Best AIM Growth Stocks

Midwich Group and Brooks Macdonald Group are a few noticeable companies with a strong future outlook. The market’s optimistic sentiment towards these stocks indicates a level of confidence in the future outlook of their businesses. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

Midwich Group Plc (AIM:MIDW)

Midwich Group Plc distributes audio visual (AV) and document solutions to the trade markets in the United Kingdom, Ireland, France, Germany, Australia, and New Zealand. Started in 1979, and currently headed by CEO Stephen Fenby, the company employs 600 people and with the stock’s market cap sitting at GBP £409.90M, it comes under the small-cap group.

MIDW is expected to deliver an extremely high earnings growth over the next couple of years of 54.13%, driven by a positive double-digit revenue growth of 31.60% and cost-cutting initiatives. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 33.65%. MIDW’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Should you add MIDW to your portfolio? Check out its fundamental factors here.

Brooks Macdonald Group plc (AIM:BRK)

Brooks Macdonald Group plc, through its subsidiaries, provides a range of investment and wealth management services to private clients, pension funds, charities, professional intermediaries, and trustees in the United Kingdom and internationally. Established in 1991, and currently headed by CEO Caroline Connellan, the company size now stands at 500 people and has a market cap of GBP £250.95M, putting it in the small-cap category.

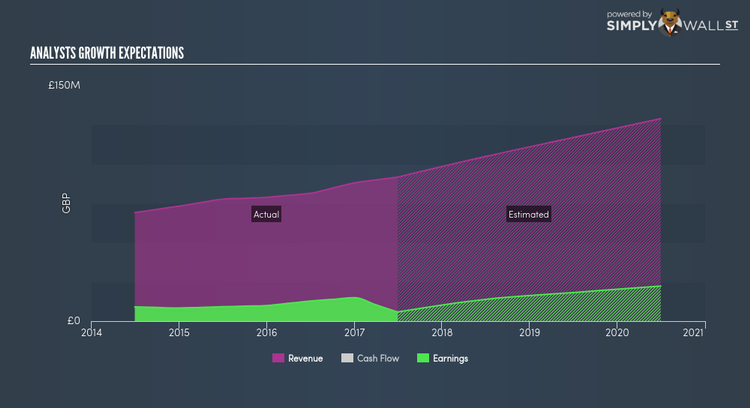

Extreme optimism for BRK, as market analysts projected an outstanding earnings growth, which is expected to more than double, supported by a double-digit sales growth of 27.50%. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of BRK, it does not appear extreme. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 17.42%. BRK ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Check out its fundamental factors here.

McBride plc (LSE:MCB)

McBride plc, together with its subsidiaries, manufactures and sells private label household and personal care products to retailers in the United Kingdom, other regions in Europe, and Asia. Started in 1860, and currently lead by Rik De Vos , the company size now stands at 4,125 people and with the stock’s market cap sitting at GBP £409.97M, it comes under the small-cap category.

MCB’s forecasted bottom line growth is an exceptional triple-digit, driven by the underlying double-digit sales growth of 10.59% over the next few years. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of MCB, it does not appear extreme. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 29.01%. MCB ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Thinking of investing in MCB? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.