Most banks expect legal bills to fall — except Wells Fargo

Wells Fargo (WFC) has had a rocky 11 months. First, news broke that the third largest bank by assets had been creating millions of accounts without customers’ permission, resulting in $185 million in fines. But that’s not all. The bank has been hounded by more scandals involving mortgages and overdraft charges. Just this month, Sen. Jerry Moran (R-Kan.), began looking into whether the bank duped borrowers into buying expensive car insurance.

All of this has opened the San Francisco-based bank up to some serious litigation risks, and the bank has continuously had to update how much it may have to pony up to square things with consumers it has wronged.

There are many legal balls in the air, and many of them are class-actions. A class-action suit regarding the fake accounts is in the process of being settled; a judge granted preliminary approval to a $142 million settlement of that case in July. A proposed class-action accusing the bank of “racketeering violations and fraud” was filed recently after the bank admitted to providing unnecessary auto insurance. Multiple lawsuits are ongoing in regards to unauthorized changes to mortgages.

And on Friday, Wells Fargo was hit with a proposed class-action lawsuit alleging the bank’s merchant services overcharged for credit-card processing, thus ripping off small businesses.

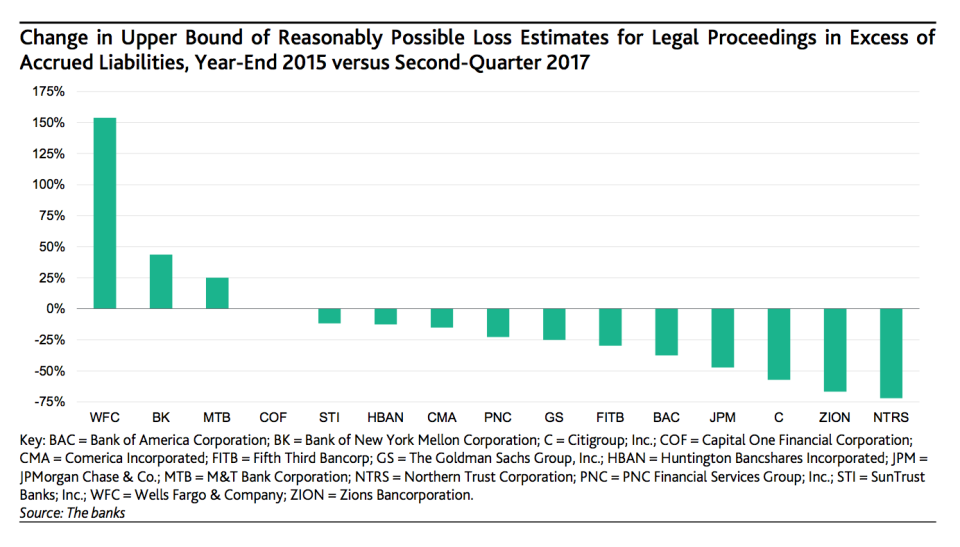

According to Moody’s, Wells Fargo’s revisions of possible losses from litigation come at a time when “most other banks’ reasonably possible litigation losses are declining.”

Wells Fargo is doing very well financially, posting reasonably strong earnings, so the effects of these potential losses may not be a particularly material factor for the health of the company.

But compared to other banks, Wells Fargo’s potential legal liabilities in the past two years are stark as the chart from Moody’s shows above. While Wells Fargo’s upper bound of possible legal losses shot up 150%, they went down between 25% and 50% for Bank of America (BAC), JPMorgan Chase (JPM), and Citigroup (C). Banks have been paying for the way they made, marketed and sold residential mortgage-backed securities ahead of the financial crisis. That litigation is finally starting to wind down.

Because of all this legal exposure, it’s not a surprise that the bank is looking closely at the CFPB’s new arbitration rule that bans banks from forcing arbitration instead of allowing consumers to band together in a class-action suit, which is more costly for the companies. The rule has been challenged by Congress and the House voted to repeal it.

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, tech, and personal finance. Follow him on Twitter @ewolffmann. Got a tip? Send it totips@yahoo-inc.com.

Read More:

What Bitcoin needs to do to become real currency

Trump weighs slashing one of the most popular tax deductions

Big banks are going after Venmo and Venmo is winning

73% of Android users are less likely to switch to iPhone due to headphone jack

‘Market FOMO’ has millennials putting cash into the stock market

Sometimes fake holidays like ‘National Ice Cream Day’ actually work

A robot lawyer can fight your parking tickets and much more

Consumer watchdog is making it easier for consumers to sue banks