Best Industrial Dividend Stocks In TSX

Industrial names generally suffer from deep cyclicality which can affect companies operating in areas ranging from machinery to aerospace to construction. Hence, considering economic volatility is of paramount importance when thinking about an industrials company’s profitability. This impacts cash flows which in turn determines the level of dividend payout. During times of growth, these industrial names could provide a strong boost to your portfolio income. If you’re a long term investor, these high-dividend industrials stocks can boost your monthly portfolio income.

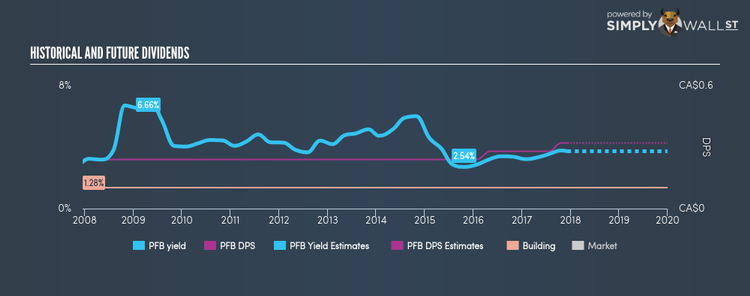

PFB Corporation (TSX:PFB)

PFB has a wholesome dividend yield of 3.50% and pays out 86.02% of its profit as dividends . The company’s DPS have increased from $0.24 to $0.32 over the last 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. The company also looks promising for it’s future growth, with analysts expecting an impressive doubling of earnings per share over the next year.

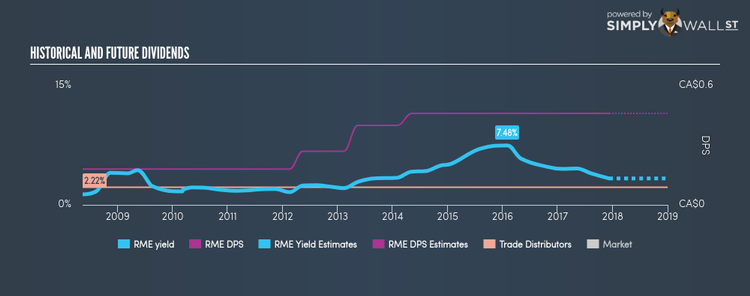

Rocky Mountain Dealerships Inc. (TSX:RME)

RME has a good-sized dividend yield of 3.32% and the company has a payout ratio of 45.92% . RME’s last dividend payment was $0.46, up from it’s payment 10 years ago of $0.18. It should comfort existing and potential future shareholders to know that RME hasn’t missed a payment during this time.

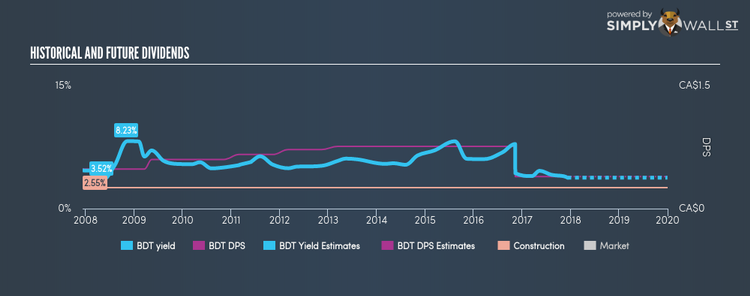

Bird Construction Inc. (TSX:BDT)

BDT has a nice dividend yield of 3.77% and has a payout ratio of 161.63% . Although shareholders may not be happy that the last payment of $0.39 was lower than its dividend payout of $0.4836 10 years ago, the company has consistently paid a dividend in this period. Over the next 12 months, analysts are predicting double digit earnings growth of 68.94%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.