What’s Behind the Massive Rally in Nio’s Stock Price? Analyst Weighs In

Many tech companies have posted massive share gains since the COVID-inflicted March slump. Few, though, have generated as much upside as Nio Limited (NIO). Catching a ride on the EV trend, since March lows, shares of the Chinese EV maker are up by an incredible 1070%.

While Deutsche Bank analyst Edison Yu points out there hasn’t been a specific catalyst to send shares higher, the analyst counts several developments that have helped keep up momentum.

First of all, in a recent interview, CEO William Li said that he expects Nio will be able to manufacture 150,000 vehicles annually by the end of next year, compared to the 60,000 it can currently produce. In the long term, Nio hopes to boost the figure up to 300,000 a year.

Furthermore, the China market is “inflecting faster” than the analyst anticipated, as evidenced by September’s strong sales; Passenger BEV sales were up 70% year-over-year to 100,000 units. This amounts to the highest monthly volume since June 2019, which was the cut-off month for government subsidies.

Additionally, Yu believes the fact customers have been waiting several months for deliveries due to excess orders, has caused growing excitement among buyers, whilst the meteoric rise of the homemade brand has resulted in “patriotic buying.” Add a surge in call option volume into the mix and it all results in a “stock on fire.”

Still, Yu also points out how sentiment might change. It is the EV maker giant that Nio needs to keep an eye on.

“We do see some risk that Tesla could materially cut the price of its locally made (MIC) Model Y from 488k RMB ($73k) to something in the mid-high 300k range ($56-58k). This could potentially hurt near-term sentiment and slow down NIO’s order book momentum considering it would be a direct competitor to NIO’s EC6 and ES6,” the analyst said.

Overall, Yu maintains a Buy rating on Nio shares. Yu intends to revisit his valuation "after the company reports quarterly numbers." (To watch Yu’s track record, click here)

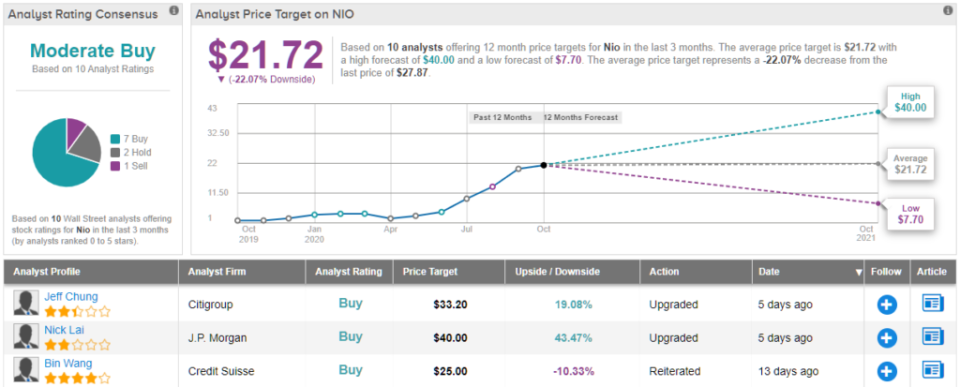

Overall, based on 7 Buys, 2 Holds and 1 Sell, the stock has a Moderate Buy consensus rating. However, the analysts think the surge needs to pause for a breather, as the $21.72 average price target implies shares will drop by 22% over the coming months. (See Nio stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.