Barrick's (GOLD) Earnings and Sales Trail Estimates in Q2

Barrick Gold Corporation GOLD recorded net earnings (on a reported basis) of $194 million or 11 cents per share in second-quarter 2019 against net loss of $94 million or 8 cents in the year-ago quarter.

Barring one-time items, adjusted earnings per share (EPS) were 9 cents, which fell short of the Zacks Consensus Estimate of 10 cents.

Barrick recorded revenues of $2,063 million, up roughly 21% year over year. However, the figure trailed the Zacks Consensus Estimate of $2,090.8 million.

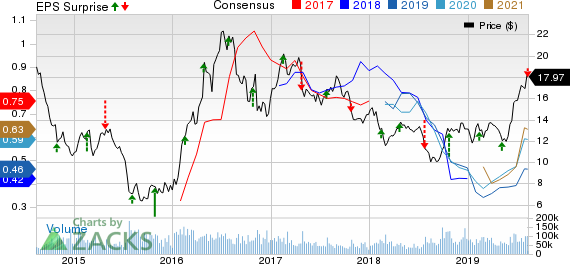

Barrick Gold Corporation Price, Consensus and EPS Surprise

Barrick Gold Corporation price-consensus-eps-surprise-chart | Barrick Gold Corporation Quote

Operational Highlights

Total gold production was around 1.35 million ounces in the quarter, up 26.8% year over year. The results were driven by strong performances at Veladero in Argentina and Loulo-Gounkoto in Mali. Average realized price of gold was $1,317 per ounce compared with $1,313 per ounce in the year-ago quarter.

Cost of sales per ounce went up roughly 9% year over year to $964 million. All-in sustaining costs (AISC) rose 2% to $869 per ounce in the quarter.

Copper production increased 17% year over year to 97 million pounds. Average realized copper price was $2.62 per pound, down 16% year over year.

Financial Position

At the end of second quarter, Barrick had cash and cash equivalents of $2,153 million, up around 3.3% year over year. Long-term debt was $5,504 million at the end of the second quarter.

Net cash provided by operating activities rose more than three folds year over year to $434 million in the quarter.

Guidance

Barrick stated that its annual production is expected to be at the upper end of 2019 guidance and cost metrics at the lower end of the range.

For 2019, the company anticipates attributable gold production in the range of 5.1-5.6 million ounces at AISC of $870-$920 per ounce and cost of sales of $910-$970 per ounce.

The company expects copper production in the range of 375-430 million pounds at AISC of $2.40-$2.90 per pound and at cost of sales of $2.30-$2.70 per pound.

Capital expenditure is projected between $1,400 million and $1,700 million.

Price Performance

Barrick’s shares have surged 72.6% in the past year compared with the industry’s 57% rally.

Zacks Rank & Other Key Picks

Barrick currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Kinross Gold Corporation KGC, Alamos Gold Inc AGI and Arconic Inc ARNC, all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross has an expected earnings growth rate of 140% for 2019. The company’s shares have surged 59.8% in the past year.

Alamos Gold has projected earnings growth rate of 280% for the current year. The company’s shares have rallied 53.2% in a year’s time.

Arconic has an estimated earnings growth rate of 42.7% for the current year. Its shares have moved up 23.5% in the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Arconic Inc. (ARNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research