Best ASX Undervalued Companies

Undervalued companies, such as Mayne Pharma Group and OPUS Group, are those that trade at a price below their actual values. Investors can determine how much a company is worth based on how much money they are expected to make in the future, or compared to the value of their peers. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them good investments if you believe the price should eventually reflect the stock’s actual value.

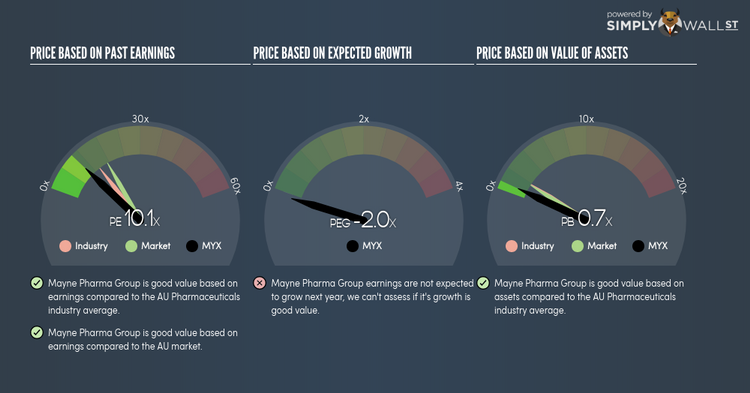

Mayne Pharma Group Limited (ASX:MYX)

Mayne Pharma Group Limited manufactures and sells branded and generic pharmaceutical products worldwide. The company size now stands at 789 people and with the market cap of AUD A$963.44M, it falls under the small-cap group.

MYX’s stock is currently trading at -36% below its true level of $0.98, at the market price of $0.63, according to my discounted cash flow model. The discrepancy signals an opportunity to buy low. Moreover, MYX’s PE ratio is trading at 10.1x against its its pharmaceuticals peer level of 13.8x, implying that relative to its peers, we can purchase MYX’s shares for cheaper. MYX is also in great financial shape, with short-term assets covering liabilities in the near future as well as in the long run. It’s debt-to-equity ratio of 26% has over the past couple of years demonstrating its capacity

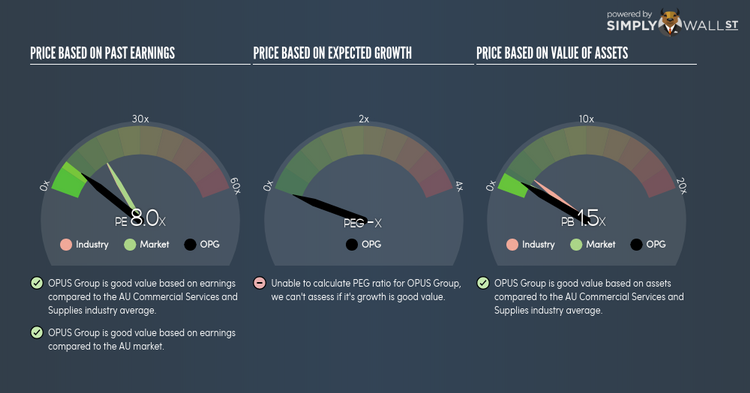

OPUS Group Limited (ASX:OPG)

OPUS Group Limited primarily provides printing and related services primarily in Australia and New Zealand. The company now has 304 employees and with the market cap of AUD A$50.62M, it falls under the small-cap group.

OPG’s shares are currently trading at -26% beneath its real value of $0.65, at the market price of $0.48, according to my discounted cash flow model. This discrepancy gives us a chance to invest in OPG at a discount. What’s even more appeal is that OPG’s PE ratio stands at 8x against its its commercial services peer level of 17.1x, meaning that relative to other stocks in the industry, we can purchase OPG’s shares for cheaper. OPG is also strong financially, with near-term assets able to cover upcoming and long-term liabilities. OPG also has a miniscule amount of debt on its balance sheet, which gives it headroom to grow and financial flexibility.

Whitehaven Coal Limited (ASX:WHC)

Whitehaven Coal Limited develops and operates coal mines in New South Wales. Started in 1999, and headed by CEO Paul Flynn, the company employs 1,500 people and has a market cap of AUD A$3.75B, putting it in the mid-cap stocks category.

WHC’s shares are now trading at -33% below its actual value of $5.68, at a price of $3.78, according to my discounted cash flow model. The divergence signals an opportunity to buy WHC shares at a low price. Additionally, WHC’s PE ratio is trading at around 9.2x while its oil and gas peer level trades at 11.6x, implying that relative to its comparable company group, you can buy WHC for a cheaper price. WHC is also strong financially, as current assets can cover liabilities in the near term and over the long run. It’s debt-to-equity ratio of 12% has been reducing over the past couple of years demonstrating WHC’s ability to pay down its debt.

For more financially sound, undervalued companies to add to your portfolio, you can use our free platform to explore our interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.