Best Growth Stock in January

Companies that have significant growth prospects for profitability and returns can add tangible upside to your portfolio. Dynacor Gold Mines and Pason Systems are examples of many potential outperformers that analysts are bullish on. If a buoyant growth prospect is what you’re after in your next investment, I’ve put together a list of high-growth stocks you may be interested in, based on the latest financial data from each company.

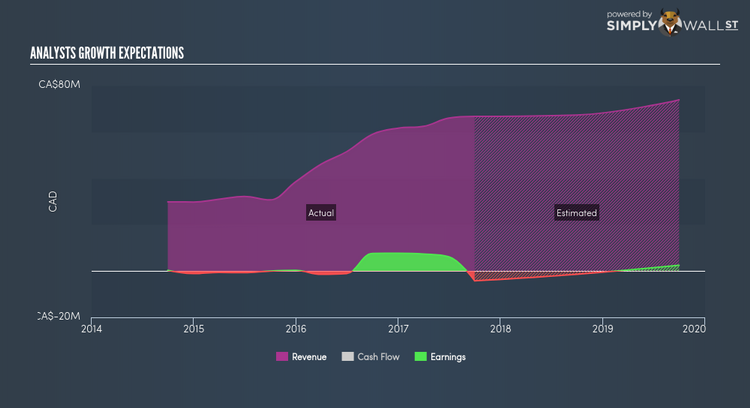

Dynacor Gold Mines Inc. (TSX:DNG)

Dynacor Gold Mines Inc., through its subsidiaries, engages in processing, exploration, and development of mineral properties in Peru. Established in 1996, and currently lead by Jean Martineau, the company currently employs 348 people and with the company’s market cap sitting at CAD CA$74.91M, it falls under the small-cap category.

Could this stock be your next pick? I recommend researching its fundamentals here.

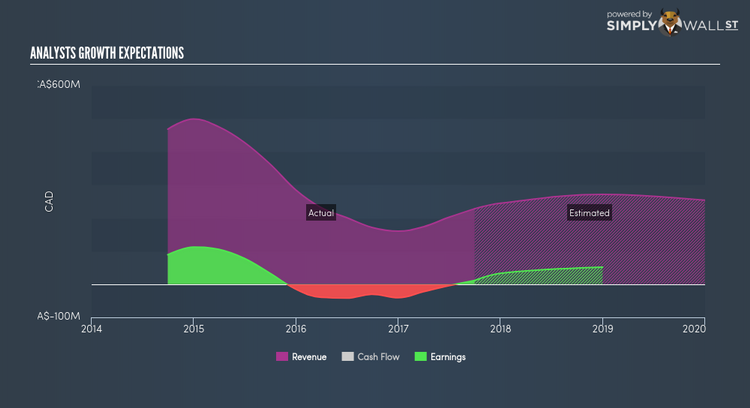

Pason Systems Inc. (TSX:PSI)

Pason Systems Inc. provides specialized data management systems for drilling rigs worldwide. Started in 1978, and currently headed by CEO Marcel Kessler, the company now has 550 employees and with the company’s market capitalisation at CAD CA$1.63B, we can put it in the small-cap category.

PSI is expected to deliver an extremely high earnings growth over the next couple of years of 83.29%, driven by a positive revenue growth of 13.20% and cost-cutting initiatives. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of PSI, it does not appear too severe. PSI ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering PSI as a potential investment? Other fundamental factors you should also consider can be found here.

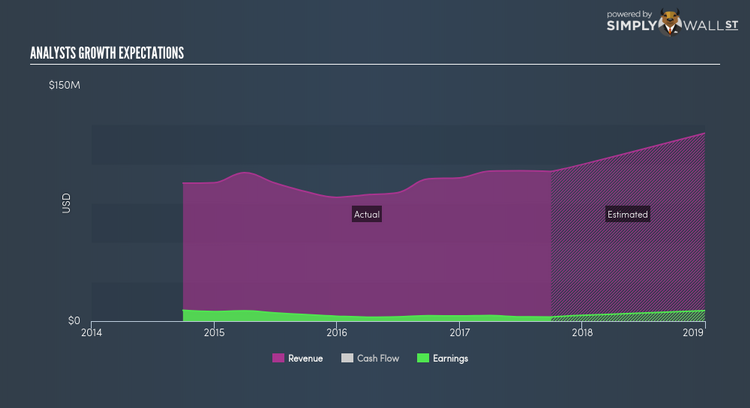

BSM Technologies Inc. (TSX:GPS)

BSM Technologies Inc. provides real-time GPS fleet and asset management solutions in Canada, the United States, and internationally. Started in 1996, and currently lead by Aly Rahemtulla, the company size now stands at 251 people and with the stock’s market cap sitting at CAD CA$110.68M, it comes under the small-cap stocks category.

An outstanding doubling of earnings is forecasted for GPS, driven by an underlying sales growth of 10.69% over the next few years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of GPS, it does not appear extreme. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 3.80%. GPS’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.