Biden launches tax war with GOP

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

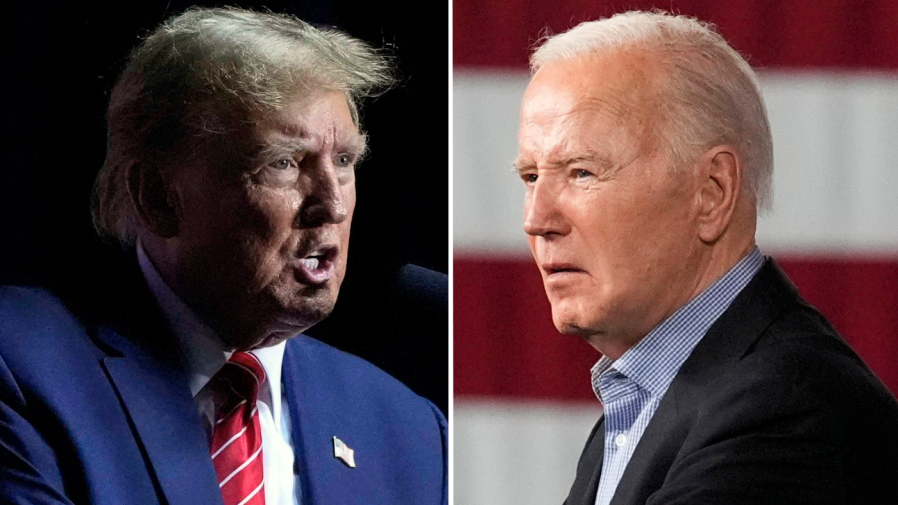

President Biden has launched a tax war with the Republican Party, proposing a slate of hikes on wealthy individuals and big businesses ahead of a likely rematch with former President Trump.

In an ambitious budget proposal released Monday, the president called for a wealth tax on individuals worth more than $100 million and restoring the corporate income tax rate closer to its pre-Trump level.

While Biden’s tax plans are dead on arrival in the GOP-controlled House, they draw a stark contrast between his agenda and the Republican quest to cement Trump-era tax cuts with a sweep in the upcoming election.

“There is no way these proposals can pass a divided Congress — especially in an election year,” wrote Brian Gardner, chief Washington policy strategist at Stifel Investment Bank, in an analysis.

Even so, Gardner added, “2025 will be the year of the tax debate regardless of which candidate wins the presidency since several provisions of the Jobs and Tax Cuts Act of 2017 expire next year.”

In his budget proposal, Biden called for a 25 percent minimum tax rate on “the wealthiest 0.01 percent” of Americans, as well as a restoration of the top income tax rate for Americans making more than $400,000 a year to 39.6 percent.

The president also proposed raising the corporate tax rate to 28 percent, emphasizing that this is “still well below the 35 percent rate that prevailed prior to the 2017 tax law.”

The corporate minimum alternative tax, which was first enacted as part of the Inflation Reduction Act (IRA) to target billion-dollar corporations who often manage to avoid paying their full tax bill, would also be raised from 15 percent to 21 percent under Biden’s budget proposal.

The Biden administration has floated similar tax increases on the wealthy in previous budgets, including in years when Democrats controlled Congress, but most of those proposals failed to make it into law.

Biden’s so-called billionaire minimum income tax and a plan to close the loophole on carried interest, which was nixed by then-Democratic Sen. Kyrsten Sinema (I-Ariz.), were two notable examples.

Administration officials described the president’s goals on tax policy as consistent from year to year. They told The Hill that the president’s budget proposals are not just about signaling and messaging, but that there is political reality behind them.

“The Inflation Reduction Act did include tax increases on people at the top and on corporations,” Michael Linden, former executive associate director at the White House Office of Management and Budget (OMB) and senior policy fellow at the Washington Center for Equitable Growth, said in an interview.

A 1 percent tax on corporate stock buybacks was included in the IRA, which the administration is now seeking to bump up to 4 percent. The IRA also had the 15-percent corporate alternative minimum tax, which current officials described as an “important step in the direction” of the current proposal seeking to bump it up to 21 percent.

The current budget once again seeks to reform taxation of investment income, increasing the rate to 37 percent for people with income above $1 million.

“Companies and very rich individuals — their taxation is not the same [as others’]. That’s one of the key things the Biden budget is seeking to address,” Bobby Kogan, another former Biden OMB official and now director of budget policy at the Center for American Progress, told The Hill.

However, the Republican chair of the House Ways and Means Committee, Rep. Jason Smith (R-Mo.), slammed the president’s new budget proposal as “the largest tax increase in the history of our country.”

“Almost $5 trillion in new taxes, and that’s not even counting his proposal that he wants all of the 2017 Trump tax cuts to expire, as well,” Smith told Newsmax on Monday.

“This is the wrong recipe for America,” he added. “I would love to have a revamped tax code that is simpler, flatter, and fair. That’s exactly what we’re going to strive for in 2025, when we’re seeing all these Trump tax cuts that are expiring, and hopefully, we’ll be able to move in that direction.”

The GOP-controlled House Budget Committee advanced its own budget resolution last week. Much like Biden’s budget proposal, the resolution won’t be signed into law, but it lays out Republicans’ blueprint for spending in the coming fiscal year.

On the tax front, conservatives are pushing for an extension of Trump’s 2017 law, which they argue enacted “pro-growth” policies that their latest budget resolution supports.

“We didn’t create inflation with [the] Tax Cut and Jobs Act, and we grew middle class wages,” Rep. Blake Moore (R-Utah) said during a markup of the GOP plan last week. “Quit calling it a tax benefit for the wealthy. It’s not. It grows our economy, so we have a fighting chance to be able to overcome our massive deficits and our ballooning debt.”

Trump, for his part, has called for a fresh round of tax cuts if he wins the presidency this year.

“You’re all getting the biggest tax cuts because we’re doing additional cuts and a brand-new Trump economic boom like you’ve never seen before,” the former president said at a South Carolina rally last month, according to Bloomberg.

After a dominant performance on Super Tuesday and former U.N. Ambassador Nikki Haley’s decision to drop out of the race, Trump appears likely to secure the GOP nomination and face Biden once again in November.

As the pair prepares for a rematch, they are each leaning into their own brand of populism.

Trump has embraced populist trade policies that have rankled the business community and broke from decades of GOP support for free trade.

But the former president’s support for lower corporate taxes and looser financial rules are pillars of Republican pro-business economic policy.

Biden, however, is taking a more aggressive stance against big businesses and the wealthy with his proposals and rhetoric.

“Folks at home, does anybody really think the tax code is fair?” Biden said in his State of the Union address on Thursday. “Do you really think the wealthy and big corporations need another $2 trillion tax break?”

Beyond his latest tax proposals, Biden has also sought to crack down on corporations that engage in price gouging and deceptive pricing, slamming them for raising prices to “pad their profits.”

“With all the uncertainty around the election, one clear-cut winner from this election will be populism because, whether it’s populism on the left, populism on the right, both are on the rise,” Stephen Myrow, managing partner at Beacon Policy Advisors, told The Hill.

Biden’s populist push comes as the president is attempting to reinvigorate his core base ahead of the general election, Myrow said.

“If you go back to his ‘Build Back Better’ agenda, a lot of that got left on the editing floor because they had to negotiate with Manchin and Sinema,” he said, referring to West Virginia Sen. Joe Manchin (D). “But I think it plays well with the base, the way he’s hammering on it.”

Rakeen Mabud, chief economist and managing director of policy and research at the left-leaning Groundwork Collaborative, noted that no matter how people describe Biden’s policies, he is laying out a “stark contrast between the two choices” facing America in a way that she finds “compelling.”

“What the president and the administration is really doing I think is tapping into a collective sense of ‘this economy isn’t working for us’ and pushing back and laying out his plans for addressing that,” Mabud said.

Updated at 8:53 a.m.

For the latest news, weather, sports, and streaming video, head to The Hill.