointed to its total shareholder return under CEO Carlos Rodriguez being north of 200%. Ackman argues that the return doesn’t fairly capture how poorly the company has performed under current CEO Carlos Rodriguez. Specifically, he contends that ADP overstated its total shareholder return during Rodriguez’s tenure as CEO by just over 60 percentage points.

“They say the stock is up 200% since he’s been CEO. The answer is it’s up 140%,” Ackman told Yahoo Finance. “And that sounds pretty good over the last six years until you compare it to the industry. And the company has underperformed the industry by about more than 25 percentage points over the same period.”

Ackman noted that while human capital management (HCM) industry stocks have outperformed as a whole, ADP has been lagging its peers.

“The way you benchmark a company — you don’t look at the absolute performance,” he said. “The absolute level of the performance has been good. You look at the potential.”

He added that ADP also used the high intraday 12 p.m. price of $111.65 on July 25, 2017, as the endpoint for the total shareholder return calculation. But Ackman and others would point out at least some of the recent gains were driven by news reports of Pershing Square’s purchases.

ADP’s stated return also includes CDK, which was spun out to shareholders under new management. Ackman argues “the proper way to [account for the CDK spinoff] is to consider that as a dividend and then have that money reinvested into [ADP].”

On top of all that, “the stock actually went down 4% the day he started,” Ackman said.

One thing that stood out to the Pershing Square team was how the company compares to Paychex (PAYX), a competitor in the human capital management (HCM) business.

“If you look at Paychex, over the last six years, Paychex has gotten more and more profitable and productive,” Ackman said. “Their margins are up to 41% versus ADP’s on a like for like basis — ADP’s core employer services business is at a 19% margin — so basically less than half a direct competitor for a big part of ADP’s business. And we said, ‘Wow, this doesn’t make lot of sense.’”

He also called ADP “one of the least efficient big companies.” That said, he sees an opportunity to run the business much more effectively and efficiently.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.