Berkshire Hathaway's stock could be worth 30% more in a year, Whitney Tilson says

Value investor Whitney Tilson, who runs hedge fund Kase Capital, has been a Warren Buffett devotee and a Berkshire Hathaway bull for a long time.

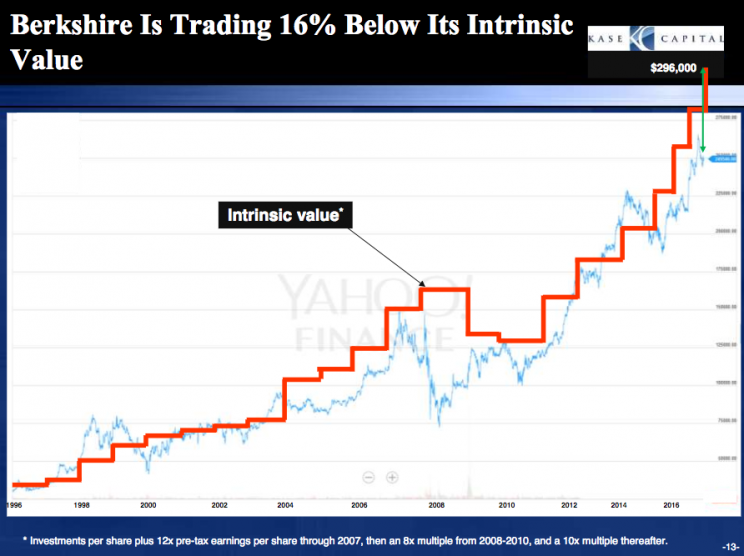

At $249,540 for the A-shares, Tilson thinks Berkshire Hathaway’s stock (BRK.A) is undervalued.

On Thursday, Tilson released an updated presentation where he pegged the current intrinsic value for Berkshire’s A-shares at $296,000. Tilson notes the stock is trading 19% below that level.

One year from now, Tilson expects the A-shares to have an intrinsic value of $324,000, 30% above today’s price.

Tilson’s estimates for intrinsic value for Berkshire do not include any premium for having Warren Buffett at the helm. In other words, he expects the company to still grow in the event Buffett is no longer running the company.

Some of the key catalysts for Tilson’s thesis include strong earnings growth for the operating businesses. The price should benefit from meaningful acquisitions and new stock investments.

He’s also looking for additional share repurchases should the stock drop to 1.2-times book value or below. He notes that the stock is currently 1.45-times book value.

Tilson pointed out that Berkshire has had one formal share repurchase program, which was announced in September 2011. The plan was to repurchase shares at no higher than a 10% premium to the stock’s book value. In December 2012, Buffett said he paid just over $1.2 billion to buy 9,200 A-shares. He also said that the board raised to price limit so shares could be repurchased at a 20% premium.

“It confirms that Buffett shares our belief that Berkshire stock is undervalued,” Tilson wrote.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Read more: