Best TSX Financial Dividend Paying Companies

The fortunes of financial services companies often follow that of the broader economy. These companies provide services ranging from consumer finance to investment banking. Downturns can hit financial services companies hard as net interest margins shrink and credit losses grow. However, in good times, they report steady profits and many pay attractive dividends. If you’re a long term investor, these high-dividend financial stocks can boost your monthly portfolio income.

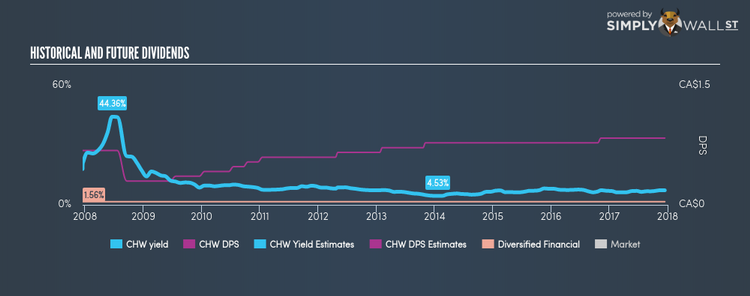

Chesswood Group Limited (TSX:CHW)

CHW has an alluring dividend yield of 7.33% and is currently distributing 87.59% of profits to shareholders . Over the past 10 years, CHW has increased its dividends from $0.684 to $0.84. To the enjoyment of shareholders, the company hasn’t missed a payment during this period.

MCAN Mortgage Corporation (TSX:MKP)

MKP has a juicy dividend yield of 8.28% and is paying out 75.43% of profits as dividends , with analysts expecting a 94.60% payout in the next three years. While there’s been some level of instability in the yield, MKP has overall increased DPS over a 10 year period from $1 to $1.48. MCAN Mortgage is also reasonably priced, with a PE ratio of 10.9 that compares favorably with the CA Mortgage average of 13.

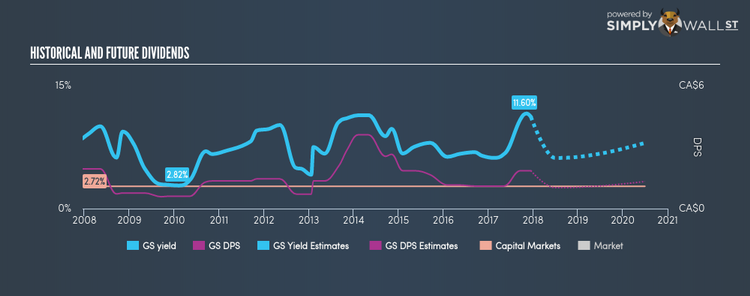

Gluskin Sheff + Associates Inc. (TSX:GS)

GS has a enticing dividend yield of 11.21% and is currently distributing 72.42% of profits to shareholders . With a yield above the savings rate, bank account beating investors will be happy, but perhaps even happier knowing that GS is in the top quartile of market payers.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.