Here are the best and worst states to refinance

It is easier to refinance your home in some states than others, a new study shows.

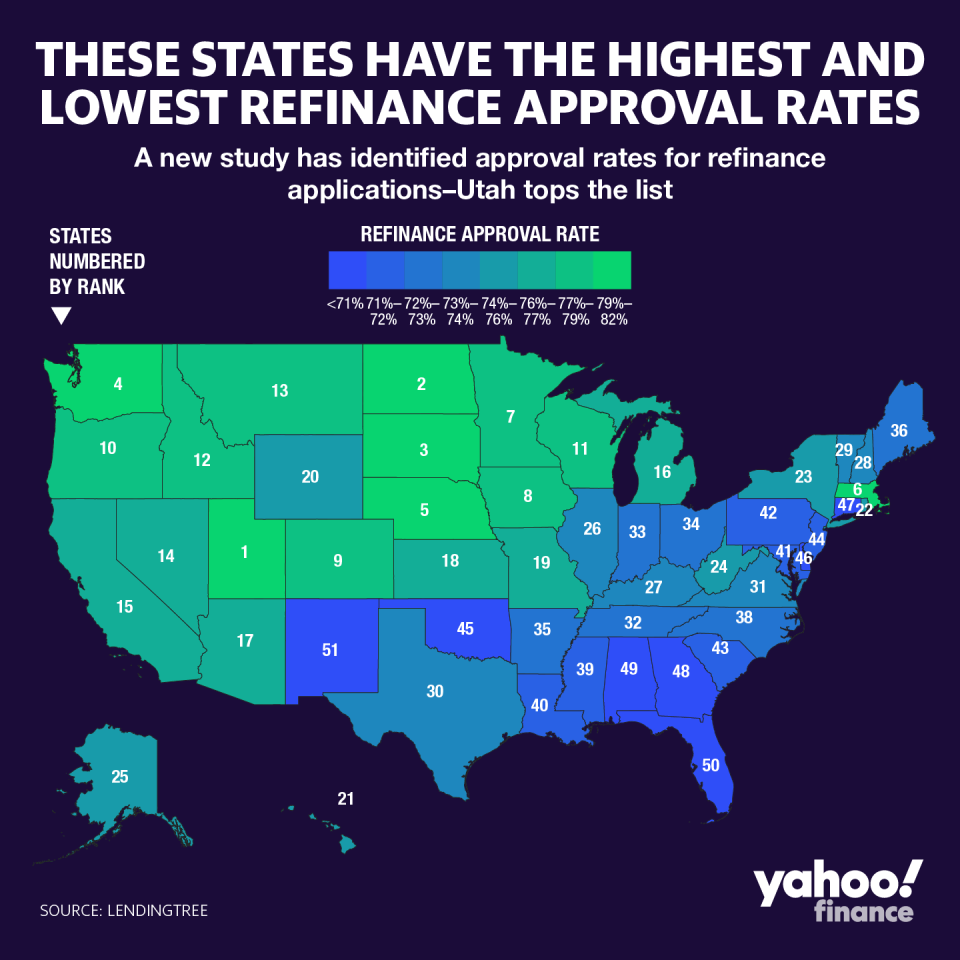

On average, 75% of mortgage refinance applications are approved. But in some states like Utah homeowners are more likely to be approved than others, according to a LendingTree study, which examined 10 million mortgage applications using the most recent available Home Mortgage Disclosure Act (HMDA) data for 2018.

Some states see higher approval ratings because of lending standards, homebuyers’ average credit score, home price appreciation and homebuyers’ equity, said Tendayi Kapfidze, chief economist at LendingTree.

The best state for refinancing was Utah, with an 82.4% approval rate. The worst was New Mexico, with a 66.5% approval rate. But overall, that side of the country did well. Applications on the East Coast were less likely to be approved, while the Midwest and West Coast saw above-average approval ratings.

Utah, North Dakotah, and South Dakota topped the rankings, something Kapfidze said surprised him.

“We do a lot of these studies, and those states rarely stand out... But when we looked at the reasons, those states were good on home price appreciation and on credit scores,” said Kapfidze. North Dakota had 60% home value appreciation, the highest in the study, and South Dakota had 32% appreciation, still a favorable score. North and South Dakota shared a 724 average credit score, also the highest in the study.

Florida did particularly bad in the ranking at No. 50, even though it performs well on interpretive metrics like homeowner credit scores and home price appreciation. Kapfidze blamed the low refinance approval rate on high wealth inequality in the state, which may skew the data.

“In Florida, there is a dynamic where inequality is greater than in other states because a lot of money comes in from retirees and foreigners. On the other hand, a lot of people in Florida are part of big agricultural and tourism industries, which are among the lower-paying industries,” said Kapfidze. “Money comes from the outside, which builds up prices, but because of inequality, a lot of Floridians are left behind, perhaps driving down the approval rating.”

Frenzy to refinance

Refinancing has been a popular option this year with mortgage rates dipping below 4%. Refinance applications were up 169% year-over-year in the first week of September, according to the Mortgage Bankers Association.

But refinancing has started to cool and is expected to temper in 2020, according to Fannie Mae’s November economic and housing outlook. Still, refinance applications were up 61% year-over-year the last week of November.

“Right now, rates are down… so even people in recently-bought homes might have the opportunity to refinance,” said Kapfidze. The last time rates were this low was two years ago, and at that point, they might not have been in a position to refinance.”

Sarah Paynter is a reporter at Yahoo Finance. Follow her on Twitter @sarahapaynter

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

Low mortgage rates are fueling a housing shortage

The cities most at risk of a real estate bubble: UBS

Generation Z actually prefers to buy homes instead of rent: Freddie Mac survey