Best Dividend Stock Picks

Mears Group is one of our top dividend-paying companies that can help boost the investment income in your portfolio. These stocks are a safe way to create wealth as their stable and constant yields generally hedge against economic uncertainty and deliver downside protection. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

Mears Group plc (LSE:MER)

Mears Group PLC, through its subsidiaries, provides a range of outsourced services to the public and private sectors in the United Kingdom. Started in 1996, and currently run by David Miles, the company now has 12,600 employees and with the company’s market capitalisation at GBP £397.07M, we can put it in the small-cap category.

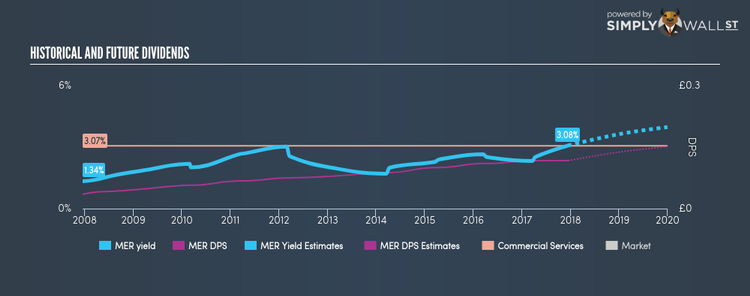

MER has a wholesome dividend yield of 3.08% and the company currently pays out 56.85% of its profits as dividends . In the last 10 years, shareholders would have been happy to see the company increase its dividend from £0.035 to £0.117. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. If analysts are correct, Mears Group has some strong future growth on the horizon with an expected increase in EPS of 57.3% over the next three years.

International Personal Finance Plc (LSE:IPF)

International Personal Finance plc provides home credit and digital loans under the Provident brand in Poland, Lithuania, the Czech Republic, Slovakia, Southern Europe, and Mexico. Started in 1997, and headed by CEO Gerard Ryan, the company size now stands at 7,584 people and with the stock’s market cap sitting at GBP £416.42M, it comes under the small-cap group.

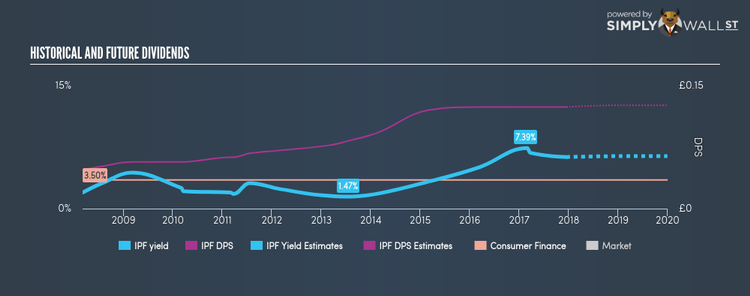

IPF has an appealing dividend yield of 6.29% and their payout ratio stands at 37.75% , with analysts expecting the payout ratio in three years to be 38.81%. Over the past 10 years, IPF has increased its dividends from £0.0475 to £0.124. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. International Personal Finance also reported a strong double digit earnings growth of 23.1% over the past 12 months.

SThree plc (LSE:STHR)

SThree plc provides recruitment services for science, technology, engineering, and mathematics industries primarily in the United Kingdom and Ireland, Continental Europe, the United States, and the Asia Pacific and the Middle East. Formed in 1986, and now run by Gary Elden, the company size now stands at 2,600 people and with the company’s market capitalisation at GBP £447.76M, we can put it in the small-cap stocks category.

STHR has a wholesome dividend yield of 3.97% and their current payout ratio is 56.05% . The company’s DPS have increased from £0.079 to £0.14 over the last 10 years. The company has been a dependable payer too, not missing a payment in this 10 year period.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.