Best Growth Stock Picks

High-growth stocks that are financially stable are attractive for many reasons. They provide a strong upside to your portfolio, with less likelihood of downside risks compared to less financially robust companies. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

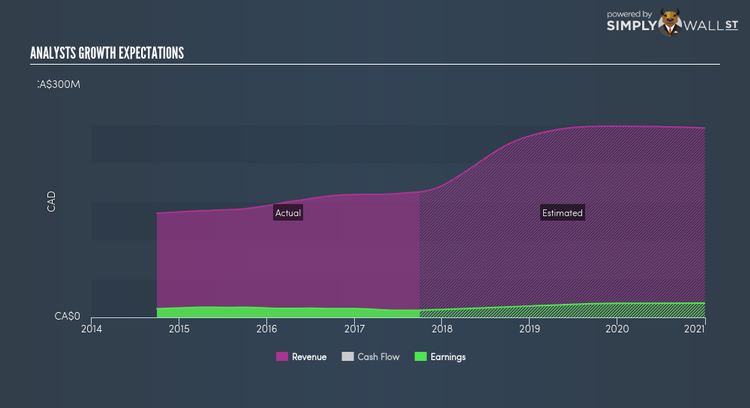

K-Bro Linen Inc. (TSX:KBL)

K-Bro Linen Inc., together with its subsidiaries, engages in the processing, management, and distribution of general linen and operating room linen to healthcare institutions, hotels, and other commercial accounts in Canada. Founded in 1954, and run by CEO Linda McCurdy, the company provides employment to 1,930 people and has a market cap of CAD CA$392.97M, putting it in the small-cap group.

KBL’s projected future profit growth is a robust 24.00%, with an underlying 50.51% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 8.52%. KBL’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Want to know more about KBL? Check out its fundamental factors here.

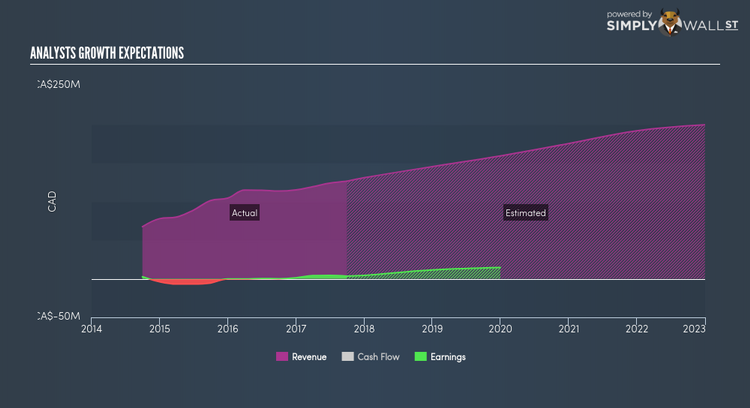

Pure Technologies Ltd. (TSX:PUR)

Pure Technologies Ltd. engages in the development and application of technologies for the inspection, monitoring, and management of physical infrastructure worldwide. Established in 1993, and now led by CEO John Elliott, the company now has 510 employees and has a market cap of CAD CA$496.10M, putting it in the small-cap stocks category.

PUR’s forecasted bottom line growth is an exceptional 67.85%, driven by the underlying double-digit sales growth of 23.29% over the next few years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. PUR’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Considering PUR as a potential investment? Check out its fundamental factors here.

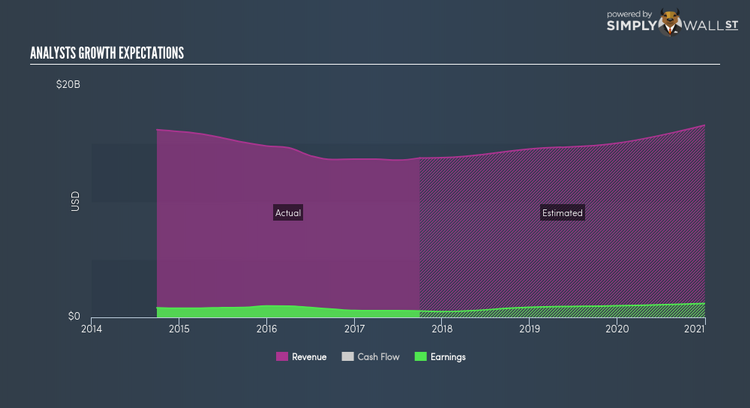

Agrium Inc. (TSX:AGU)

Agrium Inc. produces, markets, and distributes crop nutrients, crop protection products, seeds, and merchandise products primarily in the United States, Canada, Australia, and South America. Established in 1931, and currently headed by CEO Charles Magro, the company provides employment to 15,200 people and with the market cap of CAD CA$19.98B, it falls under the large-cap stocks category.

AGU’s projected future profit growth is a robust 28.20%, with an underlying 8.33% growth from its revenues expected over the upcoming years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 12.80%. AGU’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Want to know more about AGU? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.