Best Dividend Stock Picks

Dividend-paying companies such as Artis Real Estate Investment Trust and Granite Real Estate Investment Trust can help grow your portfolio income through their sizeable dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. Here are other similar dividend stocks that could be valuable additions to your current holdings.

Artis Real Estate Investment Trust (TSX:AX.UN)

Artis is a diversified Canadian real estate investment trust investing in office, retail and industrial properties. Artis Real Estate Investment Trust was started in 2003 and has a market cap of CAD CA$2.12B, putting it in the mid-cap group.

AX.UN has a juicy dividend yield of 7.68% and is currently distributing 123.39% of profits to shareholders . The company’s dividends per share have risen from $1.05 to $1.08 over the last 10 years. Much to the delight of shareholders, the company has not missed a payment during this time. More on Artis Real Estate Investment Trust here.

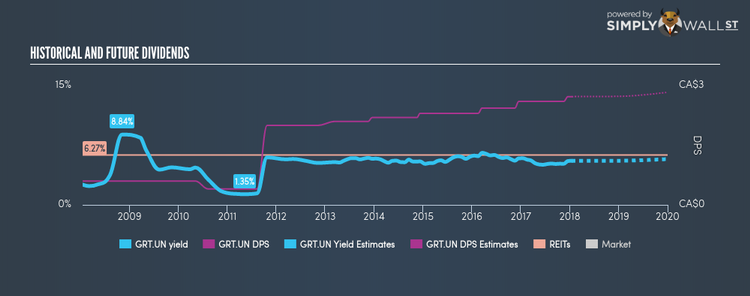

Granite Real Estate Investment Trust (TSX:GRT.UN)

Granite Real Estate Investment Trust owns and manages industrial, warehouse, and logistics properties in North America and Europe. Started in 1998, and now run by Michael Forsayeth, the company size now stands at 48 people and with the stock’s market cap sitting at CAD CA$2.30B, it comes under the mid-cap category.

GRT.UN has a sumptuous dividend yield of 5.54% and their current payout ratio is 78.66% . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from $0.6 to $2.72. Granite Real Estate Investment Trust has been a strong performer over the last five years, with the company averaging double digit earnings growth of 18.31% during this time. Dig deeper into Granite Real Estate Investment Trust here.

ATCO Ltd. (TSX:ACO.X)

ATCO Ltd. engages in structures and logistics, electricity, and pipelines and liquids businesses worldwide. Established in 1947, and currently lead by Nancy Southern, the company now has 6,751 employees and with the market cap of CAD CA$5.01B, it falls under the mid-cap stocks category.

ACO.X has a solid dividend yield of 3.44% and their current payout ratio is 49.81% . ACO.X’s DPS have risen to $1.51 from $0.47 over a 10 year period. The company has been a reliable payer too, not missing a payment during this time. More on ATCO here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.